Flat Owners Take Legal Action Over Unrevealed Freeholder Insurance Payments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Flat Owners Take Legal Action Over Unrevealed Freeholder Insurance Payments

Hundreds of leaseholders across the UK are launching legal action against their freeholders, claiming they were unaware of substantial insurance payments levied on their behalf. This burgeoning legal battle highlights a growing concern about transparency and accountability within the often opaque world of property management. The case raises serious questions about the rights of leaseholders and the responsibilities of freeholders in managing building insurance.

The issue centers around undisclosed or inadequately explained insurance premiums added to service charges. Leaseholders allege that freeholders failed to provide clear and detailed breakdowns of insurance costs, leading to suspicions of inflated payments and potential misappropriation of funds. Many feel they've been overcharged for years, with little recourse to challenge the fees.

What are Leaseholders Claiming?

The legal action, spearheaded by several solicitor firms specializing in property law, focuses on several key claims:

- Lack of Transparency: Leaseholders argue that freeholders failed to provide clear and accurate information regarding the insurance policies taken out on their behalf, making it impossible to verify the legitimacy of the costs.

- Inflated Premiums: Many suspect that the premiums charged were significantly higher than the market rate, leading to substantial overpayments over the years. Evidence gathered suggests that some freeholders may have benefited from kickbacks or commissions from insurance brokers.

- Breach of Contract: The claimants argue that the freeholders' actions constitute a breach of contract, violating the terms of their lease agreements. This breach, they contend, entitles them to compensation for the overpayments.

- Lack of Due Diligence: Some freeholders are accused of failing to secure the most competitive insurance policies, resulting in unnecessary financial burden for leaseholders.

The Implications for the Property Market

This legal action could have significant ramifications for the UK property market. It shines a spotlight on the often-complex relationship between freeholders and leaseholders, highlighting the power imbalance and the lack of protection afforded to many leaseholders. The outcome could lead to:

- Increased Regulatory Scrutiny: The case is likely to prompt greater government intervention and stricter regulations regarding the transparency of freeholder insurance payments.

- Improved Leaseholder Rights: The legal challenge could result in strengthened legal protections for leaseholders, ensuring greater transparency and control over their service charges.

- Changes in Insurance Practices: The case might lead to greater scrutiny of insurance brokers and freeholders' practices regarding the procurement of building insurance.

What Should Leaseholders Do?

If you suspect you've been overcharged for building insurance, several actions you can take include:

- Review your service charge statements meticulously: Look for discrepancies and unexplained insurance costs.

- Contact your freeholder for clarification: Request a detailed breakdown of all insurance payments and policy documentation.

- Seek legal advice: If you're unhappy with the response, consider consulting a solicitor specializing in property law. Several firms are currently offering free initial consultations for leaseholders facing similar issues.

This developing story underscores the importance of leaseholders actively engaging with their service charges and demanding transparency from their freeholders. The outcome of this legal action will undoubtedly shape the future of property management in the UK. Stay tuned for further updates as this case progresses. For more information on leasehold rights, visit the [link to relevant government website or consumer advice site].

Keywords: Leasehold, Freeholder, Insurance, Service Charge, Legal Action, Property Law, UK Property, Building Insurance, Transparency, Accountability, Overcharging, Compensation, Leaseholder Rights, Property Management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Flat Owners Take Legal Action Over Unrevealed Freeholder Insurance Payments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Impact Of The Department Of Educations Halt On Student Loan Forgiveness

