Higher-Than-Expected Government Borrowing: April's Financial Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Higher-Than-Expected Government Borrowing: April's Financial Report Sends Shockwaves Through Markets

April's government borrowing figures have exceeded all expectations, sending shockwaves through financial markets and sparking intense debate about the nation's fiscal health. The unexpected surge in borrowing has raised concerns about rising interest rates, increased national debt, and the overall economic outlook. Analysts are scrambling to understand the underlying causes and predict the potential consequences of this significant development.

The Office for National Statistics (ONS) released the April borrowing figures this morning, revealing a significantly larger deficit than anticipated by economists. Instead of the predicted £X billion, the actual figure reached a staggering £Y billion – a difference representing a substantial increase in government borrowing compared to the same period last year. This represents a significant jump of Z% compared to April 2022.

What Caused the Unexpected Surge in Borrowing?

Several factors are likely contributing to this higher-than-expected government borrowing:

-

Increased government spending: The government's commitment to [mention specific policy, e.g., increased healthcare spending, infrastructure projects] has undoubtedly placed significant pressure on public finances. These necessary expenditures, while crucial for long-term economic growth, have contributed to the widening deficit.

-

Lower-than-anticipated tax revenues: Tax revenues may have fallen short of projections due to various factors, including [mention possible causes e.g., a slowdown in economic activity, changes in tax policy effectiveness, or unforeseen global economic events]. This decrease in revenue has exacerbated the borrowing problem.

-

Inflationary pressures: The persistent high inflation rate is eroding the real value of government revenues while simultaneously increasing the cost of government services and programs. This inflationary environment has significantly impacted the nation's fiscal position.

Market Reactions and Expert Opinions

The release of the April borrowing figures triggered immediate and significant reactions in financial markets. The pound experienced [describe the effect on the pound, e.g., a slight dip] against major currencies, while government bond yields [describe the effect on yields, e.g., rose sharply], reflecting investor concerns about increased borrowing costs.

Economists have offered a range of opinions on the implications of this unexpected development. Some analysts suggest that the government needs to implement [suggest possible measures e.g., austerity measures, tax increases] to control spending and reduce the deficit. Others argue that continued investment in key areas is crucial for long-term economic growth and that focusing solely on deficit reduction could stifle economic recovery. The debate is likely to continue in the coming weeks and months.

What's Next?

The government is expected to respond to these figures shortly with a statement outlining its plans to address the rising national debt. Further analysis is needed to fully understand the long-term implications of April’s borrowing figures, but the immediate future looks uncertain. The situation underscores the importance of careful fiscal management and the need for a robust economic strategy to navigate the challenges ahead. The upcoming budget will be crucial in determining how the government intends to address this significant fiscal challenge. Stay tuned for further updates as the situation unfolds.

Keywords: Government borrowing, April financial report, national debt, fiscal health, economic outlook, ONS, inflation, government spending, tax revenues, market reactions, economic analysis, budget

(Optional) Call to action: For in-depth analysis and expert commentary on the UK economy, subscribe to our newsletter for regular updates. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Higher-Than-Expected Government Borrowing: April's Financial Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tax Rise Proposal Internal Memo Leaks Reveal Rayners Role

May 23, 2025

Tax Rise Proposal Internal Memo Leaks Reveal Rayners Role

May 23, 2025 -

Dakota Johnson Chris Evans And Pedro Pascals Hilarious Rom Com Quiz

May 23, 2025

Dakota Johnson Chris Evans And Pedro Pascals Hilarious Rom Com Quiz

May 23, 2025 -

Paramount S South Park Censorship Fans Respond By Buying Physical Copies

May 23, 2025

Paramount S South Park Censorship Fans Respond By Buying Physical Copies

May 23, 2025 -

O Connor Defeats Gainey In Pittsburgh Democratic Primary Election Night Recap

May 23, 2025

O Connor Defeats Gainey In Pittsburgh Democratic Primary Election Night Recap

May 23, 2025 -

Googles Veo 3 Revolutionizing Video Production With Ai And Audio

May 23, 2025

Googles Veo 3 Revolutionizing Video Production With Ai And Audio

May 23, 2025

Latest Posts

-

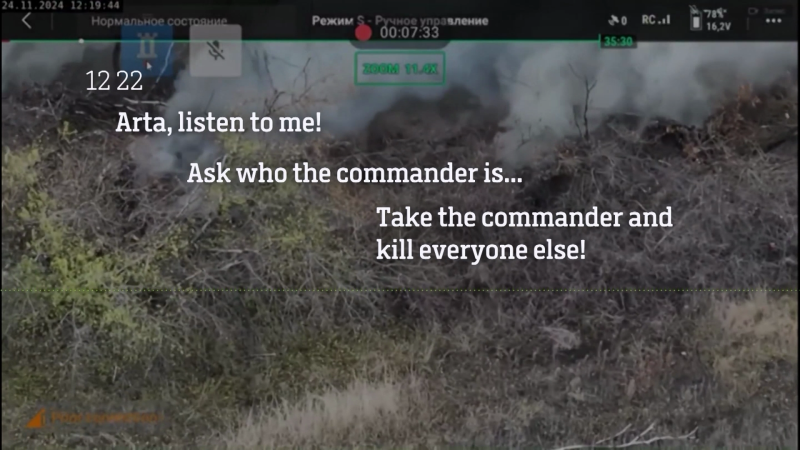

Disturbing Revelations Intercepted Russian Radio Transmissions Expose Massacre Orders

May 24, 2025

Disturbing Revelations Intercepted Russian Radio Transmissions Expose Massacre Orders

May 24, 2025 -

Americas Top 10 Beaches In 2025 According To Dr Beach

May 24, 2025

Americas Top 10 Beaches In 2025 According To Dr Beach

May 24, 2025 -

Act Now Apples Limited Time Free Upgrade For I Phone 13

May 24, 2025

Act Now Apples Limited Time Free Upgrade For I Phone 13

May 24, 2025 -

Chagos Islands Planned Deal Stalled By Legal Intervention

May 24, 2025

Chagos Islands Planned Deal Stalled By Legal Intervention

May 24, 2025 -

Political Earthquake Starmers About Face And Trumps Ambush Tactics

May 24, 2025

Political Earthquake Starmers About Face And Trumps Ambush Tactics

May 24, 2025