Grow Your Child's College Fund: The Benefits Of 529 Savings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Grow Your Child's College Fund: The Benefits of 529 Savings Plans

Planning for your child's future is a significant undertaking, and few expenses loom larger than the cost of higher education. Tuition fees, room and board, books, and other expenses can quickly add up to a substantial sum. That's why establishing a college savings plan early is crucial. Among the most popular and advantageous options available is the 529 savings plan. But what exactly are 529 plans, and why should you consider one for your child's future?

This article explores the numerous benefits of 529 plans, helping you navigate the world of college savings and make informed decisions for your family's financial well-being.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed specifically to help families save for future education expenses. These plans are sponsored by states, and each state may offer its own unique 529 plan with varying features and investment options. Contributions are made by the account owner (often a parent or grandparent), and the earnings grow tax-deferred. This means you won't pay taxes on the investment gains until the money is withdrawn to pay for qualified education expenses.

Key Benefits of 529 Plans:

-

Tax Advantages: This is perhaps the most significant advantage. As mentioned, earnings grow tax-deferred, and withdrawals used for qualified education expenses are generally federal tax-free. Many states also offer additional state tax deductions or credits for contributions made to their own state's 529 plan. This makes 529 plans significantly more advantageous than many other investment vehicles for college savings.

-

Flexibility: 529 plans offer a degree of flexibility. While primarily intended for college, funds can also be used for K-12 tuition expenses (up to $10,000 per year), as well as for apprenticeships and other qualified educational programs. This flexibility makes them a valuable tool even if your child's educational path deviates from the traditional four-year college route.

-

Investment Options: Most 529 plans offer a range of investment options, allowing you to tailor your investment strategy to your risk tolerance and time horizon. You can choose from age-based options that automatically adjust the allocation of assets as your child gets closer to college, or you can select individual funds based on your preferences.

-

Gifting Strategies: 529 plans can be utilized as part of a sophisticated gifting strategy. You can contribute a significant amount upfront and potentially avoid gift tax implications by using the 5-year gifting rule. This allows you to contribute a larger lump sum than the annual contribution limit without triggering gift tax. (Consult a tax advisor for personalized guidance).

How to Choose a 529 Plan:

Choosing the right 529 plan involves considering several factors:

- Investment options: Review the available investment choices and their performance history.

- Fees: Compare the expense ratios of different plans. Lower fees translate to higher returns over time.

- State tax benefits: Check if your state offers any tax deductions or credits for contributing to its 529 plan.

Getting Started:

Opening a 529 plan is relatively straightforward. You can typically open an account online through your state's 529 plan website or through a financial advisor. Start saving early—even small, consistent contributions can make a significant difference over time. Remember to regularly review your investment allocation and make adjustments as needed to align with your child's age and college timeline.

Conclusion:

A 529 plan is a powerful tool for saving for your child's college education. Its tax advantages, flexibility, and investment options make it a compelling choice for families looking to secure their child's future. By starting early and taking advantage of these benefits, you can significantly ease the financial burden of higher education. Don't delay – start planning for your child's college fund today! For further information, consult a qualified financial advisor. They can help you navigate the complexities of 529 plans and create a personalized savings strategy tailored to your specific needs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Grow Your Child's College Fund: The Benefits Of 529 Savings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

109 Injured After Liverpool Fc Championship Parade Incident

Jun 04, 2025

109 Injured After Liverpool Fc Championship Parade Incident

Jun 04, 2025 -

Volcanic Eruption On Mount Etna Current Updates And Impact Assessment

Jun 04, 2025

Volcanic Eruption On Mount Etna Current Updates And Impact Assessment

Jun 04, 2025 -

Sinner Reveals Why He Cant Beat Alcaraz Ahead Of Potential Roland Garros Clash

Jun 04, 2025

Sinner Reveals Why He Cant Beat Alcaraz Ahead Of Potential Roland Garros Clash

Jun 04, 2025 -

College Savings Plan 9 Effective Strategies For Starting Late

Jun 04, 2025

College Savings Plan 9 Effective Strategies For Starting Late

Jun 04, 2025 -

Us Journalist Austin Tice Syrian Prison Confirmed By Leaked Files

Jun 04, 2025

Us Journalist Austin Tice Syrian Prison Confirmed By Leaked Files

Jun 04, 2025

Latest Posts

-

Ibms Comeback Is The Tech Giant Cool Again

Jun 06, 2025

Ibms Comeback Is The Tech Giant Cool Again

Jun 06, 2025 -

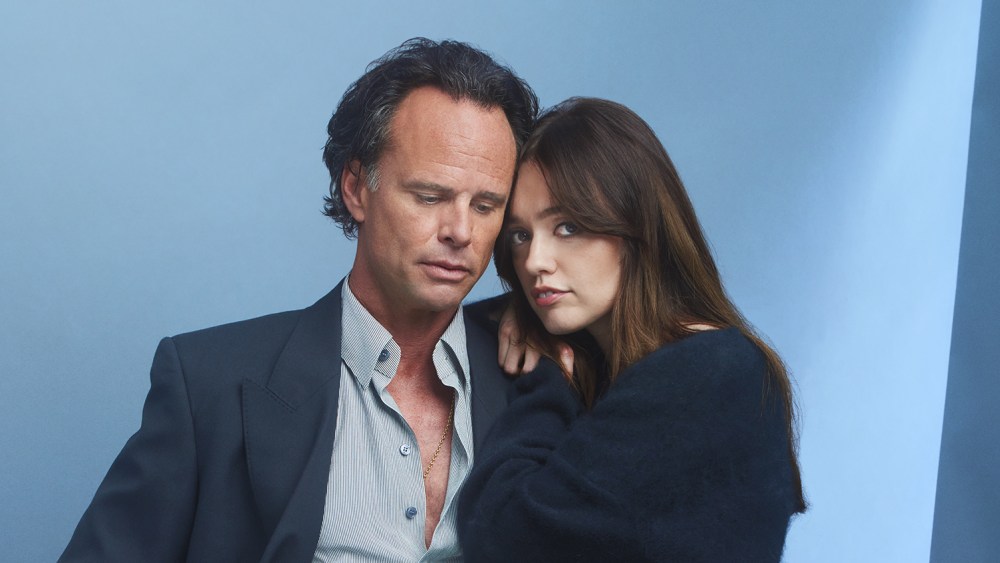

No Feud Here Walton Goggins And Aimee Lou Wood Clarify White Lotus Chemistry And Social Media Drama

Jun 06, 2025

No Feud Here Walton Goggins And Aimee Lou Wood Clarify White Lotus Chemistry And Social Media Drama

Jun 06, 2025 -

Determined Teens Weather 15 Hour Storm For New Ni Product

Jun 06, 2025

Determined Teens Weather 15 Hour Storm For New Ni Product

Jun 06, 2025 -

15 Hour Wait In The Rain The Hype Surrounding The New Ni

Jun 06, 2025

15 Hour Wait In The Rain The Hype Surrounding The New Ni

Jun 06, 2025 -

I Slowly Realized I Was Running Two Households A Personal Account

Jun 06, 2025

I Slowly Realized I Was Running Two Households A Personal Account

Jun 06, 2025