Government Borrowing Figures For April Exceed Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Figures for April Exceed Expectations: A Sign of Economic Strain?

Government borrowing in April soared far beyond forecasts, raising concerns about the UK's economic health and the government's fiscal strategy. The Office for National Statistics (ONS) released figures today revealing a borrowing figure significantly higher than anticipated, sparking debate among economists and analysts. This unexpected surge has reignited discussions about the government's spending plans and the potential need for further fiscal measures.

The ONS reported that public sector net borrowing – the difference between government spending and revenue – reached £22.7 billion in April. This is a stark contrast to the consensus forecast of around £18 billion and represents a considerable jump compared to April 2022's figure. The substantial overshoot has left many questioning the government's ability to meet its fiscal targets and manage the nation's debt.

Deeper Dive into the Disappointing Figures

Several factors contributed to this unexpectedly high borrowing figure. Inflation remains stubbornly high, impacting government spending on benefits and public services due to increased indexation. Furthermore, weaker-than-expected tax revenues have added to the pressure. Lower-than-projected economic growth has also played a crucial role, limiting tax receipts and increasing the demand for government support.

- High Inflation: The ongoing cost-of-living crisis, fueled by persistent inflation, significantly increases government expenditure on welfare programs.

- Tax Revenue Shortfall: Lower-than-predicted economic activity directly impacts tax revenues, leaving a wider gap in government finances.

- Increased Public Spending: Demand for essential public services, coupled with inflationary pressures, has driven up overall government spending.

These combined factors paint a challenging picture for the government's financial outlook. The unexpectedly high borrowing figure casts doubt on the Treasury's ability to stick to its planned fiscal consolidation targets. This development adds pressure on the Chancellor to reconsider the current fiscal strategy and potentially explore additional measures to manage public finances.

What This Means for the UK Economy

The significantly higher-than-expected borrowing figures raise concerns about the UK's economic stability. The increased national debt could lead to higher interest rates in the future, further impacting economic growth and potentially exacerbating the cost-of-living crisis. This situation necessitates careful consideration by policymakers, requiring a balanced approach between managing public finances and supporting economic growth.

Looking Ahead: Potential Government Responses

The government is likely to face increasing pressure to address these challenging figures. Options might include reviewing spending plans, exploring additional revenue-raising measures, or a combination of both. Economists are already speculating on potential policy responses, ranging from targeted spending cuts to adjustments in tax policy. The coming months will be crucial in observing the government's response and its impact on the UK economy. Further analysis from independent economic institutions will provide valuable insights into the long-term implications of these figures.

This situation warrants close monitoring. Stay informed by following reputable financial news sources and official government announcements for updates on this evolving economic situation. Understanding these developments is vital for both individuals and businesses navigating the current economic climate. We will continue to provide updates as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Figures For April Exceed Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Aprils Government Borrowing A Deeper Look At The Numbers

May 23, 2025

Aprils Government Borrowing A Deeper Look At The Numbers

May 23, 2025 -

Kitchen Knife Safety Southport Survivor Leanne Lucas Shares Her Harrowing Story

May 23, 2025

Kitchen Knife Safety Southport Survivor Leanne Lucas Shares Her Harrowing Story

May 23, 2025 -

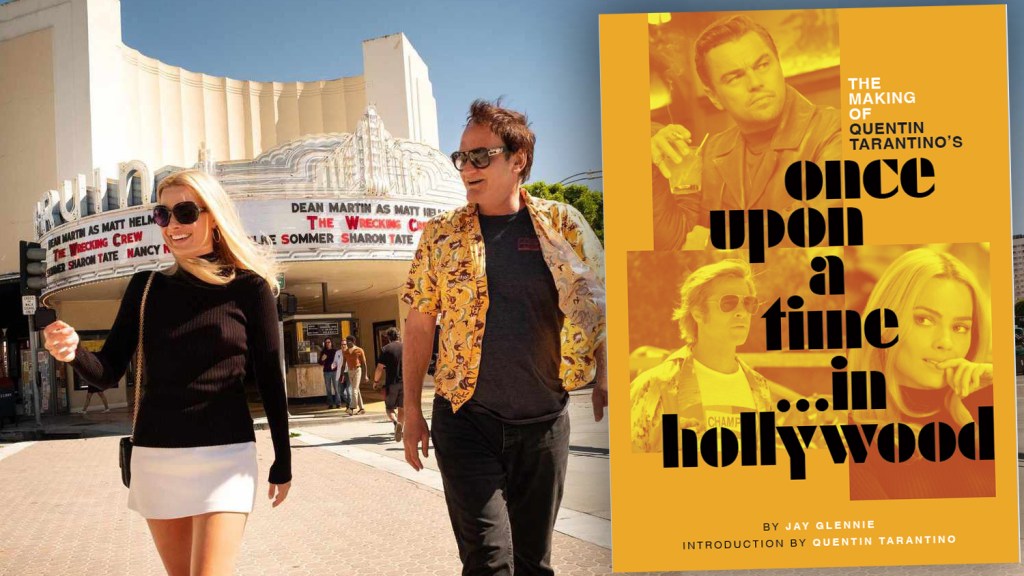

Quentin Tarantinos Filmmaking Journey New Making Of Books Announced

May 23, 2025

Quentin Tarantinos Filmmaking Journey New Making Of Books Announced

May 23, 2025 -

Melania Trumps Autobiography Ai Generated Narration Signals A Shift In The Publishing Industry

