Government Debt: April Figures Exceed Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>Government Debt: April Figures Exceed Expectations</h1>

Government debt in April soared past analyst predictions, sparking fresh concerns about the nation's fiscal health. The figures, released yesterday by the Office for National Statistics (ONS), reveal a significant increase in borrowing, exceeding even the most pessimistic forecasts. This unexpected surge raises questions about the government's ability to manage its finances effectively and meet its long-term economic goals. Experts are now scrambling to analyze the contributing factors and predict the potential consequences for the economy.

<h2>April's Shocking Numbers: A Deeper Dive</h2>

The ONS reported that government borrowing in April reached £25 billion, a figure significantly higher than the £20 billion predicted by economists. This represents a substantial increase compared to the same period last year and marks the highest April borrowing figure in over a decade. The unexpected jump is attributed to a combination of factors, including weaker-than-expected tax revenues and increased government spending.

<h3>Increased Spending and Reduced Revenue: A Perfect Storm</h3>

Several factors contributed to this alarming increase in government debt. Firstly, government spending on public services, particularly healthcare and social welfare programs, remained elevated. While necessary to support the population, this increased expenditure put significant pressure on the national budget. Secondly, tax revenues fell short of projections. This shortfall can be attributed to various factors, including the ongoing impact of inflation on consumer spending and the broader economic slowdown. The combination of increased expenditure and reduced revenue created a perfect storm, leading to the unprecedented level of borrowing.

<h2>What Does This Mean for the UK Economy?</h2>

The implications of this unexpectedly high government debt are multifaceted and far-reaching. Higher borrowing levels can lead to increased interest payments, potentially crowding out private sector investment and hindering economic growth. The increased national debt also raises concerns about the country's credit rating, which could impact the cost of borrowing in the future.

<h3>Expert Opinions and Predictions</h3>

Economists are divided on the long-term effects of this surge in borrowing. Some believe that the current situation is temporary and can be addressed through fiscal consolidation measures. Others express greater concern, arguing that sustained high borrowing levels could lead to a more prolonged period of economic instability. Many are calling for the government to implement a comprehensive plan to address the underlying issues contributing to the escalating debt. This may involve a combination of spending cuts and tax increases, a challenging proposition given the current economic climate.

<h2>Looking Ahead: Challenges and Potential Solutions</h2>

The government faces a significant challenge in managing its debt levels while simultaneously supporting economic growth and crucial public services. Potential solutions include:

- Targeted spending cuts: Focusing on areas where efficiencies can be achieved without compromising essential services.

- Tax reform: Implementing measures to increase tax revenues while minimizing the impact on businesses and individuals.

- Economic growth strategies: Investing in infrastructure and innovation to boost economic productivity.

The coming months will be crucial in determining the government's response and the subsequent impact on the UK economy. The government's upcoming budget statement will be closely scrutinized for details on how it plans to address this growing fiscal challenge. Transparency and decisive action will be essential to restore confidence in the nation's economic stability. We will continue to monitor developments and provide updates as more information becomes available. Stay tuned for further analysis and commentary on this evolving situation.

(Note: This article uses hypothetical figures for illustrative purposes. Please consult official sources for accurate and up-to-date data on government debt.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Debt: April Figures Exceed Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

South Parks New Streaming Home Which Episodes Could Be Banned

May 23, 2025

South Parks New Streaming Home Which Episodes Could Be Banned

May 23, 2025 -

Uks Longest Lived Polar Bear Passes Away At Highland Wildlife Park

May 23, 2025

Uks Longest Lived Polar Bear Passes Away At Highland Wildlife Park

May 23, 2025 -

Unusually Warm Spring Fuels Marine Heatwave Across The Uk

May 23, 2025

Unusually Warm Spring Fuels Marine Heatwave Across The Uk

May 23, 2025 -

The Democratic Partys Struggle To Cultivate A Progressive Media Star

May 23, 2025

The Democratic Partys Struggle To Cultivate A Progressive Media Star

May 23, 2025 -

Fda Strengthens Covid 19 Vaccine Warnings Following Reports Of Myocarditis

May 23, 2025

Fda Strengthens Covid 19 Vaccine Warnings Following Reports Of Myocarditis

May 23, 2025

Latest Posts

-

Embarrassment For North Korea Destroyer Launch Malfunction Sparks Kim Jong Uns Ire

