Future Of Student Loans: Experts Weigh In On Federal Vs. Private Loan Advantages

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Future of Student Loans: Experts Weigh In on Federal vs. Private Loan Advantages

The rising cost of higher education has made student loans a necessity for many, but navigating the complex world of financing your education can be daunting. Understanding the differences between federal and private student loans is crucial for making informed decisions that can impact your financial future for years to come. This article explores the evolving landscape of student loan options, examining the advantages of each type and offering insights from leading financial experts.

The Shifting Sands of Student Loan Debt:

The student loan debt crisis is a significant concern in many countries. The total amount of student loan debt continues to climb, impacting borrowers' ability to buy homes, save for retirement, and achieve other significant financial milestones. This necessitates a careful consideration of loan options before committing to a repayment plan. [Link to relevant statistic on student loan debt].

Federal Student Loans: A Safety Net with Built-In Protections:

Federal student loans offer several advantages over their private counterparts. These include:

-

Government-backed benefits: Federal loans are backed by the government, providing crucial protections for borrowers. This includes income-driven repayment plans, deferment and forbearance options during times of financial hardship, and loan forgiveness programs under certain circumstances, such as working in public service. [Link to government website detailing loan forgiveness programs].

-

Fixed interest rates: Federal student loan interest rates are generally fixed, meaning your monthly payment remains predictable throughout the loan term. This stability offers greater financial planning certainty compared to the variable interest rates often associated with private loans.

-

Accessibility: Federal student loans are generally easier to qualify for than private loans, especially for students with limited credit history. The application process is typically streamlined and straightforward.

Private Student Loans: A Supplement with Potential Pitfalls:

Private student loans can be a valuable supplement to federal loans, but borrowers should proceed with caution.

-

Variable interest rates: Private student loans often come with variable interest rates, meaning your monthly payments could fluctuate depending on market conditions. This unpredictability can make budgeting and financial planning more challenging.

-

Limited borrower protections: Private loans generally lack the borrower protections afforded by federal loans. Income-driven repayment plans and loan forgiveness programs are rarely available.

-

Higher interest rates: Private student loans typically carry higher interest rates than federal loans, especially for borrowers with less-than-perfect credit. This can significantly increase the total cost of borrowing over the life of the loan.

Expert Opinions on the Future of Student Loan Finance:

We spoke with several leading financial experts to get their perspective on the future of student loans. Dr. Emily Carter, Professor of Economics at [University Name], emphasizes the importance of "prioritizing federal loans due to their inherent borrower protections and flexible repayment options." She further suggests that "students should carefully assess their financial needs and borrow only what is absolutely necessary to avoid excessive debt."

Mr. David Lee, a financial advisor with [Financial Firm Name], adds that "a holistic approach to financial planning is crucial. Students should explore all available financial aid options, including scholarships and grants, before resorting to loans. Careful budgeting and smart financial management are key to successful repayment."

Choosing the Right Path: A Strategic Approach:

The decision of whether to opt for federal or private student loans is a personal one, requiring careful consideration of individual circumstances and long-term financial goals. A strategic approach involves:

- Exhausting all federal loan options: Maximize the amount of federal student aid you can receive before considering private loans.

- Comparing interest rates and repayment terms: Carefully compare offers from various lenders before accepting a loan.

- Creating a realistic repayment plan: Develop a budget that incorporates your student loan payments and other financial obligations.

The future of student loans is constantly evolving, influenced by economic conditions and government policies. Staying informed and making well-informed decisions is crucial for navigating this complex landscape and ensuring a brighter financial future. [Link to reputable source on student loan trends].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Future Of Student Loans: Experts Weigh In On Federal Vs. Private Loan Advantages. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