May 23, 2025

Melania Trumps Autobiography Ai Generated Narration Signals A Shift In The Publishing Industry

May 23, 2025 -

Wordle Hints Answer And Help For May 21 1432

May 23, 2025

Wordle Hints Answer And Help For May 21 1432

May 23, 2025

Latest Posts

-

Viral Tik Tok A Womans Unexpected Reunion With Pope Leo Her Childhood Bishop

May 24, 2025

Viral Tik Tok A Womans Unexpected Reunion With Pope Leo Her Childhood Bishop

May 24, 2025 -

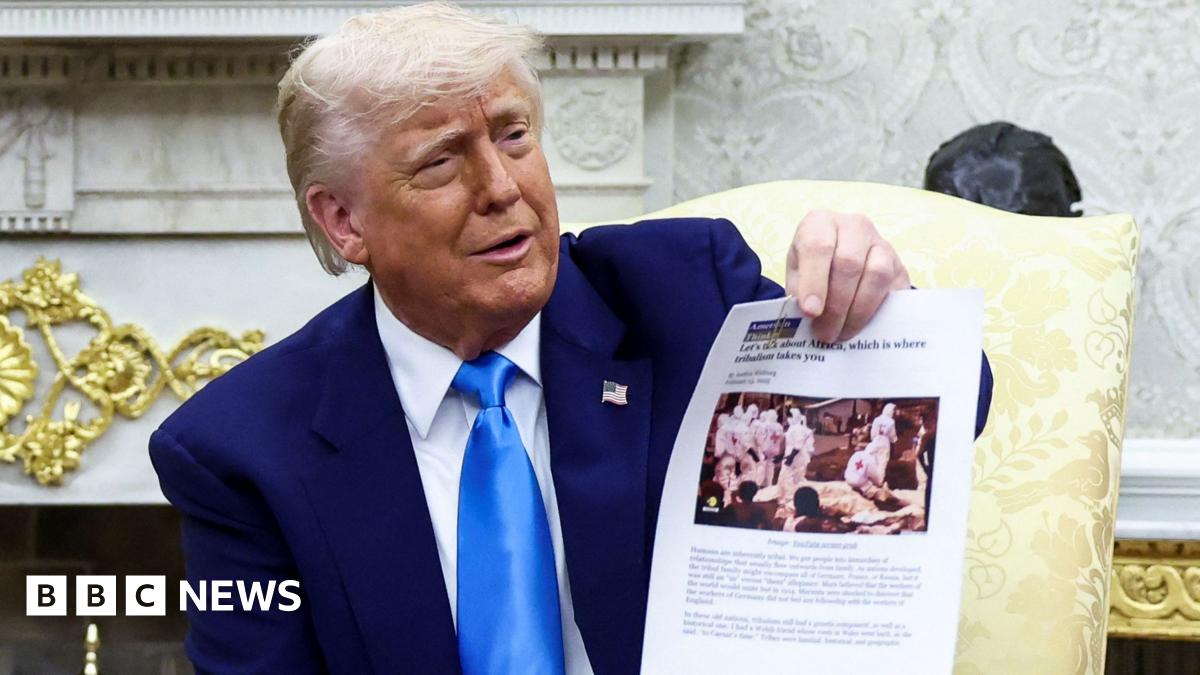

South Africas Ramaphosa Deflects Trumps Heated Rhetoric

May 24, 2025

South Africas Ramaphosa Deflects Trumps Heated Rhetoric

May 24, 2025 -

Investigation Underway Dc Shooting At Israeli Embassy Current Situation

May 24, 2025

Investigation Underway Dc Shooting At Israeli Embassy Current Situation

May 24, 2025 -

Bong Joon Hos Next Film Robert Pattinson Takes On A Leading Role

May 24, 2025

Bong Joon Hos Next Film Robert Pattinson Takes On A Leading Role

May 24, 2025 -

Melania Trump Memoir First Book To Utilize Ai For Personalized Voice Narration

May 24, 2025

Melania Trump Memoir First Book To Utilize Ai For Personalized Voice Narration

May 24, 2025