Half-Point Fed Rate Cut? Traders See Growing Probability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Half-Point Fed Rate Cut? Traders See Growing Probability

The whispers are growing louder on Wall Street: could the Federal Reserve be poised for a dramatic half-point rate cut? Traders are increasingly betting on this possibility, sending shockwaves through the financial markets. This unexpected shift in sentiment follows weeks of speculation about a more modest quarter-point reduction, highlighting the growing unease surrounding the current economic climate.

The possibility of a more aggressive rate cut reflects a growing concern among investors about the potential for a deeper economic downturn than previously anticipated. Recent economic data, including weaker-than-expected employment numbers and persistent inflationary pressures, has fueled this anxiety. The market's reaction suggests a growing belief that the Fed needs to take decisive action to prevent a more severe economic contraction.

Why the Shift in Sentiment?

Several factors are contributing to the increasing probability of a half-point cut in the Federal Funds rate, as perceived by market traders:

-

Weakening Economic Indicators: Recent economic data points to a slowing economy, with key indicators like manufacturing PMI and consumer confidence falling below expectations. This paints a picture of slowing growth and potential recessionary pressures. [Link to relevant economic data source]

-

Banking Sector Instability: The ongoing concerns surrounding the stability of the banking sector, following recent collapses, are adding to the pressure on the Fed to act decisively. A half-point cut could be seen as a necessary measure to inject liquidity into the market and bolster confidence. [Link to news article about banking sector instability]

-

Inflationary Pressures: While inflation is showing signs of cooling, it remains stubbornly above the Fed's target. This creates a complex challenge for the central bank: how to stimulate the economy without further fueling inflation. A half-point cut represents a significant gamble in this delicate balancing act.

What Does This Mean for Investors?

The potential for a half-point rate cut presents both opportunities and risks for investors. While it could provide a short-term boost to the markets, it also raises concerns about the long-term implications for inflation and economic stability.

-

Increased Market Volatility: Expect increased volatility in the coming weeks as investors react to the evolving situation. Careful portfolio management and risk assessment are crucial.

-

Bond Yields: A rate cut is likely to put downward pressure on bond yields, potentially making bonds a more attractive investment for risk-averse investors.

-

Stock Market Performance: While a rate cut might initially boost stock prices, the long-term impact depends on the effectiveness of the measure in addressing the underlying economic challenges.

Looking Ahead:

The next few weeks will be crucial in determining the Fed's course of action. Analysts will be closely scrutinizing economic data and Fed communications for clues about the likelihood of a half-point rate cut. The decision will undoubtedly have significant repercussions for the global economy. This situation highlights the importance of staying informed and adapting investment strategies accordingly. [Link to reputable financial news source]

Call to Action: Stay informed about the latest developments by subscribing to our newsletter for regular updates on economic news and market analysis. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Half-Point Fed Rate Cut? Traders See Growing Probability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bridget Phillipson Challenges For Labours Number Two Spot

Sep 11, 2025

Bridget Phillipson Challenges For Labours Number Two Spot

Sep 11, 2025 -

Is Gavin Newsoms Anti Trump Stance Helping His Presidential Ambitions

Sep 11, 2025

Is Gavin Newsoms Anti Trump Stance Helping His Presidential Ambitions

Sep 11, 2025 -

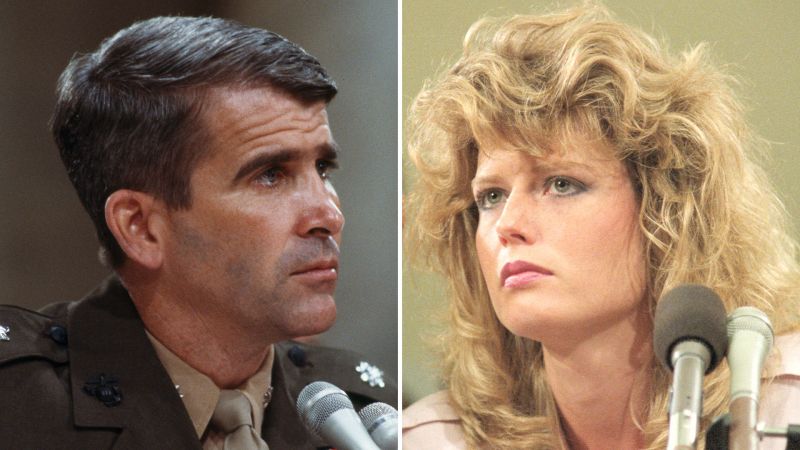

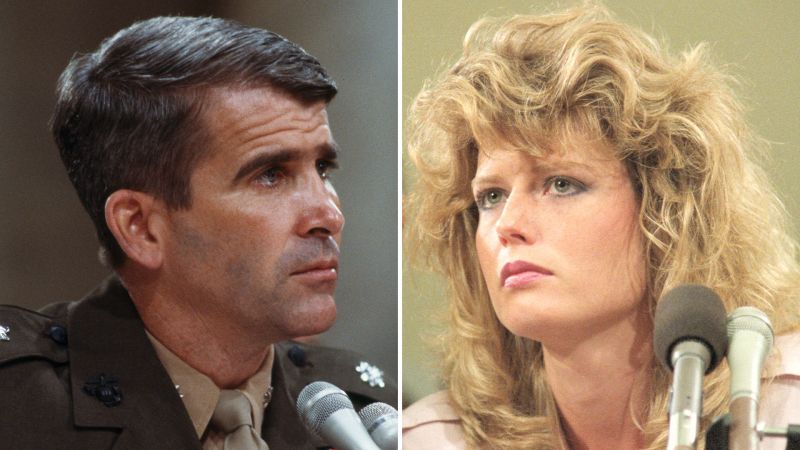

Fawn Hall And Oliver Norths Union A Deeper Look At The Iran Contra Affairs Legacy

Sep 11, 2025

Fawn Hall And Oliver Norths Union A Deeper Look At The Iran Contra Affairs Legacy

Sep 11, 2025 -

Joe Rogan Questions Khabib Nurmagomedovs Ufc Legacy An Asterisk Debate

Sep 11, 2025

Joe Rogan Questions Khabib Nurmagomedovs Ufc Legacy An Asterisk Debate

Sep 11, 2025 -

Will Lewis Washington Post Chiefs Undisclosed Role In Boris Johnsons Government

Sep 11, 2025

Will Lewis Washington Post Chiefs Undisclosed Role In Boris Johnsons Government

Sep 11, 2025

Latest Posts

-

Legal Battle Gregg Wallace And The Bbc Clash

Sep 11, 2025

Legal Battle Gregg Wallace And The Bbc Clash

Sep 11, 2025 -

Transgender Policies In Schools Why Parents Voices Matter

Sep 11, 2025

Transgender Policies In Schools Why Parents Voices Matter

Sep 11, 2025 -

Iran Contra Scandal The Untold Story Of Oliver North And Fawn Halls Marriage

Sep 11, 2025

Iran Contra Scandal The Untold Story Of Oliver North And Fawn Halls Marriage

Sep 11, 2025 -

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025

Us Rejects Potential Israeli Military Action Against Doha Unproductive Strategy

Sep 11, 2025 -

Aocs Luxury Hotel Stays A Discrepancy With Her Anti Oligarchy Stance

Sep 11, 2025

Aocs Luxury Hotel Stays A Discrepancy With Her Anti Oligarchy Stance

Sep 11, 2025