Higher-Than-Expected Government Borrowing In April: Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Higher-Than-Expected Government Borrowing in April: A Deep Dive into the Numbers

Government borrowing surged to unexpected heights in April, raising concerns among economists and fueling debate about the nation's fiscal health. The figures, released earlier this week by [Insert Name of Relevant Government Agency/Source], reveal a borrowing level significantly exceeding initial forecasts, prompting questions about the underlying causes and potential future implications. This in-depth analysis will explore the key factors contributing to this financial situation and examine potential consequences for the economy.

Understanding the April Borrowing Figures

The official data shows that the government borrowed [Insert Specific Amount] in April, a [Percentage]% increase compared to the same period last year and a considerable [Percentage]% over the projected figures. This dramatic rise represents the [Rank – e.g., highest] level of government borrowing seen in [Time Period – e.g., the last five years]. This significant jump immediately sparked concerns about the sustainability of current fiscal policies and their potential impact on inflation and interest rates.

Several factors contributed to this higher-than-expected borrowing.

-

Increased Government Spending: A notable increase in government spending across various sectors, including [Mention specific sectors, e.g., healthcare, infrastructure, social welfare programs], played a crucial role. This rise in spending reflects the government's commitment to [Mention specific government initiatives or programs]. However, critics argue that the spending increase wasn't adequately offset by revenue generation.

-

Lower-Than-Expected Tax Revenue: Tax revenues fell short of projections, contributing significantly to the increased borrowing. This shortfall may be attributed to a number of factors, including [Mention potential factors like economic slowdown, tax evasion, or changes in tax policy]. Understanding the reasons behind this revenue shortfall is critical for developing effective fiscal strategies.

-

Impact of Global Economic Uncertainty: The ongoing global economic uncertainty, characterized by [Mention relevant global economic factors such as inflation, supply chain disruptions, or geopolitical tensions], has undoubtedly impacted government revenue and expenditure, exacerbating the borrowing situation.

Potential Implications and Future Outlook

The implications of this higher-than-expected borrowing are multifaceted and potentially significant.

-

Increased Interest Rates: Higher government borrowing could lead to increased demand for funds in the market, potentially pushing interest rates higher. This could have a ripple effect, impacting borrowing costs for businesses and consumers alike. Rising interest rates could also dampen economic growth.

-

Inflationary Pressures: Increased government spending financed through borrowing can contribute to inflationary pressures, further eroding the purchasing power of consumers. This is particularly concerning given the current inflationary environment.

-

National Debt: The increased borrowing inevitably adds to the national debt, raising concerns about the long-term sustainability of the nation's finances. Managing the national debt effectively will require careful fiscal planning and potentially difficult policy decisions.

What's Next?

The government's response to this situation will be crucial. Experts anticipate [Mention potential government responses such as fiscal austerity measures, tax increases, or adjustments to government spending]. Close monitoring of government policy announcements and economic indicators will be essential in understanding the evolving economic landscape. Further analysis is needed to determine the long-term effects of this significant borrowing increase on the national economy. Stay tuned for further updates as the situation unfolds.

Related Articles:

- [Link to a relevant article on government spending]

- [Link to a relevant article on national debt]

- [Link to a relevant article on inflation]

This article provides an in-depth analysis of the unexpected surge in government borrowing in April. The information presented highlights the complexities of fiscal policy and its impact on the broader economy. Understanding these dynamics is critical for informed decision-making and navigating the current economic climate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Higher-Than-Expected Government Borrowing In April: Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Flow And Veo 3 Google I O Showcases Ais Future In Video

