Four In Ten Fail To Save Enough For Retirement: Pension Commission Seeks Answers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Four in Ten Fail to Save Enough for Retirement: Pension Commission Seeks Answers

The UK faces a looming retirement crisis as a staggering 40% of the population are failing to save adequately for their golden years, prompting the Pension Commission to launch a major investigation. This alarming statistic highlights a growing concern about the future financial security of millions of Britons and underscores the urgent need for effective policy solutions. The Commission aims to uncover the root causes of this shortfall and propose actionable strategies to alleviate the problem.

The revelation, based on data from the latest Office for National Statistics (ONS) report, paints a bleak picture for many nearing retirement age. This isn't simply a matter of lifestyle choices; deeper systemic issues are at play, impacting individuals across different income brackets and age groups. The Commission's investigation will delve into these complexities, examining everything from the adequacy of current pension schemes to the effectiveness of government initiatives aimed at promoting retirement savings.

The Root Causes of the Retirement Savings Gap

Several key factors contribute to this widespread inadequacy in retirement savings:

-

Stagnant Wages: The persistent stagnation of wages, particularly for younger generations, leaves less disposable income available for saving. Inflation consistently outpacing wage growth further exacerbates this challenge. [Link to ONS Wage Statistics]

-

Rising Cost of Living: The increasing cost of housing, healthcare, and everyday essentials leaves many struggling to make ends meet, let alone save for retirement. This is particularly impactful for those in lower-income brackets. [Link to relevant cost of living index]

-

Lack of Financial Literacy: A significant portion of the population lacks the financial knowledge and understanding necessary to make informed decisions about retirement planning. Many simply don't know how much they need to save or the best strategies for doing so.

-

Complexity of Pension Schemes: The complexity of different pension schemes, including workplace pensions and private pensions, can be overwhelming for many individuals, leading to confusion and inaction. [Link to Government Guide on Pensions]

-

Impact of the Gig Economy: The rise of the gig economy has created a significant proportion of self-employed workers without access to employer-sponsored pension schemes, leaving them solely responsible for their retirement savings.

The Pension Commission's Investigation: A Search for Solutions

The Pension Commission's investigation will focus on identifying practical solutions to address this critical issue. Their efforts will include:

-

Reviewing existing government policies: An in-depth assessment of the effectiveness of current government incentives and regulations designed to encourage retirement savings.

-

Consulting with stakeholders: Engagement with industry experts, financial advisors, and individuals to gain diverse perspectives and insights.

-

Exploring innovative solutions: Investigating potential solutions such as automatic enrolment improvements, increased financial literacy programs, and adjustments to the state pension.

-

Recommending policy changes: The Commission will ultimately propose concrete policy recommendations aimed at improving retirement savings outcomes for the UK population.

The Commission's findings and recommendations are eagerly anticipated, offering a crucial step towards tackling this growing crisis. The long-term financial security of millions depends on addressing this issue effectively and proactively. The investigation's results will be crucial in shaping future policy decisions concerning retirement planning in the UK. Stay tuned for updates on this critical issue.

Call to Action: Learn more about your pension options and plan for your retirement today. Visit [Link to a reputable financial advice website] for helpful resources and guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Four In Ten Fail To Save Enough For Retirement: Pension Commission Seeks Answers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Protests Erupt In Epping Injuries Reported Amidst Disorder

