Government Borrowing Exceeds Expectations In April Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Surges Beyond Forecasts in April Report: What Does it Mean for the Economy?

The latest government borrowing figures for April have sent shockwaves through financial markets, exceeding even the most pessimistic forecasts. The unexpected surge raises serious questions about the UK's (or relevant country - adjust as needed) economic outlook and the government's fiscal strategy. Experts are now scrambling to assess the implications of this significant development, and the implications could be far-reaching.

April's Shocking Figures: A Deeper Dive

The Office for National Statistics (ONS) – or relevant statistical agency – released its April borrowing figures, revealing a far larger deficit than anticipated. Instead of the projected [insert projected figure], the actual borrowing figure reached a staggering [insert actual figure]. This represents a [percentage increase/decrease] compared to April of the previous year and significantly surpasses the consensus forecast amongst economists. The reasons behind this dramatic increase are multifaceted and require careful examination.

Factors Contributing to the Unexpected Surge

Several key factors are believed to have contributed to the unexpectedly high government borrowing figures:

- Inflationary Pressures: Persistent high inflation continues to erode the purchasing power of the pound (or relevant currency), impacting tax revenues and increasing government spending on welfare programs and public services. The cost of living crisis continues to strain public finances.

- Increased Interest Payments: Rising interest rates, designed to combat inflation, have dramatically increased the cost of servicing the national debt. This puts further pressure on government finances and contributes to the widening deficit.

- Slowing Economic Growth: Slower-than-expected economic growth translates to lower tax revenues, further exacerbating the borrowing problem. Concerns about a potential recession are adding to the pressure.

- Unexpected Expenditure: Unforeseen government spending on areas such as [mention specific areas, e.g., energy support schemes, healthcare] could also have contributed to the higher-than-expected borrowing figures.

Market Reactions and Future Outlook

The release of the April borrowing figures triggered immediate market reactions. Government bond yields [rose/fell], reflecting investor concerns about the government's fiscal position. The pound (or relevant currency) also experienced [fluctuations – describe the effect]. The Bank of England (or relevant central bank) is now faced with a difficult balancing act: managing inflation while also addressing the growing concerns about government debt.

What Does This Mean for You?

The increased government borrowing has potential implications for everyone. Higher borrowing could lead to:

- Increased Taxes: The government may be forced to introduce new taxes or increase existing ones to reduce the deficit.

- Reduced Public Spending: Cuts to public services could be implemented to control government spending.

- Higher Inflation: Increased government borrowing can contribute to higher inflation if not managed effectively.

Conclusion: Uncertainty Remains

The unexpectedly high government borrowing figures for April paint a concerning picture of the UK's (or relevant country) current economic state. The government will need to carefully consider its fiscal strategy to address this challenge. Further analysis and monitoring of economic indicators are crucial to fully understand the long-term consequences of this development. The coming months will be critical in determining the government's response and the impact on the wider economy. Stay tuned for further updates and analyses as the situation unfolds.

(Optional CTA): For more in-depth analysis on UK (or relevant country) economic trends, subscribe to our newsletter [link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Exceeds Expectations In April Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Record Tropical Forest Loss Fueled By Devastating Fires A Climate Change Crisis

May 23, 2025

Record Tropical Forest Loss Fueled By Devastating Fires A Climate Change Crisis

May 23, 2025 -

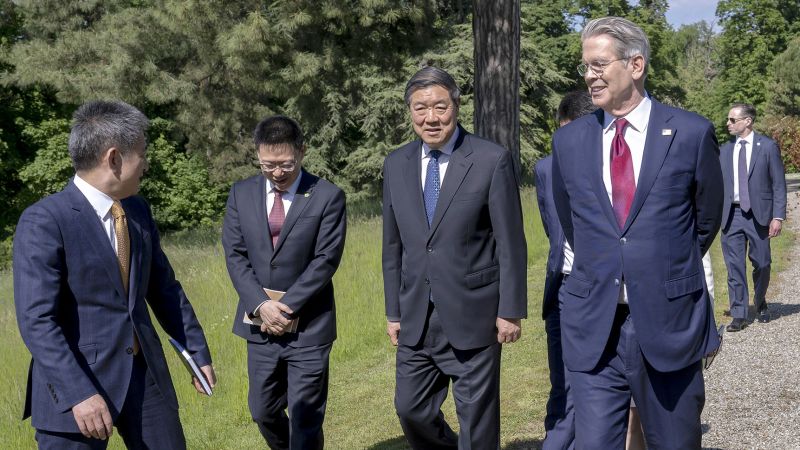

After A Short Lived Truce Us And China Trade Dispute Heats Up Again

May 23, 2025

After A Short Lived Truce Us And China Trade Dispute Heats Up Again

May 23, 2025 -

El Encuentro De Angela Marmol Y Tom Cruise Una Anecdota Sorprendente

May 23, 2025

El Encuentro De Angela Marmol Y Tom Cruise Una Anecdota Sorprendente

May 23, 2025 -

Paramount Secures South Park The Future Of The Shows Streaming Home

May 23, 2025

Paramount Secures South Park The Future Of The Shows Streaming Home

May 23, 2025 -

Women With Dense Breasts Deserve More Demand For Increased Nhs Cancer Screening

May 23, 2025

Women With Dense Breasts Deserve More Demand For Increased Nhs Cancer Screening

May 23, 2025

Latest Posts

-

Aprils Government Borrowing A Deeper Look At The Numbers

May 23, 2025

Aprils Government Borrowing A Deeper Look At The Numbers

May 23, 2025 -

Cassie Venturas Testimony Supported Diddy Trial Expert Analysis

May 23, 2025

Cassie Venturas Testimony Supported Diddy Trial Expert Analysis

May 23, 2025 -

Italys Citizenship Law Amended Eligibility Expanded To Include Great Grandparents

May 23, 2025

Italys Citizenship Law Amended Eligibility Expanded To Include Great Grandparents

May 23, 2025 -

Expert Witness Testimony In Diddys Abuse Case A Detailed Look

May 23, 2025

Expert Witness Testimony In Diddys Abuse Case A Detailed Look

May 23, 2025 -

Melania Trump Memoir Audiobook Unveiling The Story Behind The Ai Collaboration

May 23, 2025

Melania Trump Memoir Audiobook Unveiling The Story Behind The Ai Collaboration

May 23, 2025