Government Borrowing Figures For April: A Disappointing Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Figures for April: A Disappointing Increase

Government debt continues its upward trajectory, sparking concerns among economists and the public. April's borrowing figures, released earlier this week, paint a concerning picture of the nation's finances, revealing a significant increase that surpasses expectations and fuels anxieties about the country's long-term economic stability. The data underscores the challenges faced by the government in balancing its budget amidst rising inflation and slowing economic growth.

The Office for National Statistics (ONS) announced that government borrowing reached £22.8 billion in April, a substantial rise compared to the £19.6 billion borrowed during the same month last year. This represents a significant increase and is considerably higher than the consensus forecast of economists who predicted a figure closer to £20 billion. This disappointing increase raises serious questions about the government's fiscal strategy and its ability to manage public finances effectively.

Understanding the Factors Contributing to Increased Borrowing

Several key factors contributed to this concerning rise in government borrowing:

-

Persistent Inflation: High inflation continues to erode the purchasing power of the pound, increasing the cost of public services and squeezing government budgets. The Bank of England's efforts to curb inflation, while necessary, also impact economic growth and increase borrowing needs. Learn more about the .

-

Increased Spending on Public Services: Demand for essential public services, such as healthcare and social welfare, remains high. The government's commitment to these services, while crucial, contributes to increased expenditure and subsequently, higher borrowing.

-

Slowing Economic Growth: A slower-than-expected economic growth rate reduces tax revenues, further exacerbating the government's fiscal challenges. Lower tax receipts directly impact the government's ability to meet its spending commitments without resorting to increased borrowing.

Implications and Future Outlook

The increased borrowing figures have significant implications for the UK economy. The higher national debt increases the country's vulnerability to economic shocks and places a greater burden on future generations. Furthermore, it could potentially lead to higher interest rates, further impacting economic growth and household budgets.

The government's response to these figures will be crucial in determining the future trajectory of public finances. Economists are calling for a comprehensive review of government spending and a robust plan to address the underlying fiscal challenges. This might involve a combination of spending cuts, tax increases, or a combination of both. The upcoming budget will be closely scrutinized for indications of the government's planned strategy.

What does this mean for you? While the implications of increased government borrowing are complex, it's essential to stay informed. Understanding the factors contributing to higher debt levels empowers you to engage in informed discussions about economic policy and its impact on your financial well-being.

Stay tuned for further updates and analysis as the situation unfolds. We will continue to monitor the economic landscape and provide timely insights into the government's fiscal policy and its impact on the UK economy. for regular updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Figures For April: A Disappointing Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Israeli Embassy Staff Attack In Dc What We Know So Far

May 23, 2025

Israeli Embassy Staff Attack In Dc What We Know So Far

May 23, 2025 -

News Analysis This Must End Now And The Rayner Controversy

May 23, 2025

News Analysis This Must End Now And The Rayner Controversy

May 23, 2025 -

Coin Market Cap Ai Will Mind And Pepe Coin Lead The Next Altcoin Rally

May 23, 2025

Coin Market Cap Ai Will Mind And Pepe Coin Lead The Next Altcoin Rally

May 23, 2025 -

Mastering I Os 18 5 6 Intelligent Features You Should Know

May 23, 2025

Mastering I Os 18 5 6 Intelligent Features You Should Know

May 23, 2025 -

The Rayner Strategy And The This Must End Now Headlines A Political Analysis

May 23, 2025

The Rayner Strategy And The This Must End Now Headlines A Political Analysis

May 23, 2025

Latest Posts

-

Melania Trumps Ai Assisted Memoir A New Chapter In Audiobook Form

May 23, 2025

Melania Trumps Ai Assisted Memoir A New Chapter In Audiobook Form

May 23, 2025 -

From U Turn To Ambush The Top News Stories Of The Day Featuring Starmer And Trump

May 23, 2025

From U Turn To Ambush The Top News Stories Of The Day Featuring Starmer And Trump

May 23, 2025 -

Democrats Search For A Progressive Joe Rogan A Doomed Undertaking

May 23, 2025

Democrats Search For A Progressive Joe Rogan A Doomed Undertaking

May 23, 2025 -

Fda Requires Updated Covid 19 Vaccine Labels To Highlight Myocarditis Risk

May 23, 2025

Fda Requires Updated Covid 19 Vaccine Labels To Highlight Myocarditis Risk

May 23, 2025 -

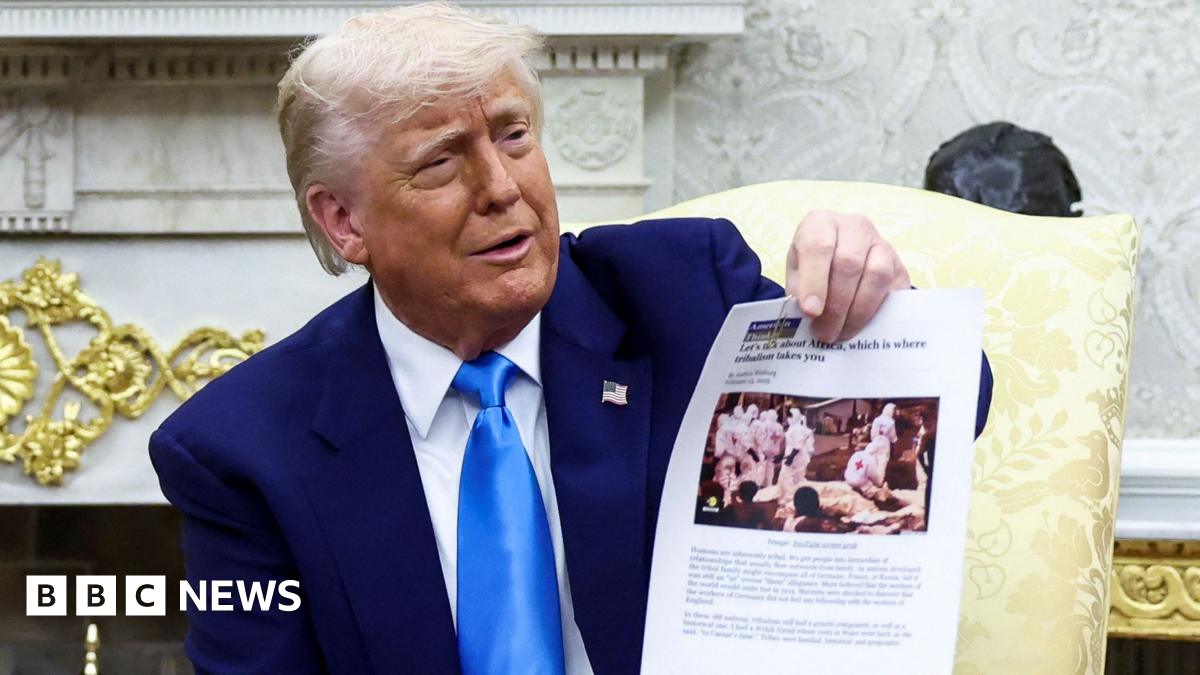

Ramaphosa Remains Unfazed By Trumps Aggressive Tactics

May 23, 2025

Ramaphosa Remains Unfazed By Trumps Aggressive Tactics

May 23, 2025