From Bank Of America To Boom Stock: Inside Warren Buffett's Latest Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

From Bank of America to Boom Stocks: Inside Warren Buffett's Evolving Investment Strategy

The Oracle of Omaha surprises again. Warren Buffett, the legendary investor known for his value investing approach and long-term holdings, has recently shown a shift in his investment strategy. While his core tenets remain, a closer look reveals a fascinating evolution, incorporating elements previously considered outside his typical playbook. This move has sent ripples through the financial world, sparking intense speculation and analysis.

For decades, Buffett's Berkshire Hathaway focused on acquiring undervalued companies with strong fundamentals, a strategy that yielded incredible returns. Think Coca-Cola, American Express, and Wells Fargo – long-term holdings representing the bedrock of his investment philosophy. However, recent investments paint a slightly different picture.

The Shift Towards Tech and Growth

Buffett's recent foray into tech stocks, particularly Apple, has been a significant departure from his traditional value-oriented approach. While Apple is undoubtedly a profitable company, its valuation at times has been considered higher than what traditional value investors would deem "undervalued." This investment highlights a willingness to embrace growth stocks, a sector previously less prominent in Berkshire Hathaway's portfolio. This isn't just a small tweak; it signifies a potential adaptation to the changing economic landscape and the dominance of tech giants in the modern market.

This strategic shift isn't limited to Apple. While still maintaining significant holdings in established financial institutions like Bank of America, Berkshire Hathaway has shown increased interest in companies with strong growth potential, even if they come with higher valuations than his usual targets. This suggests a nuanced approach, potentially balancing his traditional value investing principles with a consideration for growth prospects in a rapidly evolving market.

Beyond the Headlines: Analyzing the Underlying Factors

Several factors might be driving this change:

- The Changing Market Landscape: The rise of technology and the increasingly dynamic nature of the global economy require a more adaptable investment strategy. The traditional value approach, while still valuable, may not be sufficient to capitalize on the explosive growth seen in certain sectors.

- Succession Planning: As Buffett nears the end of his career, there's speculation that this shift represents a strategic repositioning of Berkshire Hathaway's portfolio for the future, potentially catering to the investment preferences of his successors.

- Market Opportunities: Despite the higher valuations, some high-growth companies offer compelling long-term opportunities that traditional value investing might miss. Buffett's team may be identifying unique situations where the risk is justified by the potential reward.

Bank of America: A Steady Hand in a Shifting Portfolio

While the focus is on the new additions, it's crucial to remember Bank of America remains a cornerstone of Buffett's portfolio. This underlines his continued belief in established financial institutions and their resilience in times of economic uncertainty. The continued investment in Bank of America shows a commitment to long-term, steady growth alongside the new, potentially riskier, ventures.

What's Next for the Oracle of Omaha?

The evolution of Buffett's investment strategy is a compelling narrative. It suggests that even the most experienced investors must adapt to the ever-changing dynamics of the market. While the future remains uncertain, one thing is clear: Warren Buffett's moves continue to shape the investment world, prompting investors and analysts alike to closely watch his next moves. This shift warrants careful consideration for anyone interested in understanding long-term investment strategies and the evolution of market dynamics. Are we witnessing a complete paradigm shift, or a calculated refinement of a legendary approach? Only time will tell.

Keywords: Warren Buffett, Berkshire Hathaway, Investment Strategy, Value Investing, Growth Stocks, Bank of America, Apple, Tech Stocks, Oracle of Omaha, Investment Portfolio, Stock Market, Financial News, Investment Analysis

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on From Bank Of America To Boom Stock: Inside Warren Buffett's Latest Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rangers Tap David Quinn Joe Sacco As Assistant Coaches