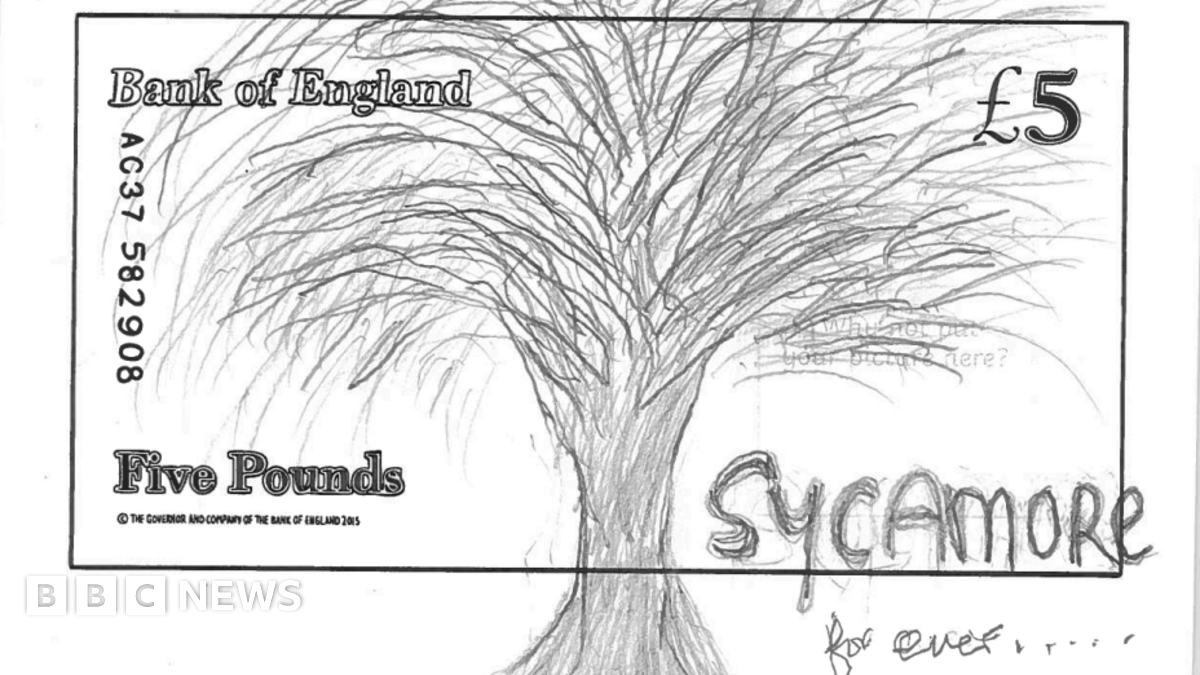

Bank Of Englands Banknote Redesign Thousands Submit Design Ideas

Aug 01, 2025

Bank Of Englands Banknote Redesign Thousands Submit Design Ideas

Aug 01, 2025 -

Bitcoin Market Outlook The Implications Of Coinbases Falling Btc Premium

Aug 01, 2025

Bitcoin Market Outlook The Implications Of Coinbases Falling Btc Premium

Aug 01, 2025 -

U S National Security Concerns Examining The Actions Of The Brazilian Government

Aug 01, 2025

U S National Security Concerns Examining The Actions Of The Brazilian Government

Aug 01, 2025 -

Experience The Classic Plants Vs Zombies Replanted Launches With New Content

Aug 01, 2025

Experience The Classic Plants Vs Zombies Replanted Launches With New Content

Aug 01, 2025 -

Top 5 Goblin Decks For Clash Royales July August 2025 Event A Comprehensive Guide

Aug 01, 2025

Top 5 Goblin Decks For Clash Royales July August 2025 Event A Comprehensive Guide

Aug 01, 2025

Latest Posts

-

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025 -

Backlash Against Bbc Master Chef Faces Cancellation After Judge Sackings

Aug 03, 2025

Backlash Against Bbc Master Chef Faces Cancellation After Judge Sackings

Aug 03, 2025 -

Mr Beasts Challenge Cenat Vs X Qcs Streaming Empire Compared

Aug 03, 2025

Mr Beasts Challenge Cenat Vs X Qcs Streaming Empire Compared

Aug 03, 2025 -

New Policy Only Working Class Individuals Eligible For Civil Service Internships

Aug 03, 2025

New Policy Only Working Class Individuals Eligible For Civil Service Internships

Aug 03, 2025 -

Public Outrage Prompts Master Chef Review Bbc Responds To Judge Controversy

Aug 03, 2025

Public Outrage Prompts Master Chef Review Bbc Responds To Judge Controversy

Aug 03, 2025