Jul 19, 2025

Impact Of The Department Of Educations Halt On Student Loan Forgiveness

Jul 19, 2025 -

Air India Flight Fuel Emergency A Study In Pilot Responses Under Pressure

Jul 19, 2025

Air India Flight Fuel Emergency A Study In Pilot Responses Under Pressure

Jul 19, 2025 -

All Ultimate Lo L Skins Awarded 4222 Pick Ems Winners Announced Msi 2025

Jul 19, 2025

All Ultimate Lo L Skins Awarded 4222 Pick Ems Winners Announced Msi 2025

Jul 19, 2025 -

Netflix Prime Disney And More What To Watch This Weekend July 18 20

Jul 19, 2025

Netflix Prime Disney And More What To Watch This Weekend July 18 20

Jul 19, 2025 -

Fact Check Trumps Assertion On Coca Colas Sugar Change In The Us

Jul 19, 2025

Fact Check Trumps Assertion On Coca Colas Sugar Change In The Us

Jul 19, 2025

Latest Posts

-

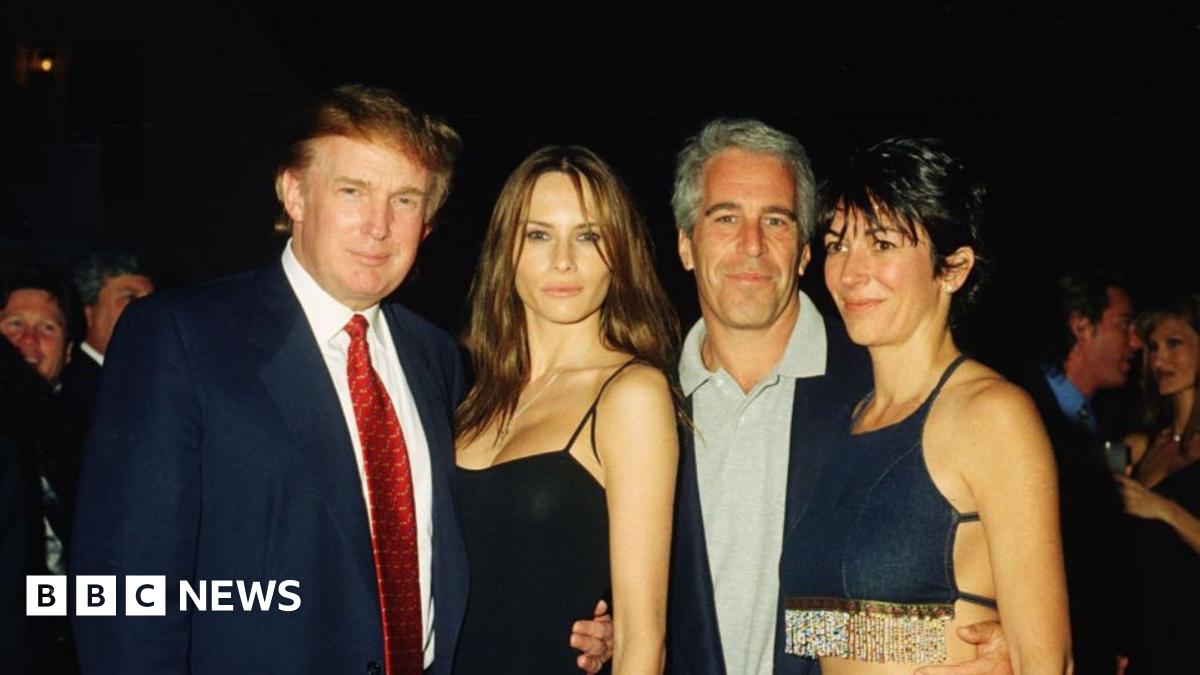

Epsteins Shadow The Enduring Impact On The Maga Movement

Jul 20, 2025

Epsteins Shadow The Enduring Impact On The Maga Movement

Jul 20, 2025 -

Astronomers Unexpected Coldplay Concert Moment Captures Attention

Jul 20, 2025

Astronomers Unexpected Coldplay Concert Moment Captures Attention

Jul 20, 2025 -

The Edge Of Fate Raid Launch Date Time And Destiny 2 Strategies

Jul 20, 2025

The Edge Of Fate Raid Launch Date Time And Destiny 2 Strategies

Jul 20, 2025 -

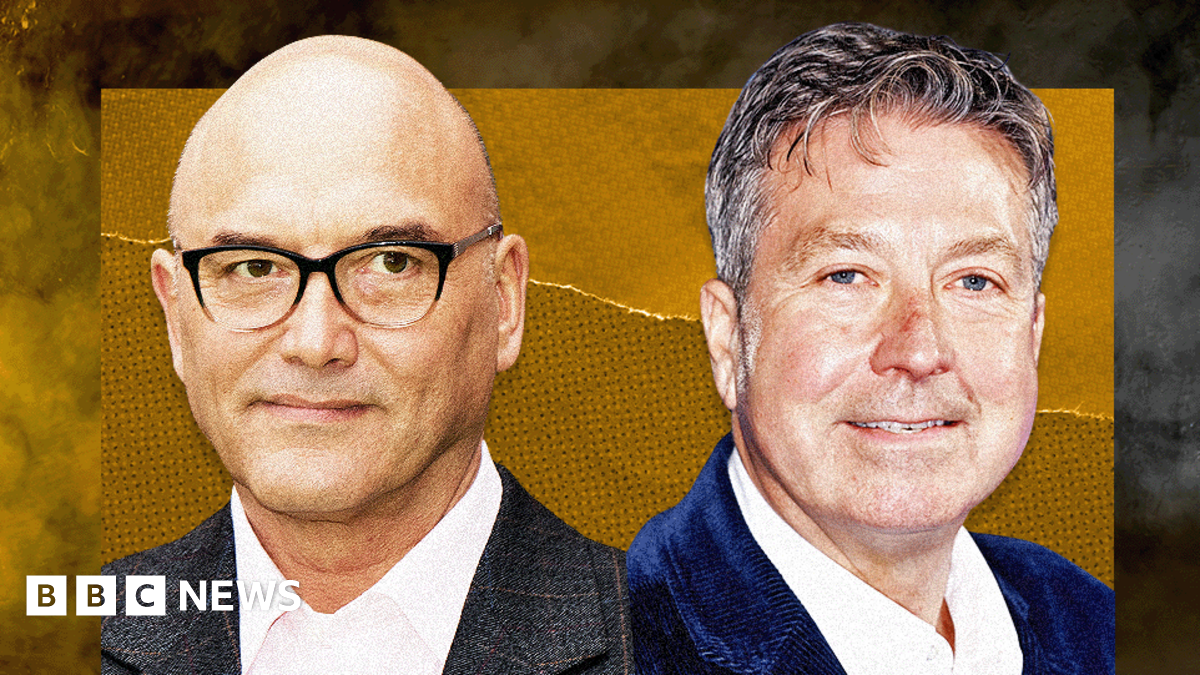

Master Chefs Future Uncertain After Wallace And Torodes Sacking

Jul 20, 2025

Master Chefs Future Uncertain After Wallace And Torodes Sacking

Jul 20, 2025 -

Barroso Filha Reside No Brasil Noticias De Deportacao Sao Falsas

Jul 20, 2025

Barroso Filha Reside No Brasil Noticias De Deportacao Sao Falsas

Jul 20, 2025