Gold's Price Surge: A Guide To Safe And Smart Gold Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold's Price Surge: A Guide to Safe and Smart Gold Investments

Gold. The word itself conjures images of wealth, security, and timeless value. And right now, with global uncertainty impacting markets, the price of gold is surging, making many investors wonder: is now the time to buy? This guide explores the recent price increases, examines smart investment strategies, and provides essential tips for navigating the world of gold investment safely.

Why is Gold's Price Rising?

Several factors contribute to gold's recent price surge. Firstly, inflationary pressures are a major driver. As the cost of goods and services increases, investors often turn to gold as a hedge against inflation, preserving their purchasing power. Secondly, geopolitical instability plays a significant role. Global conflicts and economic uncertainty often lead to increased demand for gold, considered a safe haven asset. Finally, weakening currencies can boost gold's appeal, as investors seek alternative stores of value. [Link to reputable financial news source discussing current inflation rates].

Different Ways to Invest in Gold:

Investing in gold isn't just about buying physical bars. Several avenues exist, each with its own advantages and disadvantages:

-

Physical Gold: This includes gold bars and coins. While offering tangible ownership, it requires secure storage and insurance. Consider the premiums charged by dealers when purchasing physical gold.

-

Gold ETFs (Exchange-Traded Funds): These funds track the price of gold, offering a convenient and liquid way to invest. They are traded on stock exchanges, making buying and selling easy. [Link to a reputable site explaining Gold ETFs].

-

Gold Mining Stocks: Investing in companies that mine gold can offer higher potential returns but also carries higher risk. The success of these investments is tied to the mining company's performance, not just the price of gold.

-

Gold Mutual Funds: These funds pool money from multiple investors to invest in gold-related assets, providing diversification and professional management.

Smart Strategies for Gold Investment:

Before diving in, consider these key points:

-

Diversification is Key: Don't put all your eggs in one basket. Gold should be part of a diversified investment portfolio, balancing risk and reward.

-

Long-Term Perspective: Gold investments are generally considered long-term plays. Short-term price fluctuations are normal; focus on your overall investment strategy.

-

Research and Due Diligence: Thoroughly research any investment option before committing your funds. Understand the associated fees, risks, and potential returns.

-

Secure Storage: If investing in physical gold, ensure secure storage to protect your investment against theft or loss. Consider a reputable vault or safe deposit box.

-

Understand the Costs: Factor in storage costs, insurance premiums, and any transaction fees when calculating your overall investment cost.

Safeguarding Your Gold Investment:

-

Reputable Dealers: Only purchase gold from reputable dealers with a proven track record. Verify their authenticity and legitimacy before making any transactions.

-

Proper Documentation: Keep accurate records of all your gold purchases and transactions. This is crucial for tax purposes and for tracking your investment's performance.

-

Insurance: Insure your physical gold holdings against loss or damage. This protects your investment against unforeseen circumstances.

Conclusion:

The recent surge in gold prices presents both opportunities and challenges for investors. By understanding the various investment options, employing smart strategies, and prioritizing safety and security, you can navigate this market effectively. Remember to consult with a qualified financial advisor before making any significant investment decisions. This article provides general information and should not be considered financial advice.

Call to Action: Learn more about responsible gold investment strategies by [linking to a relevant resource, perhaps a government website or reputable financial planning site].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold's Price Surge: A Guide To Safe And Smart Gold Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

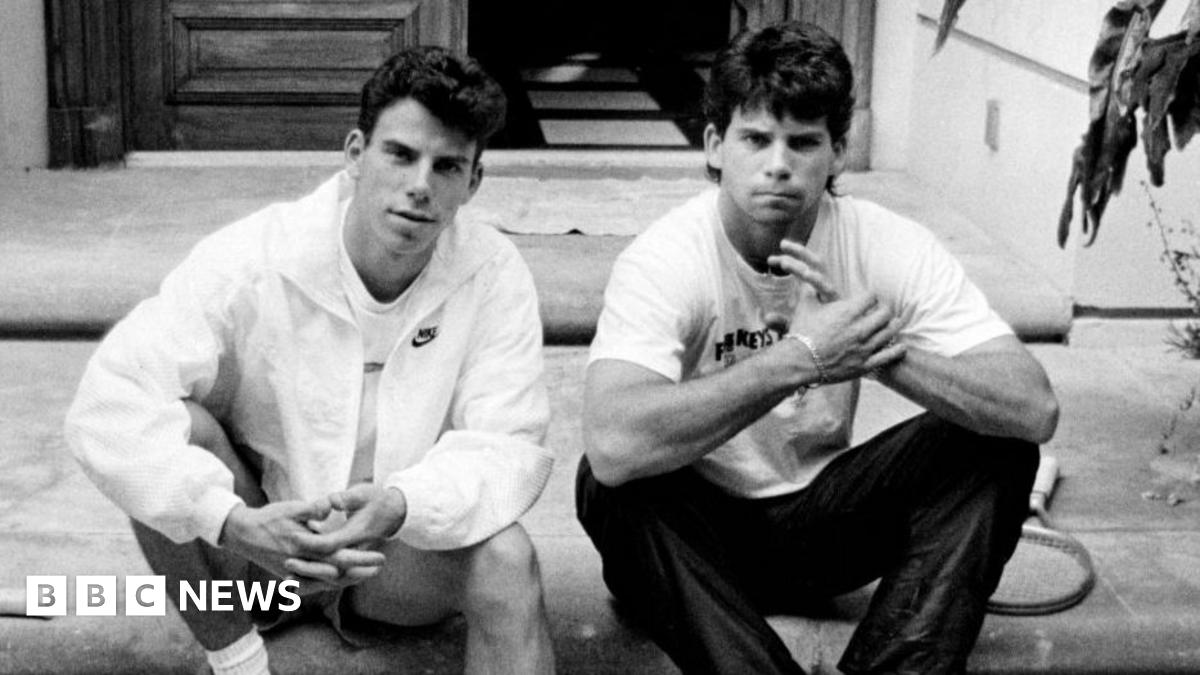

Menendez Brothers 1989 Murders Judge Hands Down Revised Sentences

May 15, 2025

Menendez Brothers 1989 Murders Judge Hands Down Revised Sentences

May 15, 2025 -

Get Ready To Race The New Lego Spiny Shell Arrives This Week

May 15, 2025

Get Ready To Race The New Lego Spiny Shell Arrives This Week

May 15, 2025 -

Stars Defeat Opponent Granlund Nets Three Goals Postseason Implications

May 15, 2025

Stars Defeat Opponent Granlund Nets Three Goals Postseason Implications

May 15, 2025 -

Gold Investment A Comprehensive Guide To Safety And Returns

May 15, 2025

Gold Investment A Comprehensive Guide To Safety And Returns

May 15, 2025 -

High Bacteria Levels In Rock Creek Rfk Jr Shares Photos Of Family Swim Ignoring Warnings

May 15, 2025

High Bacteria Levels In Rock Creek Rfk Jr Shares Photos Of Family Swim Ignoring Warnings

May 15, 2025

Latest Posts

-

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025 -

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025 -

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025 -

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025