Government Borrowing Figures For April: A Significant Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Figures for April: A Significant Increase Sparks Debate

Government borrowing figures released today for April reveal a substantial increase, sparking debate amongst economists and raising concerns about the nation's fiscal health. The figures, released by [Name of Relevant Government Department/Agency], show a jump of [Insert Percentage]% compared to April of the previous year, reaching a total of [Insert Figure] – a number significantly higher than analysts' predictions. This sharp rise has ignited a flurry of discussions surrounding the government's spending priorities and the potential long-term implications for the economy.

Understanding the Increase: Key Factors at Play

Several factors contributed to this significant surge in government borrowing. These include:

-

Increased Spending on Public Services: The government's investment in [mention specific areas like healthcare, education, or infrastructure] has undoubtedly played a major role. While essential for long-term economic growth and improved quality of life, this increased spending directly impacts borrowing figures.

-

Inflationary Pressures: The ongoing inflationary environment has increased the cost of government services and programs. Higher prices for goods and services necessitate larger budget allocations, thereby increasing the need for borrowing. This is further exacerbated by increased interest rates on existing government debt.

-

Tax Revenue Shortfalls: While the government collects taxes, revenue may fall short of projections due to economic slowdowns or changes in tax policies. This gap between projected and actual revenue often needs to be filled through borrowing.

-

Unexpected Economic Shocks: Unexpected events, such as natural disasters or global economic crises, can strain government finances and necessitate increased borrowing to manage the fallout.

Expert Opinions and Market Reactions

The market reacted to the news with [Describe Market Reaction - e.g., a slight dip in the stock market, increased volatility in bond yields]. Economists are divided on the long-term implications.

[Quote from a prominent economist, mentioning their viewpoint and concerns. Include their credentials (e.g., Chief Economist at X Bank)].

Others argue that the increased borrowing is a necessary investment for future economic prosperity, pointing to the potential long-term benefits of increased public spending in [mention specific sectors]. [Quote from a second economist with a contrasting viewpoint].

Looking Ahead: Implications for the Future

The significant increase in government borrowing figures for April raises several crucial questions about fiscal sustainability and the government's ability to manage its debt. The government will need to carefully balance its spending priorities with the need to maintain fiscal responsibility. Failure to do so could lead to increased interest rates, reduced investor confidence, and potential negative impacts on economic growth.

Further analysis is needed to fully understand the implications of these figures. The government's response to this situation and its plans for fiscal management in the coming months will be closely scrutinized by the public and financial markets alike. We will continue to monitor this situation and provide updates as they become available.

Call to Action: Stay informed on the latest economic news by subscribing to our newsletter [link to newsletter signup]. Understanding these trends is crucial for making informed financial decisions.

(Note: Remember to replace the bracketed information with accurate and up-to-date data.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Figures For April: A Significant Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Viral Tik Tok Reconnects Influencer With Former Bishop Pope Leo

May 24, 2025

Viral Tik Tok Reconnects Influencer With Former Bishop Pope Leo

May 24, 2025 -

Prostate Cancer Risks Symptoms And Treatment Options A Cnn Interview With Dr Gupta

May 24, 2025

Prostate Cancer Risks Symptoms And Treatment Options A Cnn Interview With Dr Gupta

May 24, 2025 -

Tennis Luca Van Assche Brille A Roland Garros

May 24, 2025

Tennis Luca Van Assche Brille A Roland Garros

May 24, 2025 -

Plan Your Trip The Four Leaf Air Show At Jones Beach

May 24, 2025

Plan Your Trip The Four Leaf Air Show At Jones Beach

May 24, 2025 -

Boost Your I Os 18 5 Productivity 6 Underutilized Intelligence Features

May 24, 2025

Boost Your I Os 18 5 Productivity 6 Underutilized Intelligence Features

May 24, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

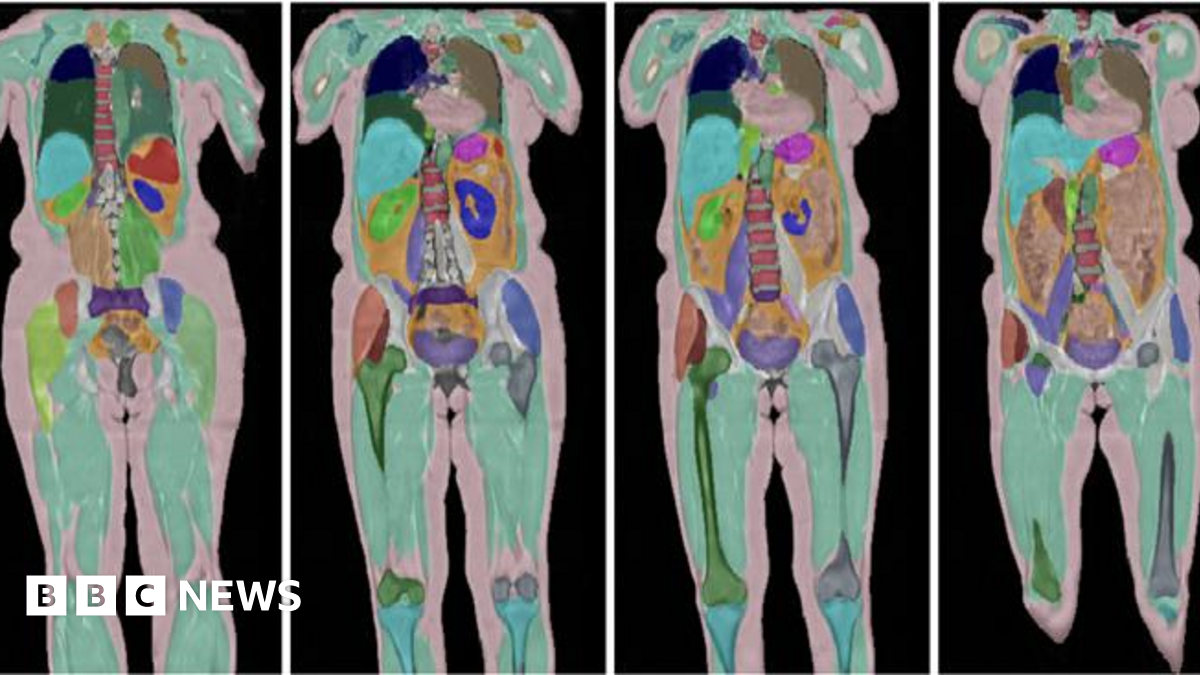

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025