Four In Ten Lacking Retirement Savings: Pension Commission Seeks Answers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Four in Ten Lacking Retirement Savings: Pension Commission Seeks Answers

A worrying trend reveals a significant retirement savings gap, leaving millions unprepared for their golden years. The Pension Commission is launching an urgent investigation to understand the root causes and propose effective solutions.

The UK is facing a retirement crisis. A shocking new report reveals that a staggering 40% of working-age adults lack any meaningful retirement savings. This alarming statistic has prompted the Pension Commission to launch a comprehensive inquiry, aiming to uncover the reasons behind this growing shortfall and explore potential remedies. The implications are severe, potentially leading to a future burdened by increased poverty among retirees and a strained social security system.

The Depth of the Problem: A Generational Challenge?

The lack of retirement savings isn't uniformly distributed across the population. Younger generations, burdened by rising living costs, student debt, and precarious employment, appear particularly vulnerable. Many struggle to prioritize long-term savings when facing immediate financial pressures. This paints a bleak picture for the future, suggesting a potential crisis for the National Insurance system and increased reliance on state pensions.

- Rising living costs: Inflation and the cost of living crisis are major contributors, leaving little disposable income for savings.

- Gig economy: The growth of the gig economy, with its inherent instability and lack of employer-sponsored pension schemes, exacerbates the problem.

- Lack of financial literacy: A significant portion of the population lacks the understanding and knowledge to effectively plan for retirement.

The Pension Commission's Investigation: What to Expect

The Pension Commission’s investigation will delve into several key areas:

- Impact of the gig economy: Analyzing the retirement savings landscape for those employed in the gig economy and proposing potential solutions.

- Financial literacy programs: Evaluating the effectiveness of existing financial literacy initiatives and exploring ways to improve access and engagement.

- Auto-enrollment schemes: Assessing the success of auto-enrollment schemes and identifying areas for improvement, perhaps targeting younger demographics more effectively.

- Government incentives: Examining the potential for increased government incentives to encourage greater retirement savings.

The Commission will consult with experts, industry stakeholders, and the public to gather a wide range of perspectives. Their findings will be crucial in shaping future government policy and informing individuals about securing their financial future.

What Can You Do? Planning for Your Retirement

While the Commission investigates, individuals can take proactive steps to improve their retirement prospects.

- Start saving early: Even small contributions made early can significantly compound over time. Explore various savings vehicles such as ISAs and pensions.

- Increase contributions: Review your current savings plan and consider increasing your contributions gradually.

- Seek financial advice: Consulting a financial advisor can provide personalized guidance tailored to your circumstances and goals. [Link to a reputable financial advice website - consider using a no-follow link here to avoid SEO penalties]

This crisis demands urgent action. The Pension Commission's investigation is a crucial first step, but individual responsibility also plays a vital role in securing a comfortable retirement. The future of retirement security in the UK depends on a collective effort from individuals, businesses, and the government. We will update you as the Commission’s findings are released. Stay tuned for further developments on this critical issue.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Four In Ten Lacking Retirement Savings: Pension Commission Seeks Answers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Viral Misinformation The Truth Behind The Yellowstone Supervolcano Animal Migration Hoax

Jul 23, 2025

Viral Misinformation The Truth Behind The Yellowstone Supervolcano Animal Migration Hoax

