Government Debt: April's Figures Reveal Higher Than Anticipated Borrowing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Debt: April's Figures Reveal Higher Than Anticipated Borrowing

Government borrowing soared to unexpected heights in April, according to the latest figures released by the Office for National Statistics (ONS). The announcement sent shockwaves through financial markets and sparked renewed debate about the UK's fiscal health. This unexpected surge raises serious questions about the government's spending plans and the long-term sustainability of the national debt.

The ONS reported that public sector net borrowing – the difference between government spending and revenue – reached £22.7 billion in April. This figure significantly surpasses the £18 billion predicted by economists and represents a substantial increase compared to April 2022's £15.4 billion. This substantial overshoot underlines the growing pressure on the UK's public finances.

Understanding the Factors Contributing to the Increased Borrowing

Several factors contributed to this unexpectedly high level of borrowing. Inflation, stubbornly high despite recent interest rate hikes, continues to impact government finances. The rising cost of living necessitates increased welfare payments, placing further strain on the public purse. Furthermore, slower than anticipated economic growth reduces tax revenues, exacerbating the already precarious financial situation.

- High Inflation: Persistent inflation significantly increases the cost of government services and welfare payments, widening the gap between spending and revenue.

- Reduced Tax Revenue: Slower economic growth directly impacts tax receipts, limiting the government's ability to fund its expenditure.

- Increased Welfare Spending: The cost of living crisis has forced the government to increase welfare support, adding to the financial burden.

Implications of the Increased National Debt

This higher-than-expected borrowing has significant implications for the UK economy. The increased national debt could lead to:

- Higher Interest Rates: Increased borrowing could pressure the Bank of England to raise interest rates further to control inflation, potentially impacting mortgage holders and businesses.

- Reduced Government Spending: The government may be forced to implement austerity measures, potentially cutting back on public services.

- Increased National Insurance Contributions: Future tax increases, such as potential rises in National Insurance, could be implemented to address the debt.

Government Response and Future Outlook

The Chancellor's office has acknowledged the challenging figures and emphasized the government's commitment to fiscal responsibility. However, concrete plans to address the rising debt remain largely unspecified. Further details are expected in the upcoming budget statement. Experts remain divided on the effectiveness of the government's current strategy, with some calling for more radical measures to tackle the growing debt.

The situation necessitates careful monitoring and informed analysis. The upcoming months will be crucial in determining how the government intends to navigate this complex financial challenge. The public needs transparency and clarity on the government's plans to address the escalating debt levels and their potential impact on the economy and everyday citizens. Further updates will be provided as the situation unfolds.

Keywords: Government debt, public sector net borrowing, UK economy, national debt, inflation, interest rates, government spending, tax revenue, fiscal responsibility, ONS, Office for National Statistics, economic growth, cost of living crisis, austerity measures, National Insurance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Debt: April's Figures Reveal Higher Than Anticipated Borrowing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

19 Year Old Twins Found Dead In Georgia Police Reveal Cause Of Death

May 24, 2025

19 Year Old Twins Found Dead In Georgia Police Reveal Cause Of Death

May 24, 2025 -

Israel Gaza Crisis Netanyahus Accusation Against Starmer Sparks Political Firestorm

May 24, 2025

Israel Gaza Crisis Netanyahus Accusation Against Starmer Sparks Political Firestorm

