Government Borrowing Exceeds Expectations In April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Exceeds Expectations in April: What Does it Mean for the Economy?

Government borrowing soared to unexpected heights in April, raising concerns amongst economists and sparking debate about the nation's fiscal health. The figures, released earlier this week by [Source: e.g., the Office for National Statistics or equivalent], significantly outpaced forecasts, prompting analysis of the underlying causes and potential consequences for the wider economy. This unexpected surge in borrowing has implications for interest rates, inflation, and future government spending plans.

April's Borrowing Figures: A Closer Look

The latest data reveals that government borrowing in April reached [Insert Specific Figure, e.g., £25 billion], considerably higher than the anticipated [Insert Predicted Figure, e.g., £18 billion] predicted by leading economists. This represents a [Percentage increase or decrease] compared to April of the previous year and is the [Superlative, e.g., highest] level of borrowing seen in [Timeframe, e.g., five years].

Several factors contributed to this significant overshoot. These include:

- Increased government spending: Higher-than-expected expenditure on [Specific areas, e.g., healthcare, social welfare programs] likely played a major role. The ongoing impact of [Relevant events, e.g., the cost of living crisis, energy price support schemes] has put pressure on public finances.

- Lower-than-expected tax revenues: Tax receipts may have fallen short of projections due to factors such as [Possible causes, e.g., a slowdown in economic growth, changes in tax policy].

- Inflationary pressures: Inflation erodes the real value of tax revenues, while simultaneously increasing the cost of government services and benefits payments. This double whammy significantly impacts the government's fiscal position.

Implications for the Economy and Future Outlook

The higher-than-expected borrowing figures have significant implications for the UK economy:

- Interest rates: The Bank of England may respond to increased government borrowing by raising interest rates further to curb inflation and manage the national debt. Higher interest rates can dampen economic growth and increase borrowing costs for businesses and households.

- Inflation: Increased government borrowing can contribute to inflationary pressures, potentially leading to a longer period of high inflation. This further complicates the economic outlook.

- Government spending plans: The government may need to re-evaluate its spending plans for the coming year, potentially leading to cuts in other areas to manage the national debt. This could have wide-ranging consequences across various sectors.

What Experts Are Saying

Leading economists are divided on the long-term implications. [Quote from a prominent economist, linking to their source]. Others argue that [Quote from another economist, with a contrasting view, linking to their source]. The situation remains fluid, and further analysis is needed to fully understand the consequences of April's borrowing figures.

Looking Ahead:

The government's upcoming budget statement will likely address these concerns. Expect further scrutiny of government spending and potential adjustments to fiscal policy. It’s crucial to monitor economic indicators closely in the coming months to assess the true impact of this unexpected surge in borrowing. Stay tuned for further updates as the situation unfolds.

Keywords: Government borrowing, April borrowing figures, UK economy, national debt, interest rates, inflation, government spending, fiscal policy, economic outlook, Bank of England, budget statement.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Exceeds Expectations In April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Proposal Could Violent Criminals Be Released Early

May 23, 2025

New Proposal Could Violent Criminals Be Released Early

May 23, 2025 -

Comey Addresses Secret Service Controversy In Exclusive Cnn Interview

May 23, 2025

Comey Addresses Secret Service Controversy In Exclusive Cnn Interview

May 23, 2025 -

Democratic Party Divided New Book Highlights Concerns Over Bidens Performance And Partys Reaction

May 23, 2025

Democratic Party Divided New Book Highlights Concerns Over Bidens Performance And Partys Reaction

May 23, 2025 -

Dodger Stadiums Camp Flog Gnaw 2025 Best Ticket Deals And Lineup Info

May 23, 2025

Dodger Stadiums Camp Flog Gnaw 2025 Best Ticket Deals And Lineup Info

May 23, 2025 -

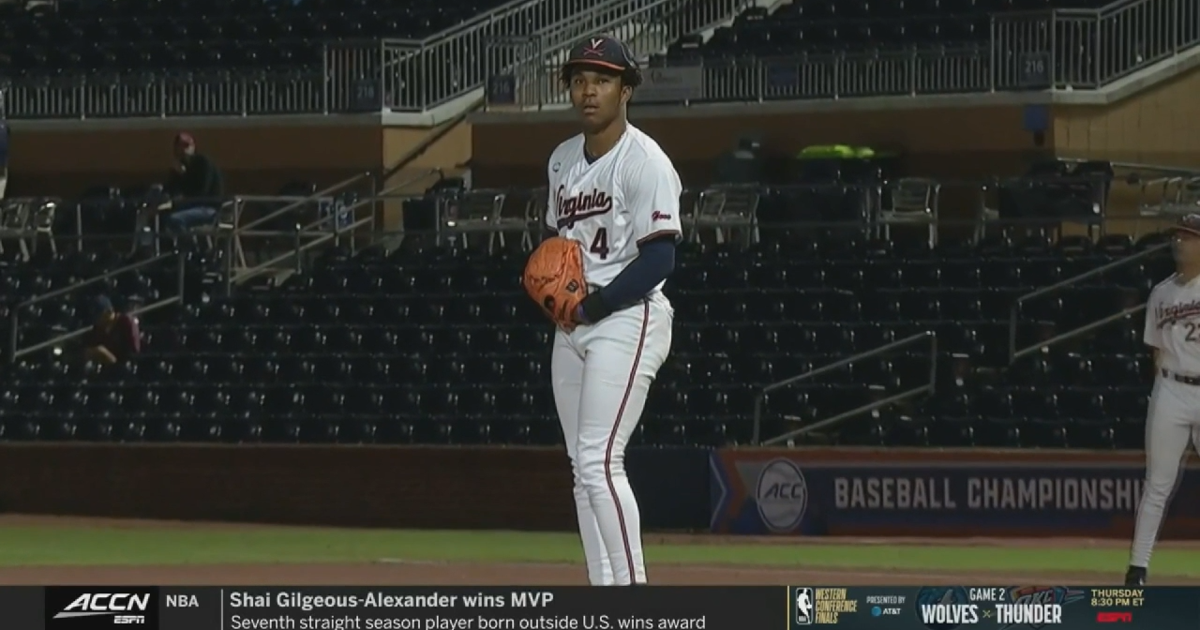

Virginia Cavaliers Fall To Boston College Acc Tournament Upset Highlights Numerous Errors

May 23, 2025

Virginia Cavaliers Fall To Boston College Acc Tournament Upset Highlights Numerous Errors

May 23, 2025

Latest Posts

-

Aprils Government Borrowing A Deeper Look At The Numbers

May 23, 2025

Aprils Government Borrowing A Deeper Look At The Numbers

May 23, 2025 -

Cassie Venturas Testimony Supported Diddy Trial Expert Analysis

May 23, 2025

Cassie Venturas Testimony Supported Diddy Trial Expert Analysis

May 23, 2025 -

Italys Citizenship Law Amended Eligibility Expanded To Include Great Grandparents

May 23, 2025

Italys Citizenship Law Amended Eligibility Expanded To Include Great Grandparents

May 23, 2025 -

Expert Witness Testimony In Diddys Abuse Case A Detailed Look

May 23, 2025

Expert Witness Testimony In Diddys Abuse Case A Detailed Look

May 23, 2025 -

Melania Trump Memoir Audiobook Unveiling The Story Behind The Ai Collaboration

May 23, 2025

Melania Trump Memoir Audiobook Unveiling The Story Behind The Ai Collaboration

May 23, 2025