First-Time Homebuyers: The 31-Year Mortgage Reality

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

First-Time Homebuyers: Navigating the 31-Year Mortgage Reality

The dream of homeownership is powerful, especially for first-time buyers. But that gleaming new key often comes attached to a 30-year mortgage – a commitment spanning over three decades. Understanding the long-term implications of this significant financial undertaking is crucial for navigating the often-complex world of homebuying successfully. This article will explore the realities of a 31-year mortgage (accounting for potential closing costs extending the timeframe slightly) and offer advice for first-time homebuyers.

The 30-Year Mortgage: A Long-Term Commitment

A 30-year mortgage offers lower monthly payments compared to shorter-term loans. This is appealing to first-time homebuyers, often juggling student loans, car payments, and other financial responsibilities. However, the lower monthly payment comes at a cost: you'll pay significantly more in interest over the life of the loan. This means a larger portion of your initial payments goes towards interest rather than principal, impacting your equity growth.

Understanding the True Cost:

Let's delve deeper into the financial implications. Beyond the monthly payment, consider these factors:

- Interest Accumulation: The interest paid on a 30-year mortgage can easily surpass the original loan amount. Online mortgage calculators can help you estimate the total interest you'll pay based on your loan amount and interest rate. Using these tools is crucial for realistic budgeting.

- Closing Costs: These upfront fees, including appraisal fees, lender's fees, and title insurance, can add thousands of dollars to your initial investment. Factor these into your overall budget to avoid unexpected financial strain.

- Property Taxes and Insurance: Remember, your monthly mortgage payment typically doesn't include property taxes and homeowners insurance. These are usually paid through an escrow account managed by your lender, adding to your overall monthly housing expense.

- Unforeseen Expenses: Homeownership inevitably comes with unexpected costs – repairs, maintenance, and upgrades. Building an emergency fund specifically for home maintenance is vital to avoid financial distress.

Strategies for First-Time Homebuyers:

Navigating the 31-year mortgage reality requires careful planning. Consider these strategies:

- Improve Your Credit Score: A higher credit score qualifies you for better interest rates, potentially saving you thousands of dollars over the life of your loan. Check your credit report regularly and address any errors. [Link to a reputable credit score resource]

- Save a Substantial Down Payment: A larger down payment reduces your loan amount and, consequently, your monthly payment and overall interest paid. Aim for at least 20% to avoid private mortgage insurance (PMI).

- Explore Different Mortgage Options: Shop around and compare rates from multiple lenders. Consider various mortgage types, such as fixed-rate mortgages, adjustable-rate mortgages (ARMs), and FHA loans, to find the best fit for your financial situation.

- Create a Realistic Budget: Before committing to a mortgage, create a detailed budget that includes all anticipated expenses, not just the mortgage payment itself. Ensure you can comfortably afford your monthly payments even with unexpected expenses.

The Long Game: Building Equity and Wealth

While the 31-year commitment might seem daunting, remember that homeownership is a long-term investment. Over time, your home's value may appreciate, building equity and wealth. Consistent payments and responsible home maintenance contribute significantly to this growth.

Conclusion:

Purchasing your first home is a significant milestone, but understanding the 31-year mortgage reality is crucial for long-term financial success. Thorough planning, careful budgeting, and informed decision-making are vital for navigating this journey and ensuring a positive and sustainable homeownership experience. By taking proactive steps and understanding the full cost of homeownership, first-time buyers can confidently embark on this exciting chapter of their lives.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on First-Time Homebuyers: The 31-Year Mortgage Reality. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mount Etna Spews Lava Tourist Evacuation Caught On Camera

Jun 03, 2025

Mount Etna Spews Lava Tourist Evacuation Caught On Camera

Jun 03, 2025 -

Is Hailee Steinfelds Husband Buffalo Bills Josh Allen

Jun 03, 2025

Is Hailee Steinfelds Husband Buffalo Bills Josh Allen

Jun 03, 2025 -

The Tiafoe Influence How It Propelled Baptistes Success

Jun 03, 2025

The Tiafoe Influence How It Propelled Baptistes Success

Jun 03, 2025 -

Accel Kkrs Strategic Investment In Care Line Live Expanding Telehealth Reach

Jun 03, 2025

Accel Kkrs Strategic Investment In Care Line Live Expanding Telehealth Reach

Jun 03, 2025 -

Italys Mount Etna Powerful Eruption Sends Ash High Into The Air

Jun 03, 2025

Italys Mount Etna Powerful Eruption Sends Ash High Into The Air

Jun 03, 2025

Latest Posts

-

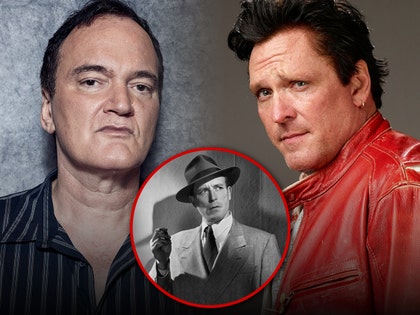

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025