Government Debt: April Figures Reveal Higher-Than-Predicted Borrowing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Debt: April Figures Reveal Higher-Than-Predicted Borrowing

Government borrowing surged to unexpected heights in April, raising concerns about the nation's fiscal health and potentially impacting future economic policy. The latest figures released by the Office for National Statistics (ONS) paint a bleaker picture than anticipated, exceeding even the most pessimistic forecasts. This unexpected jump in borrowing has sent ripples through financial markets and sparked intense debate among economists and policymakers.

The headline figure reveals that public sector net borrowing reached £22.7 billion in April, significantly higher than the £15 billion predicted by economists and a stark contrast to the £1.6 billion borrowed during the same period last year. This substantial increase signifies a worrying trend, highlighting the challenges the government faces in managing its finances.

Deeper Dive into the April Borrowing Figures

Several factors contributed to this unexpectedly high level of borrowing. Firstly, inflation continues to erode the government's tax revenues, while simultaneously increasing the cost of servicing existing debt. Higher interest rates, implemented to combat inflation, further exacerbate this issue. The ONS report highlights a significant increase in debt interest payments, accounting for a large portion of the increased borrowing.

Secondly, government spending remains elevated, particularly in areas such as healthcare and social welfare. While necessary to support vulnerable populations, this spending contributes to the widening budget deficit. The ongoing cost-of-living crisis has placed immense pressure on public services, necessitating increased government intervention and expenditure.

- Key factors contributing to the increased borrowing:

- Higher-than-expected inflation

- Increased interest rate payments on existing debt

- Elevated government spending on public services

- Lower-than-projected tax revenues

Market Reactions and Future Implications

The release of these figures has understandably caused unease within financial markets. Concerns about the government's ability to manage its debt burden are likely to lead to increased pressure on government bonds, potentially impacting interest rates and the overall cost of borrowing. The Bank of England will be closely monitoring this situation, as it could influence future monetary policy decisions.

The government faces a difficult challenge in addressing this escalating debt. Options include implementing further austerity measures, exploring avenues for increased tax revenue, or a combination of both. However, each option presents its own set of economic and political challenges. The upcoming budget will likely provide more clarity on the government's strategy for tackling this issue.

What this Means for the Average Citizen

The increased government debt ultimately impacts every citizen. Higher levels of borrowing can lead to increased taxes in the future, reduced public spending in other areas, or potentially higher inflation. Understanding the complexities of government finance is crucial for informed participation in the democratic process. Staying informed about the government's fiscal policy and its potential impact on your finances is essential.

Further Reading:

Call to Action: Stay informed about the evolving economic situation by following reputable financial news sources and engaging in discussions about government fiscal policy. Understanding the government's financial health is vital for understanding your own economic future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Debt: April Figures Reveal Higher-Than-Predicted Borrowing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tax Hike Proposal Leaked Rayner Memo Details Revealed

May 23, 2025

Tax Hike Proposal Leaked Rayner Memo Details Revealed

May 23, 2025 -

Pedro Pascal Channels Mr Darcy In Hilarious Rom Com Quiz Video

May 23, 2025

Pedro Pascal Channels Mr Darcy In Hilarious Rom Com Quiz Video

May 23, 2025 -

Pennsylvanias Democratic Primary A Victory For O Connor In Pittsburghs Mayoral Race

May 23, 2025

Pennsylvanias Democratic Primary A Victory For O Connor In Pittsburghs Mayoral Race

May 23, 2025 -

Tom Cruise Y Angela Marmol Una Historia De Encuentro Y Saliva

May 23, 2025

Tom Cruise Y Angela Marmol Una Historia De Encuentro Y Saliva

May 23, 2025 -

Experts React Evaluating Trumps Golden Dome Missile Defense Proposal

May 23, 2025

Experts React Evaluating Trumps Golden Dome Missile Defense Proposal

May 23, 2025

Latest Posts

-

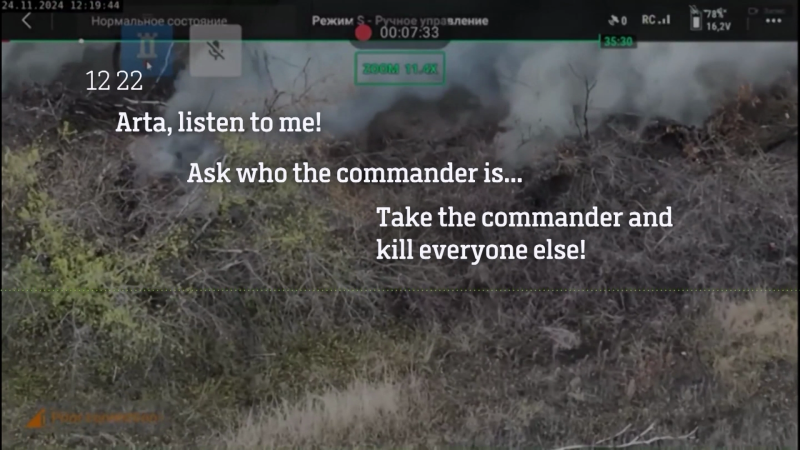

Take The Commander Kill The Rest Analysis Of Intercepted Russian Communications

May 23, 2025

Take The Commander Kill The Rest Analysis Of Intercepted Russian Communications

May 23, 2025 -

U Turn And Ambush The Days Biggest News Stories From Starmer And Trump

May 23, 2025

U Turn And Ambush The Days Biggest News Stories From Starmer And Trump

May 23, 2025 -

Apples I Phone 13 Game Changer A Free Offer You Cant Miss

May 23, 2025

Apples I Phone 13 Game Changer A Free Offer You Cant Miss

May 23, 2025 -

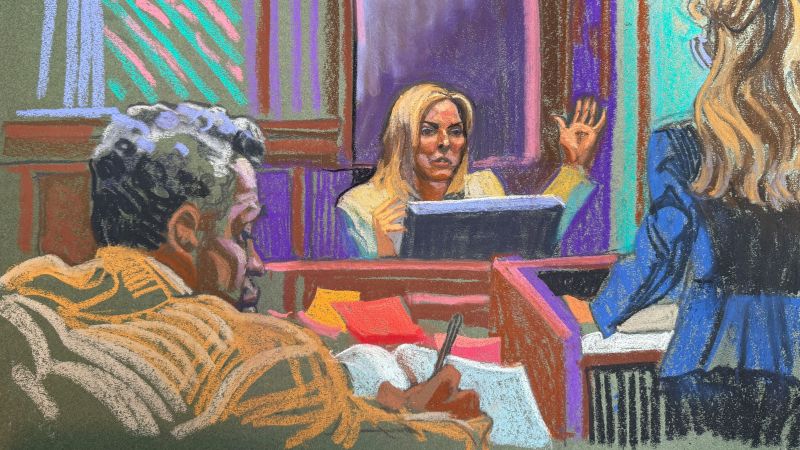

Expert Testimony On Abuse Trauma Key Moment In Diddys Trial

May 23, 2025

Expert Testimony On Abuse Trauma Key Moment In Diddys Trial

May 23, 2025 -

Pedro Pascal And Chris Evans A Pride And Prejudice Moment That Broke The Internet

May 23, 2025

Pedro Pascal And Chris Evans A Pride And Prejudice Moment That Broke The Internet

May 23, 2025