Government Borrowing Surges Unexpectedly In April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Surges Unexpectedly in April: What Does It Mean for the Economy?

Government borrowing in April soared to unexpected heights, leaving economists scrambling to understand the implications for the nation's economic health. The figures, released [Insert Date and Source of Release – e.g., yesterday by the Office for National Statistics], paint a concerning picture, exceeding forecasts and raising questions about the government's fiscal strategy. This unexpected surge has sent ripples through financial markets and sparked debate about the potential for future interest rate hikes.

A Deeper Dive into the Numbers:

The official data revealed that government borrowing reached [Insert Exact Figure] in April, significantly higher than the [Insert Forecasted Figure] predicted by economists. This represents a [Percentage Increase]% increase compared to April of the previous year and a [Percentage Difference]% deviation from the average April borrowing over the past [Number] years. This dramatic increase is primarily attributed to [Insert Key Reasons – e.g., a combination of lower-than-expected tax revenues and increased government spending on [Specific areas like healthcare or social welfare programs]].

Factors Contributing to the Surge:

- Lower Tax Revenues: A slowdown in economic activity, potentially linked to [mention relevant economic factors, e.g., high inflation or global uncertainty], has led to a decrease in tax revenues. This is particularly evident in [Specify which tax areas were most affected, e.g., corporation tax or income tax].

- Increased Government Spending: The government's commitment to [Mention specific government initiatives, e.g., increased public sector pay or investments in infrastructure projects] has contributed to higher-than-anticipated expenditure. This spending, while crucial for [Mention positive impacts of the spending, e.g., supporting essential public services or boosting economic growth], has placed a strain on public finances.

- Unexpected Economic Headwinds: The recent [Mention any recent unexpected economic events, e.g., banking crisis or supply chain disruptions] has further exacerbated the situation, impacting both tax revenues and increasing the need for government intervention.

Market Reactions and Future Outlook:

The unexpected surge in government borrowing has already triggered reactions in the financial markets. [Describe market reactions – e.g., Government bond yields have risen, suggesting investors are demanding higher returns for lending to the government. The pound has experienced [positive or negative] movement against other major currencies].

Economists are divided on the long-term implications. Some argue that this is a temporary blip, attributing the increase to short-term economic factors. Others, however, express concern about the sustainability of the government's fiscal policy, particularly in light of [mention long-term challenges, e.g., an aging population or rising national debt].

What This Means for You:

The increased government borrowing could have several consequences for ordinary citizens. This may lead to [Mention potential consequences – e.g., higher interest rates on mortgages and loans, impacting household budgets. Increased taxation may also be necessary to address the rising national debt]. It's crucial to stay informed about economic developments and adjust financial planning accordingly.

Looking Ahead:

The government will need to address this unexpected surge in borrowing strategically. This might involve [Mention potential government responses – e.g., reviewing spending plans, exploring new revenue streams, or implementing fiscal tightening measures]. The upcoming budget statement will be closely scrutinized for clues on how the government intends to navigate this challenging situation. The coming months will be crucial in determining the longer-term economic implications of April's unexpected borrowing figures. Stay tuned for further updates.

(Optional CTA): Follow us for the latest updates on government finance and economic news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Surges Unexpectedly In April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dc Shooting Understanding The Attack On The Israeli Embassy

May 23, 2025

Dc Shooting Understanding The Attack On The Israeli Embassy

May 23, 2025 -

Concussion Aftermath Townsend Shares His Path To Healing

May 23, 2025

Concussion Aftermath Townsend Shares His Path To Healing

May 23, 2025 -

Quentin Tarantinos Once Upon A Time In Hollywood Making Of Book A November Release

May 23, 2025

Quentin Tarantinos Once Upon A Time In Hollywood Making Of Book A November Release

