First-Time Homebuyer Mortgages: A 31-Year Commitment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

First-Time Homebuyer Mortgages: A 31-Year Commitment? Navigating the Long Haul

Buying your first home is a monumental achievement, a cornerstone of the American dream. But the reality of a mortgage often involves a significant, long-term commitment – often stretching over 30 years. Is a 31-year mortgage right for you? Let's delve into the complexities and considerations involved in securing a first-time homebuyer mortgage.

The Allure of the 30-Year Mortgage

The classic 30-year fixed-rate mortgage remains a popular choice for first-time homebuyers. Its appeal lies primarily in the lower monthly payments. Spreading the cost over three decades significantly reduces the burden on your monthly budget, making homeownership more accessible. This is especially crucial for those navigating the challenges of early career stages or managing other financial obligations.

However, the seemingly attractive lower monthly payments come with a significant caveat: you'll pay significantly more in interest over the life of the loan. A longer repayment period translates to more time spent paying interest, ultimately increasing the total cost of your home.

Exploring Shorter-Term Mortgage Options

While a 30-year mortgage might feel manageable initially, exploring shorter-term options like 15-year or even 20-year mortgages can offer substantial long-term savings. Although monthly payments will be higher, the reduced interest paid over the loan's lifespan can result in thousands, even tens of thousands, of dollars saved.

Factors to Consider When Choosing a Mortgage Term:

- Your Financial Situation: Honestly assess your current income, expenses, and savings. Can you comfortably afford the higher monthly payments of a shorter-term mortgage? A financial advisor can provide valuable insights into your personal financial capabilities.

- Long-Term Financial Goals: Consider your future financial plans. Will you likely receive significant salary increases in the coming years? Will you have additional income streams? These factors can influence your ability to handle higher payments.

- Interest Rates: Interest rates fluctuate, impacting the overall cost of your mortgage. Shop around and compare rates from multiple lenders to find the best deal for your chosen term. [Link to reputable mortgage rate comparison website]

- Personal Circumstances: Life is unpredictable. Consider the possibility of unforeseen job changes, family growth, or unexpected expenses. A longer-term mortgage provides more flexibility, but at a higher cost.

Beyond the Loan Term: Understanding the Total Cost of Homeownership

Remember that the mortgage payment is just one piece of the homeownership puzzle. Factor in property taxes, homeowner's insurance, potential HOA fees, and maintenance costs. These expenses can significantly impact your monthly budget. A realistic budget encompassing all these factors is crucial for long-term financial stability.

Making an Informed Decision:

Choosing a mortgage term is a significant financial decision. Don't rush the process. Seek professional advice from a financial advisor or mortgage broker. They can help you analyze your financial situation and guide you towards the mortgage term that best aligns with your long-term goals and financial well-being. Thorough research and careful planning are key to making a smart and informed choice for your future.

Call to Action: Start planning your financial future today! Explore different mortgage options and secure a consultation with a qualified financial professional. Your dream of homeownership doesn't have to be a 31-year commitment if you plan strategically.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on First-Time Homebuyer Mortgages: A 31-Year Commitment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Daleys Advice For Closeted Queer Athletes Coming Out And Finding Support

Jun 04, 2025

Tom Daleys Advice For Closeted Queer Athletes Coming Out And Finding Support

Jun 04, 2025 -

Energy Storage Firm Powin Announces Financial Difficulties Citing Industry Trends

Jun 04, 2025

Energy Storage Firm Powin Announces Financial Difficulties Citing Industry Trends

Jun 04, 2025 -

Retirement Planning With Self Directed Precious Metal Iras Key Findings And Considerations

Jun 04, 2025

Retirement Planning With Self Directed Precious Metal Iras Key Findings And Considerations

Jun 04, 2025 -

Creative 529 Plan Strategies Ohio Parents Find Relief From College Tuition

Jun 04, 2025

Creative 529 Plan Strategies Ohio Parents Find Relief From College Tuition

Jun 04, 2025 -

Syrias Imprisonment Of Austin Tice Leaked Files Shed Light On Case

Jun 04, 2025

Syrias Imprisonment Of Austin Tice Leaked Files Shed Light On Case

Jun 04, 2025

Latest Posts

-

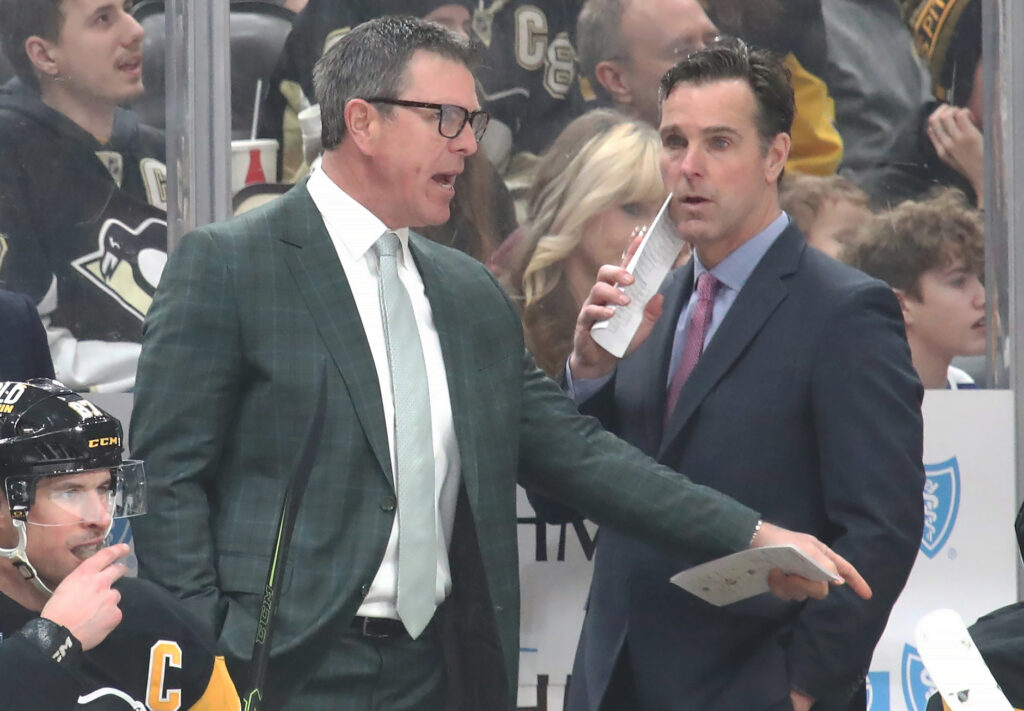

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025