Hedge Fund Two Sigma Takes Large Position In Bank Of America (BAC)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Big Bet on Bank of America: What Does it Mean for Investors?

Two Sigma Investments, a prominent quantitative hedge fund, has made a significant investment in Bank of America (BAC), sparking considerable interest and speculation within the financial community. The move, revealed in recent SEC filings, shows a large increase in Two Sigma's holdings of BAC stock, signaling potential confidence in the bank's future performance. But what does this mean for average investors? Let's delve deeper.

Two Sigma, known for its data-driven investment strategies and sophisticated quantitative models, doesn't often publicize its holdings. This unexpected large position in Bank of America therefore carries significant weight. The substantial investment suggests Two Sigma's algorithms have identified positive indicators suggesting significant future growth for BAC.

Why Two Sigma Might Be Bullish on Bank of America

Several factors could be contributing to Two Sigma's bullish stance on Bank of America:

-

Strong Earnings and Growth Potential: Bank of America has consistently delivered strong earnings reports in recent quarters, exceeding analyst expectations. This robust performance, driven by factors like higher interest rates and increased lending activity, is likely a key attraction for Two Sigma. Further, analysts predict continued growth in the coming years.

-

Improving Economic Outlook: While economic uncertainty persists, recent data suggests a more resilient economy than previously anticipated. This positive economic outlook benefits banks like Bank of America, which are sensitive to economic cycles. A more robust economy usually translates to increased lending and transactional activity, boosting bank profitability.

-

Effective Cost Management: Bank of America has demonstrated a commitment to efficient cost management, improving its profitability margins. This efficiency, in conjunction with strong revenue growth, is a highly attractive combination for investors.

-

Technological Investments: The bank is actively investing in technology and digital transformation, aiming to enhance customer experience and improve operational efficiency. These technological advancements could provide a competitive advantage and contribute to long-term growth.

What This Means for You

Two Sigma's significant investment in Bank of America doesn't guarantee future success for the bank, but it does provide a compelling data point for individual investors to consider. It’s important to remember that hedge fund activity shouldn't be the sole basis for investment decisions.

However, this move, coupled with Bank of America's own positive performance indicators, strengthens the case for the bank as a potentially attractive investment. Before making any investment decisions, it's crucial to conduct your own thorough research and consider your individual risk tolerance. Consulting with a qualified financial advisor is also recommended.

Further Considerations

- Interest Rate Risk: While higher interest rates currently benefit banks, a potential shift in monetary policy could impact profitability.

- Competition: The banking sector remains highly competitive, with numerous players vying for market share.

- Geopolitical Factors: Global economic and geopolitical events can significantly impact the performance of financial institutions.

This significant investment by Two Sigma in Bank of America provides a fascinating insight into the thinking of one of the world's most sophisticated quantitative investment firms. While it's not a guarantee of future success, it certainly adds another layer of interest to the ongoing Bank of America story. Stay tuned for further developments.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hedge Fund Two Sigma Takes Large Position In Bank Of America (BAC). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

June 2025 Social Security Benefits Official Payment Calendar

May 28, 2025

June 2025 Social Security Benefits Official Payment Calendar

May 28, 2025 -

Alexandra Daddario Dazzles In Revealing Dior Gown

May 28, 2025

Alexandra Daddario Dazzles In Revealing Dior Gown

May 28, 2025 -

Hunger In Gaza Bbc Story Reveals Infants Struggle Under Blockade

May 28, 2025

Hunger In Gaza Bbc Story Reveals Infants Struggle Under Blockade

May 28, 2025 -

Charles Iiis Impactful Canadian Tour Navigating Politics And A Us Claim

May 28, 2025

Charles Iiis Impactful Canadian Tour Navigating Politics And A Us Claim

May 28, 2025 -

Harvard And Trump A Deep Dive Into The Outrage And Alleged Fraud

May 28, 2025

Harvard And Trump A Deep Dive Into The Outrage And Alleged Fraud

May 28, 2025

Latest Posts

-

Major Blast Rocks Chemical Plant In China Rescue Operation And Investigation Launched