May 23, 2025 -

Could Jason Momoa Lead A New Street Fighter Movie Casting Rumors Heat Up

May 23, 2025

Could Jason Momoa Lead A New Street Fighter Movie Casting Rumors Heat Up

May 23, 2025 -

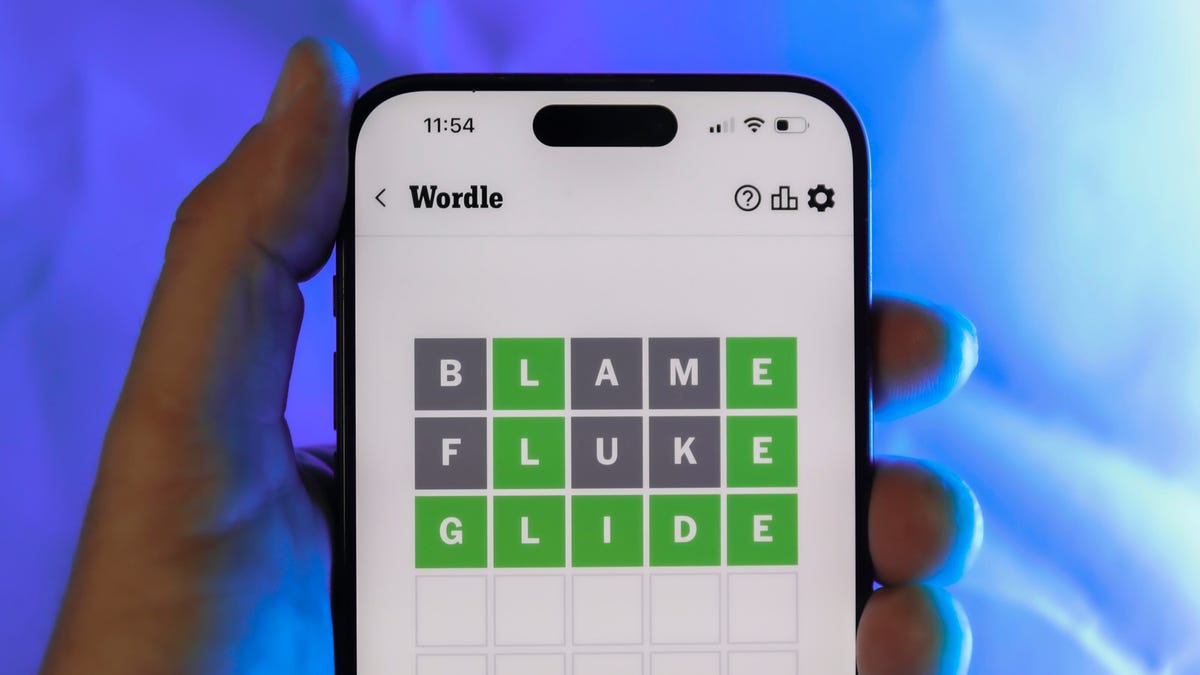

Solve Wordle 1432 May 21st Clues And The Answer

May 23, 2025

Solve Wordle 1432 May 21st Clues And The Answer

May 23, 2025

Latest Posts

-

New Italian Law Easier Citizenship For Descendants Of Great Grandparents

May 23, 2025

New Italian Law Easier Citizenship For Descendants Of Great Grandparents

May 23, 2025 -

Investigation Launched After Serious Accident At North Korean Warship Launch Kim Jong Uns Involvement

May 23, 2025

Investigation Launched After Serious Accident At North Korean Warship Launch Kim Jong Uns Involvement

May 23, 2025 -

Marine Heatwave Intensifies Uk Coastal Waters Boil

May 23, 2025

Marine Heatwave Intensifies Uk Coastal Waters Boil

May 23, 2025 -

Claiming Italian Citizenship The Impact Of The New Great Grandparent Law

May 23, 2025

Claiming Italian Citizenship The Impact Of The New Great Grandparent Law

May 23, 2025 -

Rare Heart Inflammation Risk Prompts Fda To Update Covid 19 Vaccine Warnings

May 23, 2025

Rare Heart Inflammation Risk Prompts Fda To Update Covid 19 Vaccine Warnings

May 23, 2025