Government Borrowing Figures Exceed Expectations For April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Figures Exceed Expectations for April: A Deeper Dive into the National Debt

The UK government's borrowing figures for April have significantly surpassed economists' predictions, sparking renewed concerns about the nation's public finances. The Office for National Statistics (ONS) released data revealing a borrowing figure of £20.6 billion, a considerable jump compared to the £14.5 billion forecast by analysts and a stark contrast to the £1.8 billion borrowed during the same period last year. This unexpected surge raises important questions about the government's spending plans and the overall health of the UK economy.

What Caused the Unexpected Increase?

Several factors contributed to this unexpectedly high borrowing figure. While inflation remains stubbornly high, impacting government spending on social programs and welfare initiatives, a slowdown in tax revenues also played a significant role. The combination of these two pressures has put considerable strain on the public purse.

-

High Inflation and Increased Welfare Spending: The ongoing cost of living crisis has necessitated increased government support for vulnerable households. This includes higher spending on benefits, housing assistance, and other social programs, all contributing to the elevated borrowing figures.

-

Sluggish Tax Revenue: Economic uncertainty has impacted tax receipts, with slower-than-anticipated growth in areas such as corporation tax and income tax. This decline in revenue further exacerbates the government's budgetary challenges.

-

Impact of Energy Support Schemes: While designed to mitigate the impact of high energy prices, the government's energy support schemes have added significantly to public spending, contributing to the increased borrowing.

Market Reactions and Future Outlook

The release of these figures sent ripples through the financial markets. Analysts are closely monitoring the situation, with some expressing concerns about the potential for higher interest rates and further austerity measures. The government's response will be crucial in shaping market sentiment and investor confidence.

The Chancellor is facing mounting pressure to outline a credible plan to reduce the national debt. This could involve a combination of spending cuts and tax increases, although both options are politically challenging.

Looking Ahead: The Path to Fiscal Sustainability

The April borrowing figures serve as a stark reminder of the challenges facing the UK economy. Addressing the nation's debt requires a multifaceted approach, involving both short-term measures to manage the current crisis and long-term strategies to promote sustainable economic growth. The government's forthcoming budget will be closely scrutinized for details on these strategies.

Keywords: Government borrowing, national debt, UK economy, April borrowing figures, ONS, inflation, tax revenue, public spending, fiscal sustainability, economic growth, cost of living crisis.

Related Articles: (Include links to relevant articles, if available, on your website or other reputable sources such as the ONS website or reputable news outlets) For example: "Understanding UK Inflation: A Comprehensive Guide" or "The Impact of High Interest Rates on the UK Economy."

Call to Action (subtle): Stay informed on the latest developments in UK economic policy by following our website for regular updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Figures Exceed Expectations For April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ai Revolutionizes Publishing Melania Trumps Memoir Leads The Way

May 23, 2025

Ai Revolutionizes Publishing Melania Trumps Memoir Leads The Way

May 23, 2025 -

Melania Trumps Memoir An Ai Assisted Audiobook Release

May 23, 2025

Melania Trumps Memoir An Ai Assisted Audiobook Release

May 23, 2025 -

South Parks Paramount Shift Fuels Concerns Box Set Sales Soar

May 23, 2025

South Parks Paramount Shift Fuels Concerns Box Set Sales Soar

May 23, 2025 -

Dakota Johnson Chris Evans And Pedro Pascals Rom Com Quiz A Must See

May 23, 2025

Dakota Johnson Chris Evans And Pedro Pascals Rom Com Quiz A Must See

May 23, 2025 -

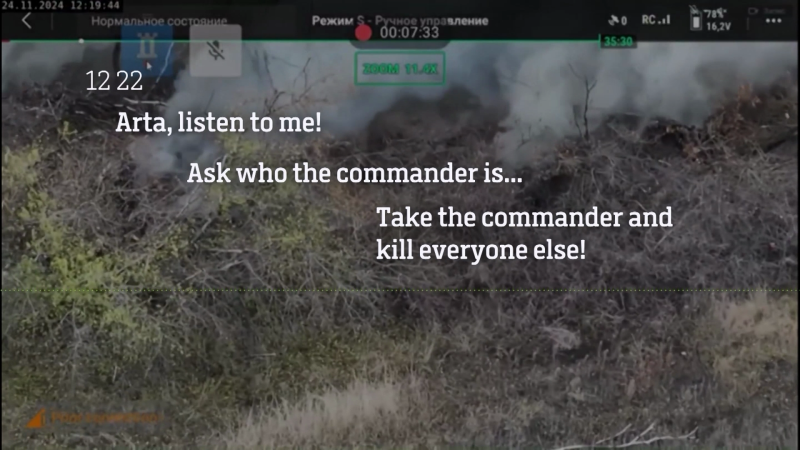

Brutal Orders Revealed Cnn Reports On Intercepted Russian Military Radio Transmissions

May 23, 2025

Brutal Orders Revealed Cnn Reports On Intercepted Russian Military Radio Transmissions

May 23, 2025

Latest Posts

-

Must See Sci Fi Movie Finally Available For Streaming

May 24, 2025

Must See Sci Fi Movie Finally Available For Streaming

May 24, 2025 -

Rare Heart Condition Risk Prompts Fda To Strengthen Covid 19 Vaccine Warnings

May 24, 2025

Rare Heart Condition Risk Prompts Fda To Strengthen Covid 19 Vaccine Warnings

May 24, 2025 -

New Proposal Raises Concerns Early Release For Violent Offenders

May 24, 2025

New Proposal Raises Concerns Early Release For Violent Offenders

May 24, 2025 -

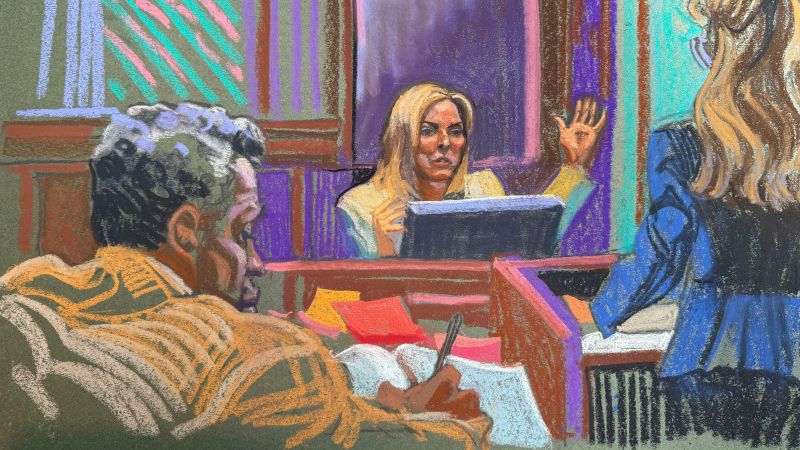

Cassie Venturas Testimony Supported Expert Analysis In Diddys Trial

May 24, 2025

Cassie Venturas Testimony Supported Expert Analysis In Diddys Trial

May 24, 2025 -

Ais Role In Memoir Writing Melania Trumps Audiobook Launch

May 24, 2025

Ais Role In Memoir Writing Melania Trumps Audiobook Launch

May 24, 2025