Jul 23, 2025

Protests Erupt In Epping Injuries Reported Amidst Disorder

Jul 23, 2025 -

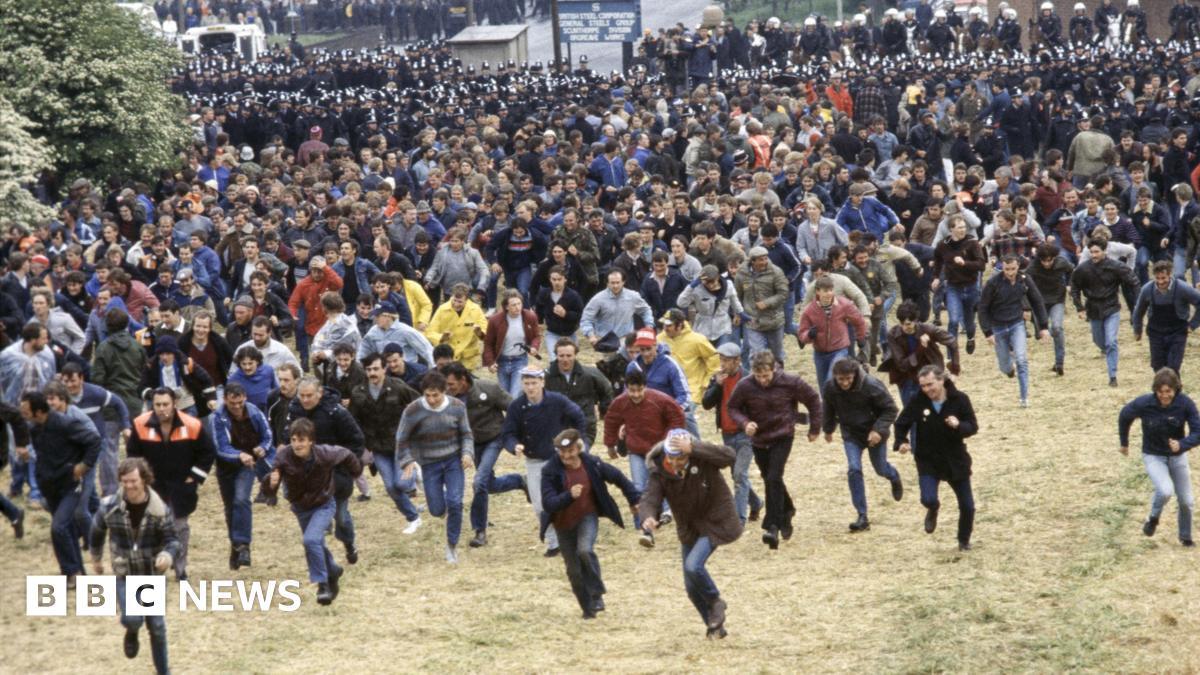

Orgreave Battle Long Awaited National Inquiry Greenlit By Yvette Cooper

Jul 23, 2025

Orgreave Battle Long Awaited National Inquiry Greenlit By Yvette Cooper

Jul 23, 2025 -

Trump Threatens Washington Commanders Redskins Name Or No Stadium Deal

Jul 23, 2025

Trump Threatens Washington Commanders Redskins Name Or No Stadium Deal

Jul 23, 2025 -

860 000 Fantasy 5 Jackpot Won In Savannah Lottery Winner Revealed

Jul 23, 2025

860 000 Fantasy 5 Jackpot Won In Savannah Lottery Winner Revealed

Jul 23, 2025 -

National Inquiry Into Orgreave Yvette Coopers Decision And What It Means

Jul 23, 2025

National Inquiry Into Orgreave Yvette Coopers Decision And What It Means

Jul 23, 2025

Latest Posts

-

Pension Commission Inquiry Addressing The Retirement Savings Gap Affecting Millions

Jul 23, 2025

Pension Commission Inquiry Addressing The Retirement Savings Gap Affecting Millions

Jul 23, 2025 -

Solve Nyt Connections Puzzle 772 Hints And Answers For July 22

Jul 23, 2025

Solve Nyt Connections Puzzle 772 Hints And Answers For July 22

Jul 23, 2025 -

Fake Lafufu Labubus Chinas Response To A Thriving Black Market

Jul 23, 2025

Fake Lafufu Labubus Chinas Response To A Thriving Black Market

Jul 23, 2025 -

Yellowstone Supervolcano Myth The Truth Behind The Online Animal Migration Panic

Jul 23, 2025

Yellowstone Supervolcano Myth The Truth Behind The Online Animal Migration Panic

Jul 23, 2025 -

Michelle Beadles Luxurious Vacation A New Chapter After Sirius Xm

Jul 23, 2025

Michelle Beadles Luxurious Vacation A New Chapter After Sirius Xm

Jul 23, 2025