Jul 23, 2025 -

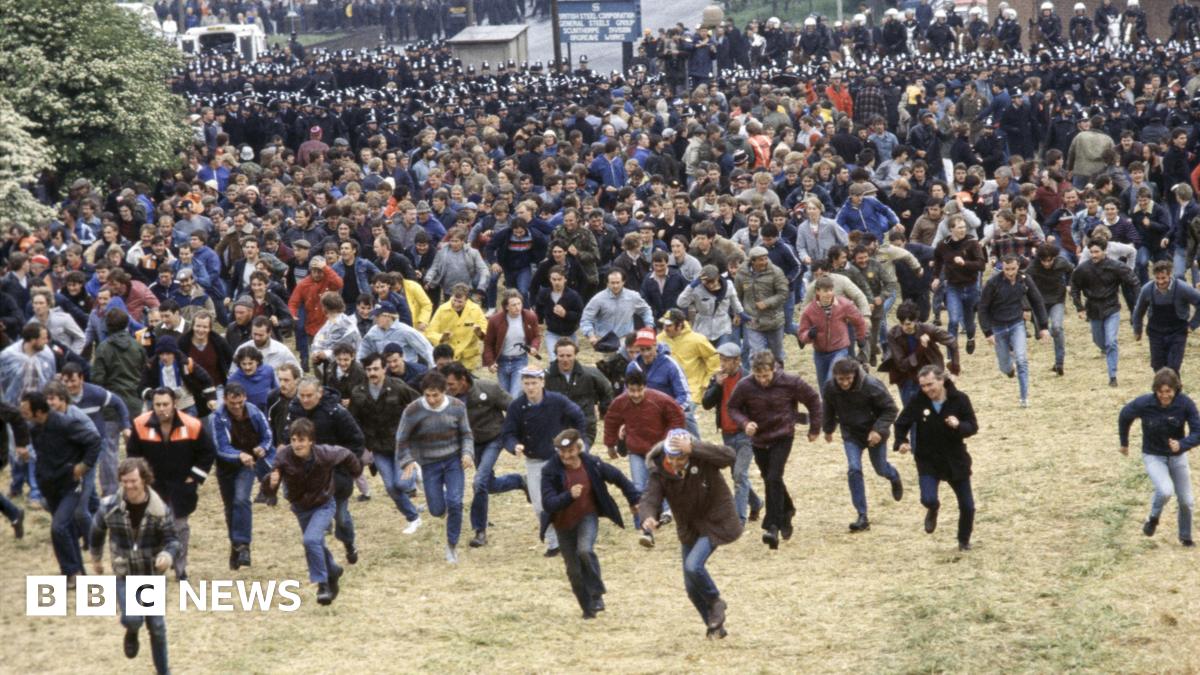

National Inquiry Into Orgreave Yvette Coopers Decision And What It Means

Jul 23, 2025

National Inquiry Into Orgreave Yvette Coopers Decision And What It Means

Jul 23, 2025 -

Trump Demands Redskins Name Return Commanders Stadium Deal In Jeopardy

Jul 23, 2025

Trump Demands Redskins Name Return Commanders Stadium Deal In Jeopardy

Jul 23, 2025 -

Kamala Harris 2020 Campaign A Look Back At The Challenges And Criticisms

Jul 23, 2025

Kamala Harris 2020 Campaign A Look Back At The Challenges And Criticisms

Jul 23, 2025 -

Deadly Russian Missile Strikes On Ukraine Amidst Drone Attacks On Moscow

Jul 23, 2025

Deadly Russian Missile Strikes On Ukraine Amidst Drone Attacks On Moscow

Jul 23, 2025

Latest Posts

-

Pension Commission Inquiry Addressing The Retirement Savings Gap Affecting Millions

Jul 23, 2025

Pension Commission Inquiry Addressing The Retirement Savings Gap Affecting Millions

Jul 23, 2025 -

Solve Nyt Connections Puzzle 772 Hints And Answers For July 22

Jul 23, 2025

Solve Nyt Connections Puzzle 772 Hints And Answers For July 22

Jul 23, 2025 -

Fake Lafufu Labubus Chinas Response To A Thriving Black Market

Jul 23, 2025

Fake Lafufu Labubus Chinas Response To A Thriving Black Market

Jul 23, 2025 -

Yellowstone Supervolcano Myth The Truth Behind The Online Animal Migration Panic

Jul 23, 2025

Yellowstone Supervolcano Myth The Truth Behind The Online Animal Migration Panic

Jul 23, 2025 -

Michelle Beadles Luxurious Vacation A New Chapter After Sirius Xm

Jul 23, 2025

Michelle Beadles Luxurious Vacation A New Chapter After Sirius Xm

Jul 23, 2025