May 29, 2025

Major Blast Rocks Chemical Plant In China Rescue Operation And Investigation Launched

May 29, 2025 -

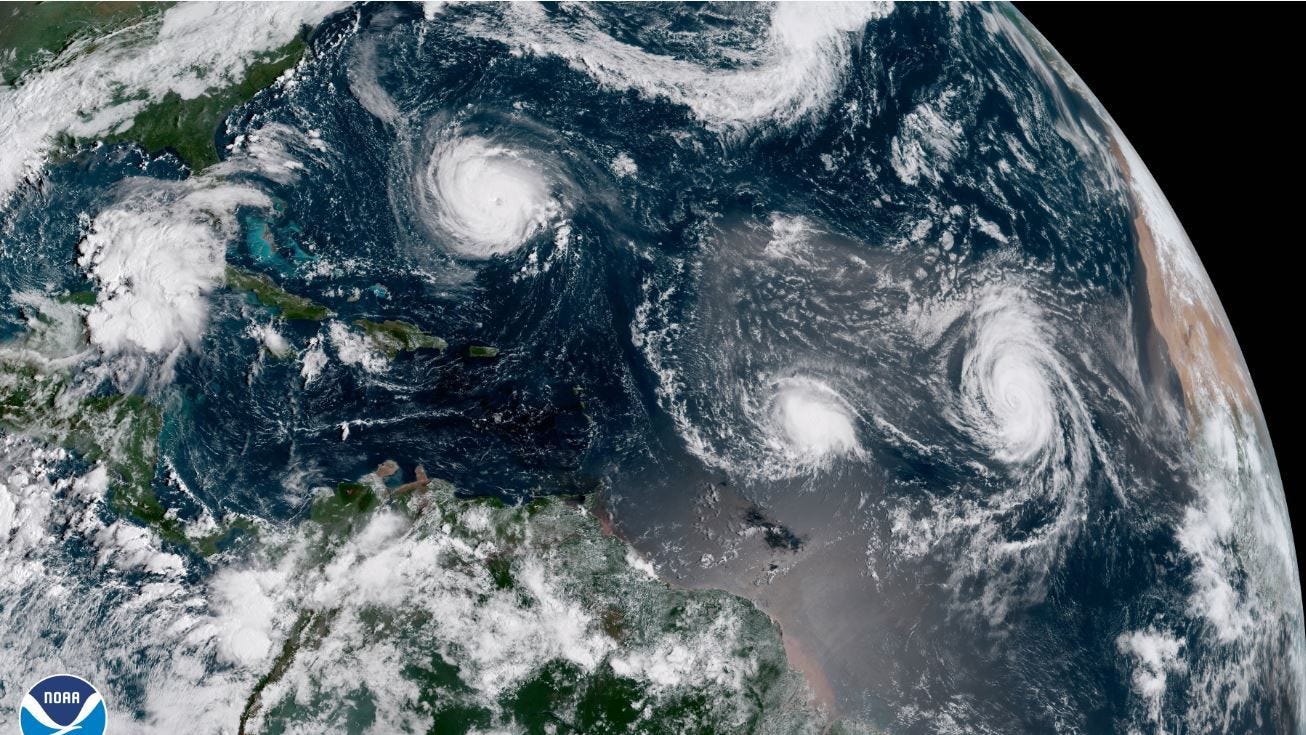

2025 Atlantic Hurricane Season Outlook And Faqs

May 29, 2025

2025 Atlantic Hurricane Season Outlook And Faqs

May 29, 2025 -

King Charles Iiis Impactful Canadian Trip Overshadowed By Trumps Claims

May 29, 2025

King Charles Iiis Impactful Canadian Trip Overshadowed By Trumps Claims

May 29, 2025 -

Man Eater Screwworm Understanding The Risks And Prevention Strategies

May 29, 2025

Man Eater Screwworm Understanding The Risks And Prevention Strategies

May 29, 2025 -

Antetokounmpo Staying Put Nets Draft Position And Key Nba Trade Rumors

May 29, 2025

Antetokounmpo Staying Put Nets Draft Position And Key Nba Trade Rumors

May 29, 2025