Jun 05, 2025

Rangers Tap David Quinn Joe Sacco As Assistant Coaches

Jun 05, 2025 -

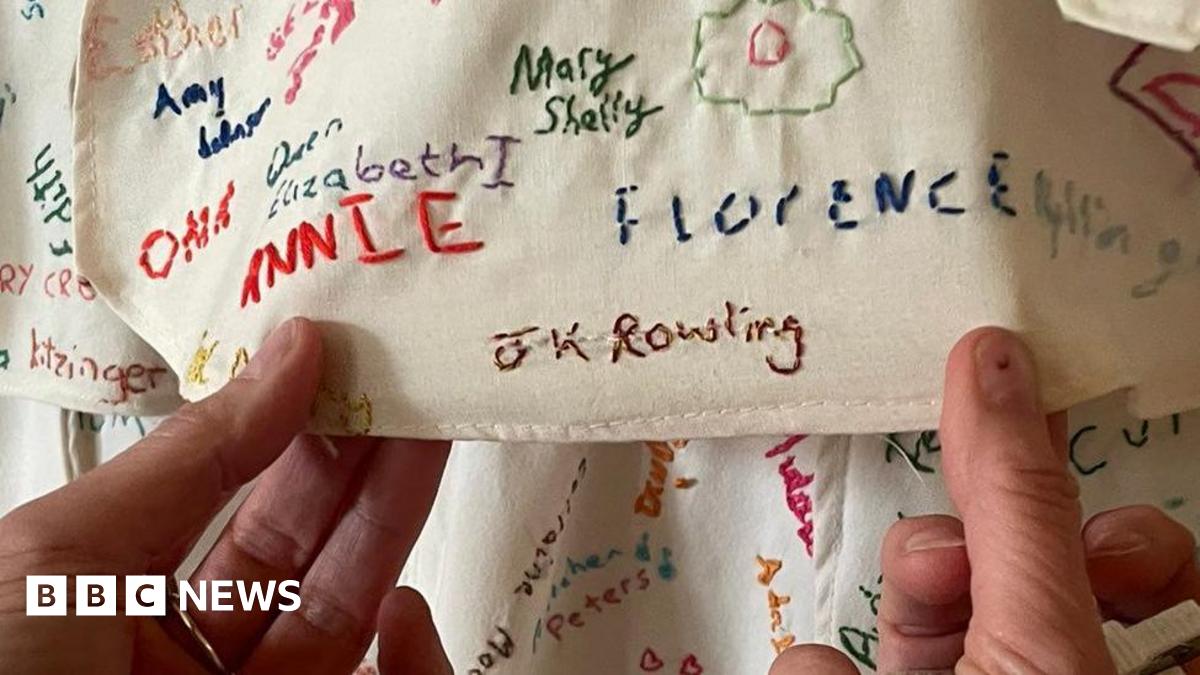

National Trust Responds To Allegations Of Concealed Damaged Artwork J K Rowling Connection

Jun 05, 2025

National Trust Responds To Allegations Of Concealed Damaged Artwork J K Rowling Connection

Jun 05, 2025 -

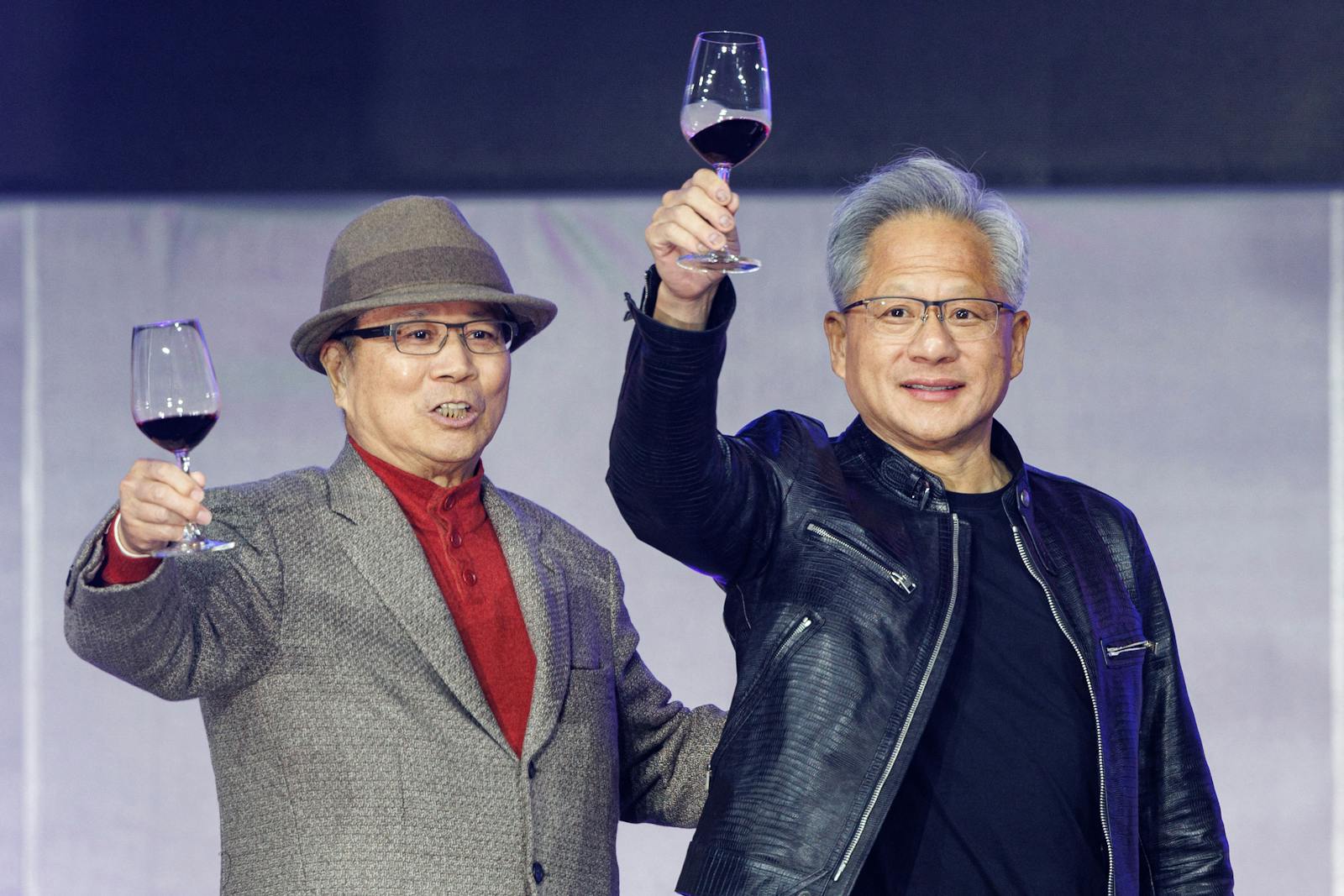

Analyzing Nvidias Core Weave A Contender For Us Profitability Crown

Jun 05, 2025

Analyzing Nvidias Core Weave A Contender For Us Profitability Crown

Jun 05, 2025 -

Us Economy Defies Expectations Aprils Job Openings Report

Jun 05, 2025

Us Economy Defies Expectations Aprils Job Openings Report

Jun 05, 2025 -

Stewart Mocks Musks Exit A Cnn Business Report On The Twitter Ceos Decision

Jun 05, 2025

Stewart Mocks Musks Exit A Cnn Business Report On The Twitter Ceos Decision

Jun 05, 2025

Latest Posts

-

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025