May 23, 2025

Flow And Veo 3 Google I O Showcases Ais Future In Video

May 23, 2025 -

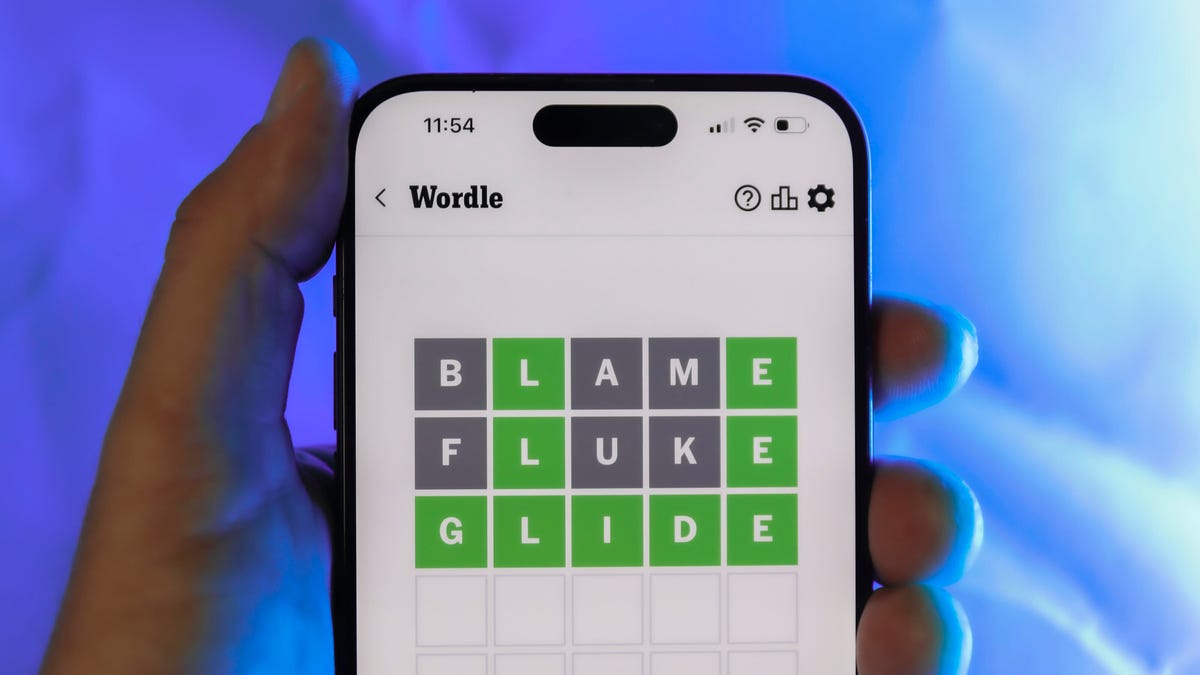

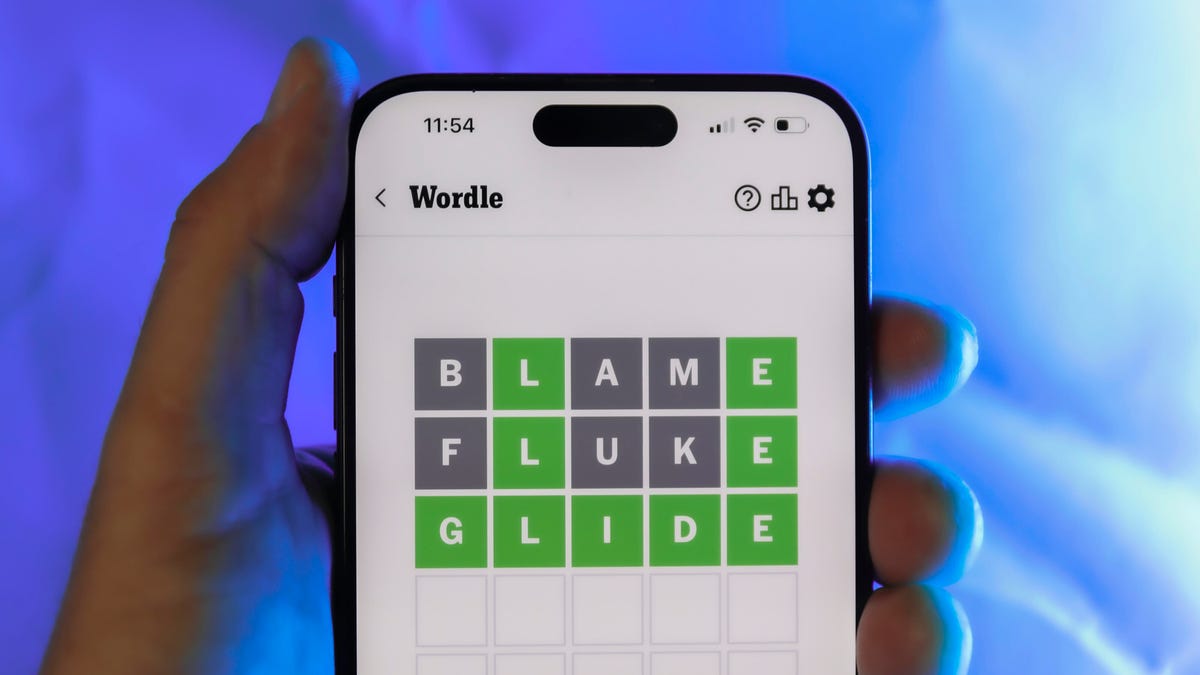

Wordle 1433 May 22 2024 Clues Answer And Help

May 23, 2025

Wordle 1433 May 22 2024 Clues Answer And Help

May 23, 2025 -

Planned M And S Online Service Interruptions July Timeline

May 23, 2025

Planned M And S Online Service Interruptions July Timeline

May 23, 2025 -

Sleeper Hit Sci Fi Film Makes Streaming Debut Catch It Now

May 23, 2025

Sleeper Hit Sci Fi Film Makes Streaming Debut Catch It Now

May 23, 2025 -

Wordle 1433 May 22 Hints Answer And Gameplay Help

May 23, 2025

Wordle 1433 May 22 Hints Answer And Gameplay Help

May 23, 2025

Latest Posts

-

Where To Stream Mickey 17 Official Max Release Date Confirmed

May 24, 2025

Where To Stream Mickey 17 Official Max Release Date Confirmed

May 24, 2025 -

Kim Jong Uns Anger Erupts After Warship Launch Failure

May 24, 2025

Kim Jong Uns Anger Erupts After Warship Launch Failure

May 24, 2025 -

Free Upgrade For I Phone 13 Users Apples New Initiative

May 24, 2025

Free Upgrade For I Phone 13 Users Apples New Initiative

May 24, 2025 -

Robert Pattinson Cast In Bong Joon Hos Next Film Plot Details And Release Date Speculation

May 24, 2025

Robert Pattinson Cast In Bong Joon Hos Next Film Plot Details And Release Date Speculation

May 24, 2025 -

Washington D C Shooting Investigation Into Attack On Israeli Embassy Personnel

May 24, 2025

Washington D C Shooting Investigation Into Attack On Israeli Embassy Personnel

May 24, 2025