First-Time Buyer Mortgages: Understanding The 31-Year Loan Landscape

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

First-Time Buyer Mortgages: Navigating the 31-Year Loan Landscape

Buying your first home is a significant milestone, often filled with excitement and…a healthy dose of anxiety. One of the biggest hurdles? Securing a mortgage. While various mortgage terms exist, the 31-year mortgage looms large for many first-time buyers, offering a lower monthly payment but potentially increasing the overall cost. Let's delve into the complexities of 31-year first-time buyer mortgages and help you make an informed decision.

Why Choose a 31-Year Mortgage?

The allure of a 31-year mortgage is undeniable: lower monthly payments. This makes homeownership more accessible, especially for first-time buyers with limited savings or facing higher living costs. A smaller monthly outlay can significantly ease financial pressure, leaving more room in your budget for other essential expenses.

- Affordability: The reduced monthly payments are the primary draw. This allows you to qualify for a more expensive property than you might with a shorter-term loan.

- Longer Repayment Period: Spreading repayments over 31 years means less strain on your monthly income.

- Potential for Increased Earning Power: Over 31 years, your income is likely to increase, making repayments more manageable over time.

The Downsides of a 31-Year Mortgage:

While attractive upfront, a 31-year mortgage isn't without its drawbacks:

- Higher Total Interest Paid: The longer repayment period means you'll pay significantly more in interest over the life of the loan. This can dramatically increase the overall cost of your home. Use a mortgage calculator to see the precise figures for your situation. [Link to a reputable mortgage calculator]

- Less Equity Build-up: You'll build equity slower with a 31-year mortgage compared to a shorter-term loan.

- Longer Commitment: You are locked into a long-term financial commitment. Life circumstances change, and a 31-year loan might not be flexible enough to adapt to those changes.

Alternatives to Consider:

Before committing to a 31-year mortgage, explore other options:

- 15-Year Mortgages: These offer faster equity building and lower overall interest payments but require significantly higher monthly repayments.

- Government-Backed Schemes: Many countries offer first-time buyer schemes with reduced deposits or favorable interest rates. Check with your local housing authority for available programs. [Link to relevant government website for your country]

- Adjustable-Rate Mortgages (ARMs): These offer lower initial interest rates, but the rate can fluctuate over time, potentially increasing your monthly payments. These carry greater risk.

Tips for First-Time Buyers:

- Shop around for the best rates: Don't settle for the first offer you receive. Compare rates from multiple lenders to secure the most favorable terms.

- Improve your credit score: A higher credit score significantly impacts the interest rate you qualify for.

- Save for a larger down payment: A larger down payment can reduce your loan amount and secure better interest rates.

- Seek professional financial advice: Consult a mortgage broker or financial advisor to navigate the complexities of mortgage options and find the best solution for your circumstances.

Conclusion:

A 31-year first-time buyer mortgage can be a viable option for many, offering the crucial advantage of affordability. However, it's crucial to weigh the long-term implications, including the higher total interest paid and slower equity build-up. Carefully consider your financial situation, explore alternative options, and seek professional advice before making a decision. Understanding the landscape of 31-year mortgages empowers you to make the best choice for your future homeownership journey. Remember to always compare rates and terms before making a final decision.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on First-Time Buyer Mortgages: Understanding The 31-Year Loan Landscape. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

El Salvadors Bukele Consolidating Power And Eroding Democracy

Jun 03, 2025

El Salvadors Bukele Consolidating Power And Eroding Democracy

Jun 03, 2025 -

Democratic Primary Showdown Siegel Vs Mamdani A Look At The Socialist Surge

Jun 03, 2025

Democratic Primary Showdown Siegel Vs Mamdani A Look At The Socialist Surge

Jun 03, 2025 -

Conquer Nyt Strands Full Solutions For June 3

Jun 03, 2025

Conquer Nyt Strands Full Solutions For June 3

Jun 03, 2025 -

Day 24 Karen Read Trial Expert Witness Questions Crime Scene Data

Jun 03, 2025

Day 24 Karen Read Trial Expert Witness Questions Crime Scene Data

Jun 03, 2025 -

Boeing Stock Upgrade Bank Of America Highlights Role In Trump Trade Policy

Jun 03, 2025

Boeing Stock Upgrade Bank Of America Highlights Role In Trump Trade Policy

Jun 03, 2025

Latest Posts

-

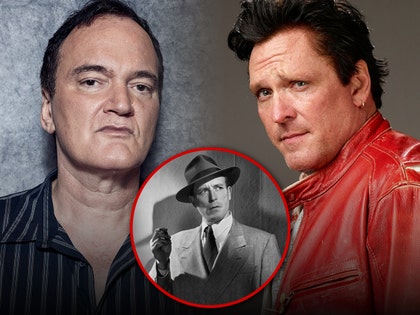

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025