Four Steps To Shield Your Retirement From A 2025 US Tourism Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Four Steps to Shield Your Retirement from a Potential 2025 US Tourism Decline

The US tourism sector, a significant contributor to the national economy, faces potential headwinds in 2025. While predicting the future is impossible, several economic factors suggest a possible downturn. This uncertainty poses a significant risk to retirees whose portfolios are, directly or indirectly, tied to the health of this industry. Don't let potential economic shifts derail your golden years. Take proactive steps now to protect your retirement savings.

Understanding the Potential Risks

Several factors could contribute to a decline in US tourism in 2025. These include:

- Inflation and Recessionary Fears: Persistent inflation and the lingering threat of recession can significantly impact discretionary spending, a key driver of tourism. Consumers may cut back on travel plans, opting for more budget-friendly activities.

- Geopolitical Instability: Global events and geopolitical uncertainty can deter international travel, impacting revenue streams for US tourism businesses.

- Rising Interest Rates: Higher interest rates make borrowing more expensive, potentially impacting investments in the tourism sector and slowing growth.

- Over-reliance on International Tourists: A significant portion of US tourism revenue comes from international travelers. Fluctuations in global economies or travel restrictions can have a dramatic impact.

These factors highlight the importance of diversification and a proactive approach to retirement planning. Relying solely on investments tied to the tourism sector could leave your retirement vulnerable.

H2: Four Steps to Safeguard Your Retirement

Here are four crucial steps to mitigate the potential impact of a US tourism decline on your retirement:

1. Diversify Your Investment Portfolio:

- Reduce Concentration Risk: Don't put all your eggs in one basket. Diversify your investments across different asset classes, including stocks, bonds, real estate, and potentially alternative investments like precious metals. Minimizing your exposure to the tourism sector is key.

- Consider Index Funds: Investing in broad market index funds offers diversification across various sectors, reducing the impact of a downturn in any single industry. [Link to reputable financial information website about index funds]

- Consult a Financial Advisor: A qualified financial advisor can help you create a personalized investment strategy tailored to your risk tolerance and retirement goals.

2. Re-evaluate Your Retirement Spending Plan:

- Create a Realistic Budget: Carefully assess your current expenses and project future needs. Identify areas where you can potentially cut back or adjust your spending habits.

- Emergency Fund: Maintain a substantial emergency fund (ideally 3-6 months of living expenses) to cover unexpected costs and withstand market volatility.

- Explore Part-Time Work: Consider supplementing your retirement income with part-time work or consulting to increase your financial security.

3. Monitor Your Investments Regularly:

- Stay Informed: Keep abreast of economic trends and market fluctuations. Regularly review your investment portfolio and make necessary adjustments based on changing circumstances.

- Don't Panic Sell: Market downturns are a normal part of the investment cycle. Avoid making rash decisions based on short-term market fluctuations. A long-term investment strategy is crucial.

4. Explore Alternative Income Streams:

- Rental Properties: Real estate investment can provide a stable income stream, relatively independent from the tourism sector.

- Dividends: Investing in dividend-paying stocks can generate passive income, supplementing your retirement funds. [Link to reputable financial information website about dividend stocks]

- Annuities: Annuities offer a guaranteed income stream, providing financial security during retirement.

Conclusion:

While a decline in US tourism in 2025 is a possibility, it doesn't have to spell disaster for your retirement. By taking proactive steps to diversify your investments, manage your spending, and explore alternative income streams, you can significantly reduce your vulnerability and ensure a comfortable and secure retirement. Remember to consult with a qualified financial advisor for personalized guidance. Your financial future is worth protecting.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Four Steps To Shield Your Retirement From A 2025 US Tourism Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Incident Macron Macron L Elysee Dement Toute Tension Dans La Video

May 26, 2025

Incident Macron Macron L Elysee Dement Toute Tension Dans La Video

May 26, 2025 -

Roland Garros Schedule 2024 Match Times And Court Information

May 26, 2025

Roland Garros Schedule 2024 Match Times And Court Information

May 26, 2025 -

Romance Blossoms Chris Hughes Rose Bouquet For Jo Jo Siwa Ignites Dating Rumors

May 26, 2025

Romance Blossoms Chris Hughes Rose Bouquet For Jo Jo Siwa Ignites Dating Rumors

May 26, 2025 -

U S Economy Faces 23 Billion Loss 230 000 Job Cuts Amidst Foreign Tourist Decline New Study

May 26, 2025

U S Economy Faces 23 Billion Loss 230 000 Job Cuts Amidst Foreign Tourist Decline New Study

May 26, 2025 -

Nolas Injury Opens Door Blue Jays Pitcher Eyed By Phillies For Rotation Spot

May 26, 2025

Nolas Injury Opens Door Blue Jays Pitcher Eyed By Phillies For Rotation Spot

May 26, 2025

Latest Posts

-

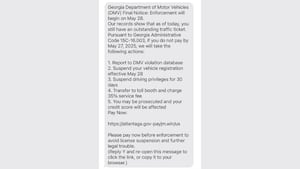

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025 -

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025 -

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025 -

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025 -

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025