May 24, 2025 -

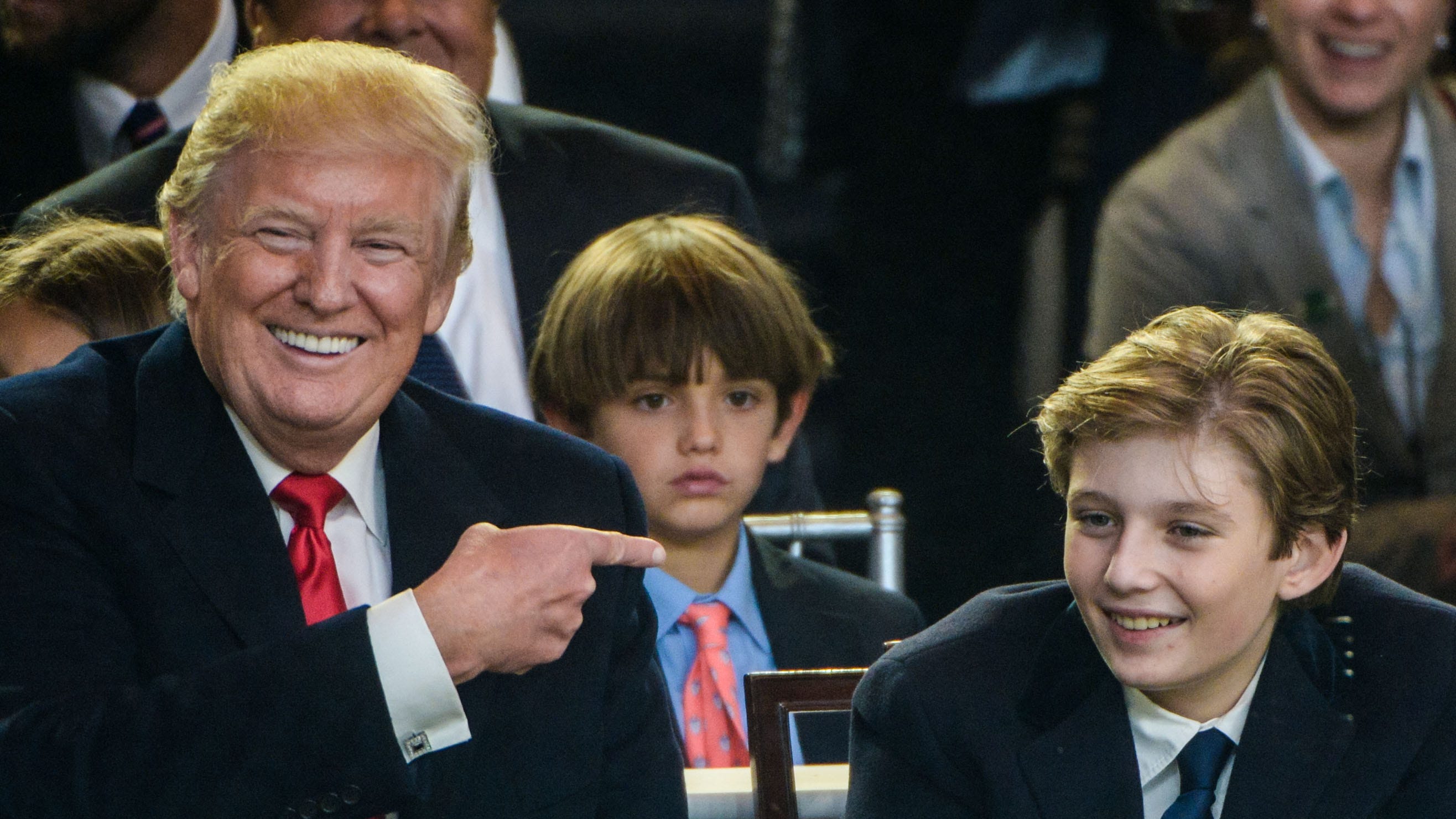

Barron Trump And Harvard Exploring The College Admissions Process For The Trump Family

May 24, 2025

Barron Trump And Harvard Exploring The College Admissions Process For The Trump Family

May 24, 2025 -

The Democratic Partys Struggle To Find Its Own Joe Rogan

May 24, 2025

The Democratic Partys Struggle To Find Its Own Joe Rogan

May 24, 2025 -

Dense Breasts Campaign Urges Nhs To Offer Additional Cancer Scans For Women

May 24, 2025

Dense Breasts Campaign Urges Nhs To Offer Additional Cancer Scans For Women

May 24, 2025

Latest Posts

-

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025 -

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025 -

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025 -

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025