May 24, 2025

Embarrassment For North Korea Destroyer Launch Malfunction Sparks Kim Jong Uns Ire

May 24, 2025 -

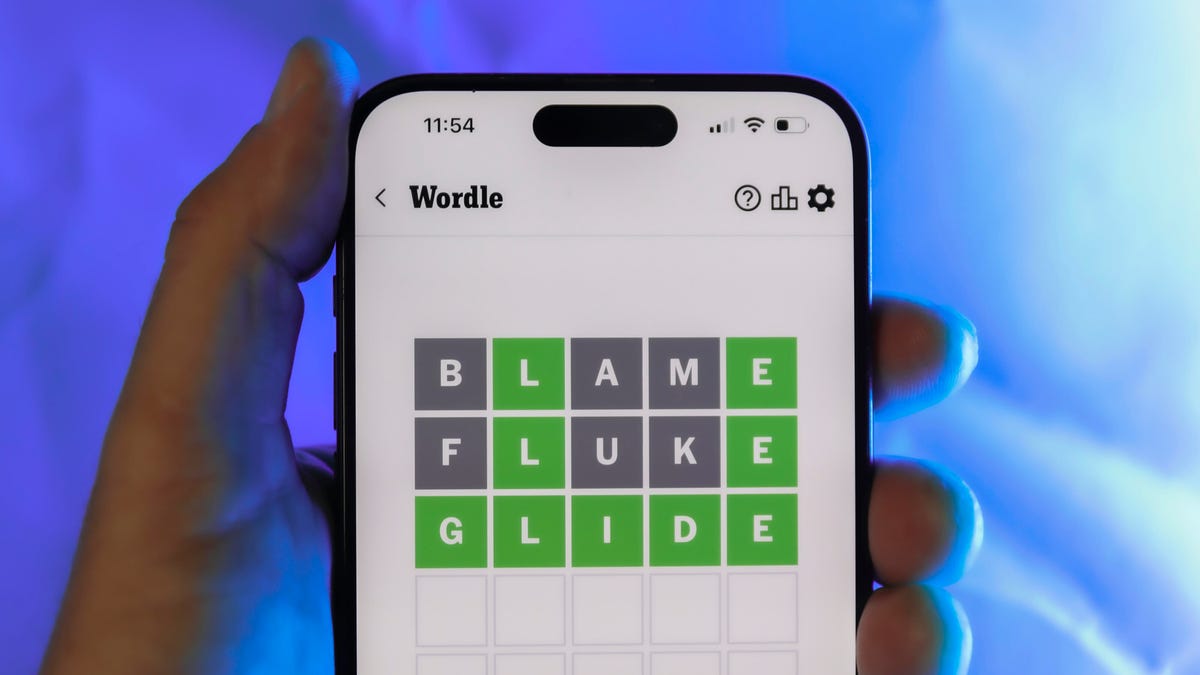

Conquer Wordle 1433 May 22 2024 Hints And The Answer

May 24, 2025

Conquer Wordle 1433 May 22 2024 Hints And The Answer

May 24, 2025 -

Democrats Quest For A Progressive Joe Rogan A Doomed Undertaking

May 24, 2025

Democrats Quest For A Progressive Joe Rogan A Doomed Undertaking

May 24, 2025 -

Must See Sci Fi Movie Finally Available For Streaming

May 24, 2025

Must See Sci Fi Movie Finally Available For Streaming

May 24, 2025 -

Rare Heart Condition Risk Prompts Fda To Strengthen Covid 19 Vaccine Warnings

May 24, 2025

Rare Heart Condition Risk Prompts Fda To Strengthen Covid 19 Vaccine Warnings

May 24, 2025