Government Borrowing Exceeds Expectations: April's Financial Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Exceeds Expectations: April's Financial Report Reveals Mounting Debt

The UK government's April borrowing figures have sent shockwaves through financial markets, significantly exceeding economists' forecasts and raising concerns about the nation's burgeoning debt. The Office for National Statistics (ONS) released the data this morning, revealing a borrowing figure that paints a concerning picture of the country's fiscal health. This unexpected surge in borrowing highlights the challenges facing the government as it navigates a complex economic landscape.

April's Disappointing Figures: A Deeper Dive

The ONS reported that public sector net borrowing in April reached £22.7 billion, considerably higher than the anticipated £19.9 billion predicted by economists. This represents a substantial increase compared to the £1.6 billion borrowed in April 2022, a stark indicator of the deteriorating fiscal position. The higher-than-expected borrowing is largely attributed to weaker-than-expected tax revenues and increased government spending.

- Lower Tax Revenue: Tax receipts fell short of expectations, impacted by factors such as inflation's effect on consumer spending and the ongoing cost-of-living crisis. This decline in tax revenue directly impacts the government's ability to fund public services.

- Increased Government Spending: Government spending, on the other hand, remained elevated, driven by continued support for vulnerable households and increased investment in key public services. While necessary, this increased expenditure further contributes to the widening budget deficit.

Impact on the UK Economy and Future Outlook

This unexpected surge in borrowing raises several key concerns:

- Rising National Debt: The increased borrowing adds to the UK's already substantial national debt, potentially impacting the country's credit rating and increasing the cost of future borrowing. This could lead to higher interest rates and further economic pressure.

- Inflationary Pressures: Increased government borrowing can contribute to inflationary pressures, further exacerbating the cost-of-living crisis and impacting household budgets. The Bank of England will be closely monitoring these figures as it assesses its monetary policy response.

- Fiscal Policy Challenges: The government now faces significant challenges in managing its public finances. The Chancellor will need to carefully consider further fiscal measures to reduce the budget deficit and ensure long-term fiscal sustainability. This may involve difficult decisions regarding spending cuts or tax increases.

Expert Opinions and Market Reactions

Analysts and economists are expressing diverse reactions to the data. Some point to the lingering effects of the pandemic and the ongoing energy crisis as contributing factors, while others express concern about the government's fiscal management strategies. The news has already triggered a reaction in financial markets, with government bond yields rising.

What Happens Next? A Call for Fiscal Responsibility

The government faces significant pressure to address the widening budget deficit and restore confidence in the UK's fiscal position. This will likely involve a combination of strategies, potentially including:

- Spending Review: A comprehensive review of government spending to identify areas for potential efficiency gains and savings.

- Tax Reform: Evaluating the tax system to ensure it's both efficient and equitable, potentially involving adjustments to existing tax rates or the introduction of new taxes.

- Economic Growth Strategies: Implementing policies designed to stimulate economic growth and increase tax revenues, creating a virtuous cycle of increased income and reduced borrowing.

The April borrowing figures serve as a stark reminder of the challenges facing the UK economy. The government must now act decisively to implement sustainable fiscal policies that ensure long-term economic stability and prosperity. This situation will undoubtedly be closely scrutinized in the coming months, and further updates will be crucial to understanding the full impact of this concerning trend. Further analysis from leading economic institutions is expected soon, offering additional insight into this critical development.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Exceeds Expectations: April's Financial Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Google Geminis Rise My Top 6 Reasons To Stick With Apples Intelligent Features

