Gold Investment Safety: A Guide For Today's Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold Investment Safety: A Guide for Today's Market

The shimmering allure of gold has captivated investors for centuries. But in today's volatile market, navigating the world of gold investment requires careful consideration. Is it a safe haven, or a risky gamble? This comprehensive guide will explore the safety and security aspects of gold investment, helping you make informed decisions.

Understanding the Appeal of Gold

Gold's enduring appeal stems from its perceived safety during economic uncertainty. Historically, it has acted as a hedge against inflation and currency devaluation. Unlike stocks or bonds, gold's value isn't tied to a company's performance or government policies. This inherent stability makes it an attractive asset for diversifying investment portfolios. Many consider it a crucial component of a robust financial strategy, particularly during times of geopolitical instability or market downturns.

Types of Gold Investments: Weighing the Risks

Several avenues exist for investing in gold, each with its own level of risk and reward:

-

Physical Gold: Buying gold bars or coins offers tangible ownership, but involves storage concerns and potential theft risks. Reputable dealers are essential for authenticity verification. Learn more about (replace with a relevant link).

-

Gold ETFs (Exchange-Traded Funds): These funds track the price of gold, offering a convenient and liquid way to invest. However, their value fluctuates with the gold price, and you don't own the physical gold.

-

Gold Mining Stocks: Investing in companies that extract gold carries higher risk but potentially greater rewards. These stocks are sensitive to commodity prices and the operational performance of the mining company. Understanding the (replace with a relevant link) is crucial.

-

Gold Futures and Options: These are derivative instruments, offering leveraged exposure to gold price movements. They are highly speculative and carry substantial risk, suitable only for experienced investors with a high risk tolerance.

Safeguarding Your Gold Investment:

Regardless of your chosen investment method, protecting your investment is paramount:

-

Due Diligence: Thoroughly research any dealer, broker, or ETF provider before investing. Check their reputation and regulatory compliance.

-

Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes to mitigate risk.

-

Secure Storage: For physical gold, invest in a secure storage solution, whether it's a home safe, a bank vault, or a specialized storage facility.

-

Insurance: Consider insuring your gold investment against loss or theft.

The Current Market Landscape & Future Outlook

The gold market is dynamic, influenced by various factors including inflation rates, interest rates, geopolitical events, and investor sentiment. Currently, (replace with a relevant link). While predicting future gold prices is impossible, understanding these influencing factors can help you make more informed investment decisions.

Conclusion: A Strategic Approach to Gold Investment

Gold can be a valuable component of a well-diversified investment portfolio, offering a potential hedge against inflation and economic uncertainty. However, it's crucial to approach gold investment strategically, understanding the risks associated with each investment type and taking appropriate safety measures to protect your assets. Remember to consult with a qualified financial advisor before making any investment decisions. They can help you tailor a strategy that aligns with your risk tolerance and financial goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold Investment Safety: A Guide For Today's Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indiana Pacers Punch Their Ticket To The East Finals 5 Crucial Moments

May 15, 2025

Indiana Pacers Punch Their Ticket To The East Finals 5 Crucial Moments

May 15, 2025 -

Top Baby Names Of 2024 Classic Names Reign Supreme

May 15, 2025

Top Baby Names Of 2024 Classic Names Reign Supreme

May 15, 2025 -

Buy And Hold For The Next Decade 2 Promising Tech Stocks

May 15, 2025

Buy And Hold For The Next Decade 2 Promising Tech Stocks

May 15, 2025 -

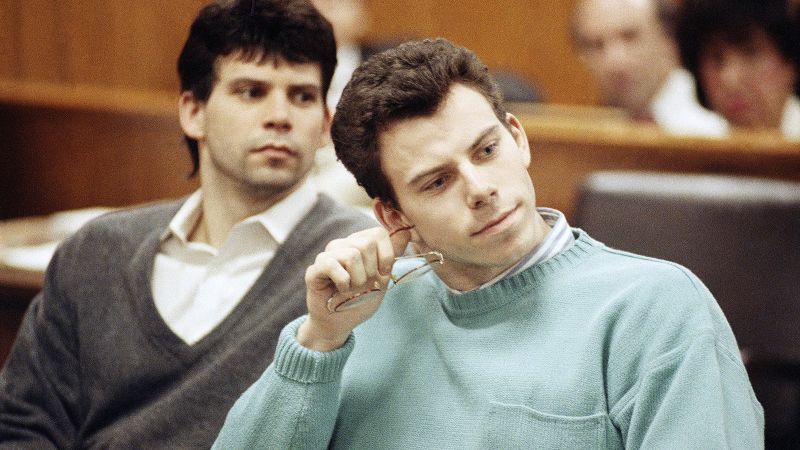

Erik And Lyle Menendez New Sentencing Hearing On The Horizon

May 15, 2025

Erik And Lyle Menendez New Sentencing Hearing On The Horizon

May 15, 2025 -

Andor Celebrating Courage And Sacrifice

May 15, 2025

Andor Celebrating Courage And Sacrifice

May 15, 2025

Latest Posts

-

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025 -

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025 -

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025 -

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025