Has SiriusXM Holdings' Success Created A Buying Opportunity Or A Sell Signal?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Has SiriusXM Holdings' Success Created a Buying Opportunity or a Sell Signal?

SiriusXM Holdings (SIRI) has enjoyed a period of consistent growth, leaving many investors wondering: is this success a reason to buy, or a warning sign that a correction is imminent? The satellite radio giant has navigated a challenging media landscape, demonstrating resilience and innovation. But is the stock priced for continued growth, or has it reached its peak? Let's delve into the factors that could influence your investment decision.

SiriusXM's Recent Performance: A Mixed Bag

SiriusXM has consistently delivered strong subscriber growth, fueled by its diverse programming, including exclusive content, sports, and music channels. This steady increase in subscribers translates to predictable revenue streams, a key attraction for investors seeking stability. However, recent financial reports have shown slowing growth, prompting some analysts to question the company's long-term potential. While profitability remains strong, the rate of expansion may be tapering off.

Factors Suggesting a Buying Opportunity:

- Strong Brand Recognition and Loyalty: SiriusXM boasts a highly recognizable brand and a loyal subscriber base. This entrenched market position provides a significant barrier to entry for competitors.

- Diversification Strategy: The company's expansion into podcasting and other audio entertainment avenues demonstrates a proactive approach to adapting to the evolving media landscape. This diversification mitigates risk associated with reliance on a single revenue stream.

- Potential for Further Growth: The continued penetration of connected cars provides a vast, untapped market for SiriusXM's services. The increasing adoption of in-car entertainment systems presents significant opportunities for future subscriber growth. Furthermore, the expansion into international markets could unlock considerable untapped potential.

Factors Suggesting a Sell Signal:

- Slowing Subscriber Growth: As mentioned earlier, the recent deceleration in subscriber growth raises concerns about the company's future trajectory. Investors need to carefully assess whether this trend is temporary or indicative of a broader market saturation.

- Competition from Streaming Services: The rise of streaming services, offering diverse and often cheaper audio entertainment options, presents a growing challenge to SiriusXM's dominance. The company needs to continuously innovate to maintain its competitive edge.

- Valuation Concerns: Some analysts argue that SiriusXM's current valuation may not fully reflect the potential slowdown in growth. A thorough assessment of the stock's price-to-earnings ratio and other key valuation metrics is crucial before making any investment decisions.

Analyzing the Technicals:

Beyond fundamental analysis, reviewing the stock's technical indicators can offer additional insights. Chart patterns, support and resistance levels, and trading volume can provide valuable clues about potential price movements. However, technical analysis should always be considered alongside fundamental analysis for a comprehensive perspective. Consult with a financial advisor for personalized guidance.

Conclusion: Weighing the Risks and Rewards

Determining whether SiriusXM represents a buying opportunity or a sell signal depends on individual investment goals and risk tolerance. While the company's strong brand and diversification efforts offer compelling reasons for optimism, the slowing subscriber growth and increased competition warrant careful consideration. Conduct thorough due diligence, consider consulting a financial advisor, and create a diversified investment portfolio to mitigate potential risks. Remember, past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Has SiriusXM Holdings' Success Created A Buying Opportunity Or A Sell Signal?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alabama Based Firm Sells Bank Of America Shares Birmingham Capital Managements Recent Activity

May 28, 2025

Alabama Based Firm Sells Bank Of America Shares Birmingham Capital Managements Recent Activity

May 28, 2025 -

Update Missing Person Case Closed Remains Identified As Michael Gaine County Kerry Farmer

May 28, 2025

Update Missing Person Case Closed Remains Identified As Michael Gaine County Kerry Farmer

May 28, 2025 -

King Charles Impactful Canadian Trip Overshadowed By Trumps Controversial Claim

May 28, 2025

King Charles Impactful Canadian Trip Overshadowed By Trumps Controversial Claim

May 28, 2025 -

Alexandra Daddarios Lace Dress Transparency And Red Carpet Glamour

May 28, 2025

Alexandra Daddarios Lace Dress Transparency And Red Carpet Glamour

May 28, 2025 -

Boardwalk Bloodshed Multiple Stabbings Reported At Seaside Heights

May 28, 2025

Boardwalk Bloodshed Multiple Stabbings Reported At Seaside Heights

May 28, 2025

Latest Posts

-

Air Traffic Control Problems At Newark Airport Secretary Offers Possible Fix

May 30, 2025

Air Traffic Control Problems At Newark Airport Secretary Offers Possible Fix

May 30, 2025 -

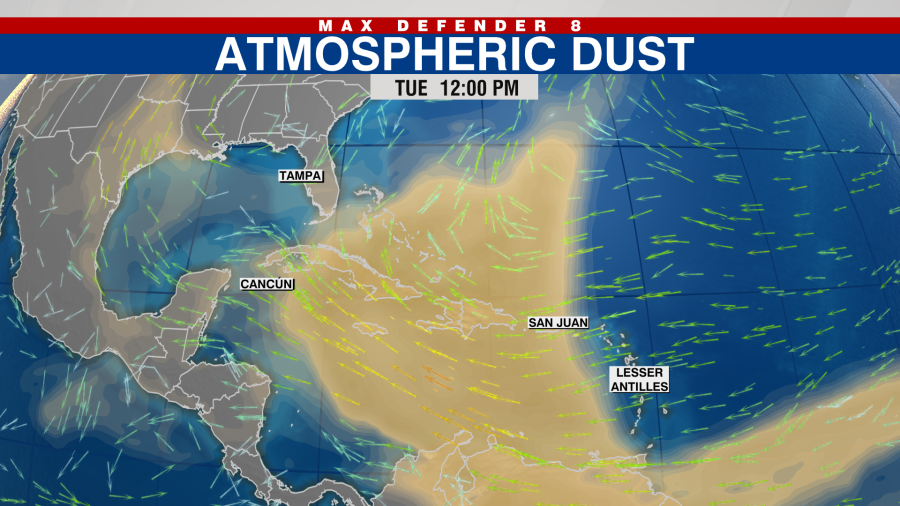

Saharan Dust Headed To Florida Air Quality And Visibility Impacts

May 30, 2025

Saharan Dust Headed To Florida Air Quality And Visibility Impacts

May 30, 2025 -

The Science Of Transgender Womens Athletic Advantage What The Research Reveals

May 30, 2025

The Science Of Transgender Womens Athletic Advantage What The Research Reveals

May 30, 2025 -

After Tesla Controversy Elon Musk Quits Trump Advisory Role

May 30, 2025

After Tesla Controversy Elon Musk Quits Trump Advisory Role

May 30, 2025 -

California Track Trans Athletes Win Sparks Rule Change Debate

May 30, 2025

California Track Trans Athletes Win Sparks Rule Change Debate

May 30, 2025