Grow Your Child's College Fund: The Benefits Of A 529 Account

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Grow Your Child's College Fund: The Untapped Power of a 529 Account

Planning for your child's future is a significant undertaking, and the soaring costs of higher education make saving early a critical necessity. While many parents grapple with how best to fund their child's college education, one powerful tool often remains underutilized: the 529 college savings plan. This article explores the numerous benefits of a 529 account and guides you through the process of maximizing its potential.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed specifically to pay for qualified education expenses. These plans are sponsored by states, and each state may offer its own variations. The money you contribute grows tax-deferred, meaning you don't pay taxes on the earnings until you withdraw them for qualified expenses. This significant tax advantage is a major draw for families looking to boost their college savings.

Key Benefits of a 529 Account:

-

Tax Advantages: As mentioned, the biggest advantage is the tax-deferred growth. This means your money grows faster than it would in a taxable account. Furthermore, withdrawals used for qualified education expenses are generally tax-free at the federal level. Check your state's laws for potential state tax benefits.

-

Flexibility: 529 plans offer flexibility in terms of investment options. Many plans provide a range of portfolio choices, from conservative to aggressive, allowing you to tailor your investment strategy to your risk tolerance and time horizon. You can also change your investment choices over time as your child gets closer to college.

-

Gifting Opportunities: You can make significant contributions to a 529 plan without triggering gift tax implications. The annual gift tax exclusion allows for larger contributions without exceeding the limit. This is particularly beneficial for grandparents or other family members who want to contribute to a child's education.

-

Accessibility: Opening and managing a 529 account is generally straightforward. Many states offer online platforms for easy account access, contribution management, and investment adjustments.

-

Beyond College: Some states are now offering greater flexibility in using 529 funds for K-12 tuition expenses, apprenticeships, and even student loan repayments. It's crucial to check the specifics of your plan.

Maximizing Your 529 Plan:

-

Start Early: The earlier you start saving, the more time your money has to grow. Even small, consistent contributions can make a significant difference over time.

-

Invest Wisely: Choose investment options that align with your risk tolerance and time horizon. Consider consulting a financial advisor for personalized guidance.

-

Utilize Matching Programs: Some employers offer matching contributions to 529 plans, which is essentially free money for your child's education.

-

Stay Informed: Regularly review your account statements and adjust your investment strategy as needed.

Qualified Education Expenses:

It's crucial to understand what constitutes a “qualified education expense.” These include:

- Tuition and fees

- Room and board

- Books and supplies

- Computer equipment and software

Choosing the Right 529 Plan:

There are numerous 529 plans available. Factors to consider when choosing a plan include:

- Investment options: Does the plan offer a range of investment choices that suit your needs?

- Fees: Compare the expense ratios of different plans.

- State tax benefits: Some states offer tax deductions or credits for contributions to their own 529 plans.

Conclusion:

A 529 college savings plan is an invaluable tool for families looking to secure their child's future. By understanding its benefits and utilizing effective strategies, you can significantly increase your chances of funding your child's higher education goals. Don't delay – start planning and saving today! Consult a financial advisor for personalized guidance tailored to your specific circumstances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Grow Your Child's College Fund: The Benefits Of A 529 Account. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Day 8 French Open 2025 Alcaraz Swiatek And Musetti Advance

Jun 03, 2025

Day 8 French Open 2025 Alcaraz Swiatek And Musetti Advance

Jun 03, 2025 -

Aziz Ziriats Death Confirmed Family Issues Statement Following Dolomites Discovery

Jun 03, 2025

Aziz Ziriats Death Confirmed Family Issues Statement Following Dolomites Discovery

Jun 03, 2025 -

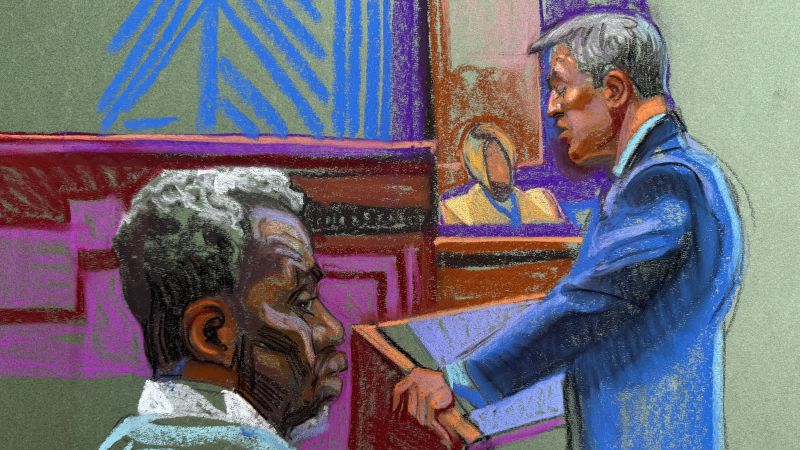

Following The Case Recent News On The Sean Diddy Combs Trial

Jun 03, 2025

Following The Case Recent News On The Sean Diddy Combs Trial

Jun 03, 2025 -

Innovative Wound Care How Fish Skin Helped A Texas Preemie Heal And Flourish

Jun 03, 2025

Innovative Wound Care How Fish Skin Helped A Texas Preemie Heal And Flourish

Jun 03, 2025 -

The R Words Resurgence Analyzing The Factors Behind Its Renewed Use

Jun 03, 2025

The R Words Resurgence Analyzing The Factors Behind Its Renewed Use

Jun 03, 2025

Latest Posts

-

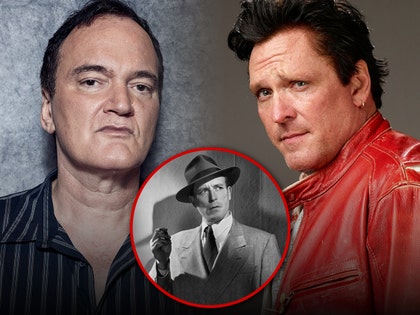

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025