Government Borrowing Exceeds April Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Exceeds April Expectations: Higher-Than-Projected Deficit Raises Concerns

Government borrowing in April surged past expectations, fueling concerns about the nation's fiscal health and potentially impacting interest rates. The unexpected jump in borrowing, exceeding forecasts from leading economists and analysts, signals a steeper climb in the national debt than initially projected. This development has significant implications for the economy and could influence future government spending plans.

This article delves into the details of April's borrowing figures, analyzes the contributing factors, and explores the potential consequences for the nation's financial landscape.

Record High Borrowing Figures Shock Markets

Official figures released [Insert Date and Source of Data, e.g., yesterday by the Office for National Statistics] revealed that government borrowing reached [Insert Exact Figure] in April. This represents a substantial increase compared to the [Insert Figure] predicted by analysts and a significant jump from the [Insert Figure] recorded in April of the previous year. The unexpectedly high figure has sent shockwaves through financial markets, raising questions about the government's fiscal management and its long-term economic strategy.

Factors Contributing to Increased Borrowing

Several factors contributed to the higher-than-expected borrowing figures. These include:

- Increased Government Spending: Higher-than-anticipated spending on [List key areas, e.g., healthcare, social welfare, and defense] significantly impacted the budget. This spending increase may reflect both planned initiatives and unforeseen expenses related to [Mention specific events or crises if applicable, e.g., the ongoing energy crisis or a specific natural disaster].

- Lower-Than-Expected Tax Revenue: Tax revenues fell short of projections, potentially due to [Explain potential reasons, e.g., slowing economic growth, changes in tax policies, or a decrease in consumer spending]. This shortfall exacerbated the pressure on government finances.

- Inflationary Pressures: The ongoing inflationary environment has likely increased the cost of government services and programs, contributing to the higher spending levels. Rising inflation also erodes the real value of tax revenues.

Potential Implications and Future Outlook

The increased government borrowing has several potential implications:

- Rising National Debt: The higher-than-expected deficit will inevitably contribute to a faster accumulation of national debt, potentially raising concerns about the country's long-term debt sustainability.

- Interest Rate Increases: Increased government borrowing could put upward pressure on interest rates as the government competes with other borrowers for funds in the market. Higher interest rates could dampen economic growth and increase the cost of government borrowing further.

- Impact on Government Policy: The government may be forced to re-evaluate its spending plans and potentially implement austerity measures to control the deficit. This could lead to difficult decisions regarding public services and social programs.

Expert Opinions and Market Reactions

Leading economists and market analysts have reacted to the news with [Summarize the key reactions and opinions from experts]. [Quote a relevant expert, if available]. The stock market experienced [Describe the market's immediate reaction], reflecting the uncertainty surrounding the government's fiscal position.

Conclusion: A Call for Fiscal Responsibility

The unexpectedly high government borrowing figures in April serve as a stark reminder of the challenges facing the nation's finances. Addressing this issue requires a comprehensive approach involving both careful spending management and a robust strategy for generating sustainable revenue. The government's response to this situation will be closely watched by investors, businesses, and citizens alike. Further analysis and government pronouncements are eagerly awaited to provide more clarity on the path forward. This situation highlights the need for greater fiscal responsibility and transparent communication about the nation's financial health.

(Optional CTA): Stay informed on the latest economic news by subscribing to our newsletter [link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Exceeds April Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

South Park Streaming Controversy The Potential For Classic Episode Removal

May 23, 2025

South Park Streaming Controversy The Potential For Classic Episode Removal

May 23, 2025 -

New Rules Could See Violent Offenders Released Early Under Good Behavior

May 23, 2025

New Rules Could See Violent Offenders Released Early Under Good Behavior

May 23, 2025 -

The Impact Of Fires Record Loss Of Tropical Forests And The Growing Climate Emergency

May 23, 2025

The Impact Of Fires Record Loss Of Tropical Forests And The Growing Climate Emergency

May 23, 2025 -

Ongoing M And S Online Service Issues Update For July

May 23, 2025

Ongoing M And S Online Service Issues Update For July

May 23, 2025 -

Hollywood Heavyweights Eyed For Street Fighter Momoa Koji Centineo And Reigns In Talks

May 23, 2025

Hollywood Heavyweights Eyed For Street Fighter Momoa Koji Centineo And Reigns In Talks

May 23, 2025

Latest Posts

-

Kim Jong Uns Fury Details Emerge Following Warship Launch Accident

May 23, 2025

Kim Jong Uns Fury Details Emerge Following Warship Launch Accident

May 23, 2025 -

Italian Citizenship Eligibility Expanded Great Grandparents Heritage Now Counts

May 23, 2025

Italian Citizenship Eligibility Expanded Great Grandparents Heritage Now Counts

May 23, 2025 -

South Park Streaming Future Paramount And Hbo Max Whats Next

May 23, 2025

South Park Streaming Future Paramount And Hbo Max Whats Next

May 23, 2025 -

La Influencer Angela Marmol Revela Un Sorprendente Detalle De Su Encuentro Con Tom Cruise

May 23, 2025

La Influencer Angela Marmol Revela Un Sorprendente Detalle De Su Encuentro Con Tom Cruise

May 23, 2025 -

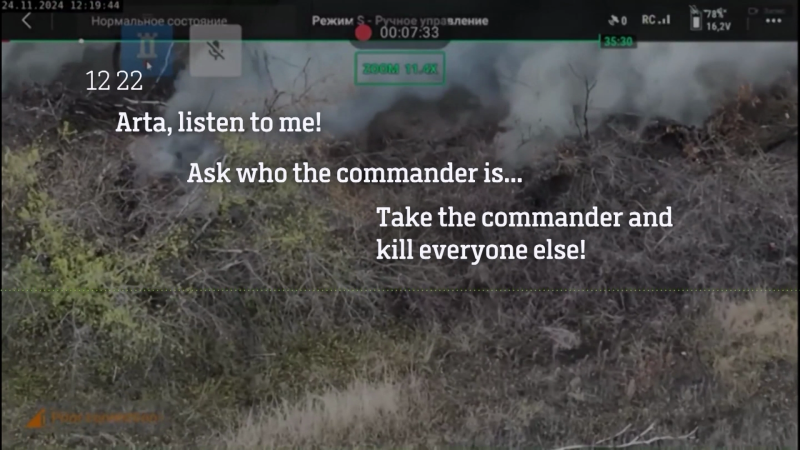

Take The Commander Kill The Rest Analysis Of Intercepted Russian Communications

May 23, 2025

Take The Commander Kill The Rest Analysis Of Intercepted Russian Communications

May 23, 2025