May 24, 2025

Google Geminis Rise My Top 6 Reasons To Stick With Apples Intelligent Features

May 24, 2025 -

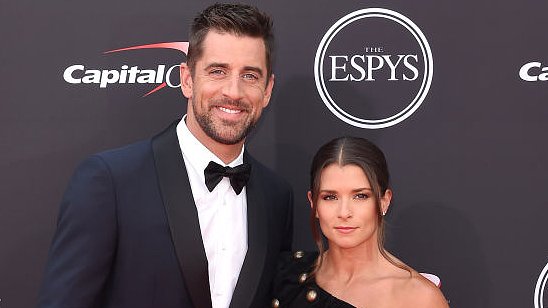

Wore Me Down To Nothing Danica Patrick Details Abusive Rodgers Relationship

May 24, 2025

Wore Me Down To Nothing Danica Patrick Details Abusive Rodgers Relationship

May 24, 2025 -

Sean Combs Trial Update Prosecutors Use Expert To Bolster Abuse Allegations

May 24, 2025

Sean Combs Trial Update Prosecutors Use Expert To Bolster Abuse Allegations

May 24, 2025 -

Airline System Outages Cnn Documents Dozens Of Incidents Jeopardizing Air Safety

May 24, 2025

Airline System Outages Cnn Documents Dozens Of Incidents Jeopardizing Air Safety

May 24, 2025 -

Barron Trump And Harvard Unconfirmed Reports Of Application Rejection Emerge

May 24, 2025

Barron Trump And Harvard Unconfirmed Reports Of Application Rejection Emerge

May 24, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

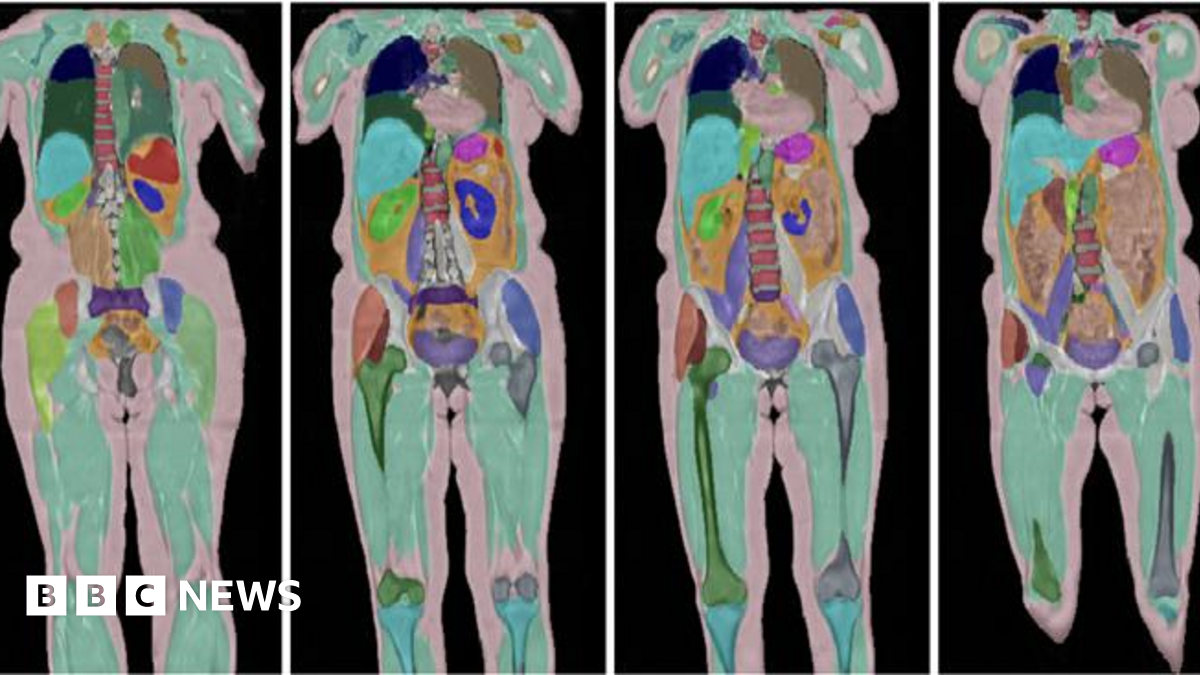

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025