Higher-Than-Expected Government Borrowing In April: Analysis And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Higher-Than-Expected Government Borrowing in April: Analysis and Implications

Government borrowing surged to unexpected heights in April, raising concerns about the nation's fiscal health and potential economic consequences. The figures, released [Insert Date and Source of Data – e.g., yesterday by the Treasury Department], significantly exceeded analysts' predictions, sparking debate among economists and policymakers. This unexpected increase necessitates a closer examination of its underlying causes and potential implications for the economy.

Understanding the April Borrowing Figures

The government borrowed [Insert Exact Amount] in April, surpassing the predicted [Insert Predicted Amount] by a considerable margin of [Insert Percentage or Amount Difference]. This represents a [Percentage Change compared to previous year/month] increase compared to [Previous Period - e.g., April last year or March this year]. Several factors contributed to this significant rise in borrowing.

-

Increased Government Spending: A key driver was the substantial increase in government spending on [List Key Areas of Increased Spending – e.g., social programs, infrastructure projects, defense]. These expenditures, while necessary in some cases, put significant pressure on the national budget. [Optional: Link to a relevant government budget report].

-

Lower-Than-Expected Tax Revenues: Simultaneously, tax revenues fell short of projections. This shortfall could be attributed to [Possible Reasons for Lower Tax Revenue – e.g., economic slowdown, changes in tax policies, decreased consumer spending]. A deeper dive into the tax revenue data is crucial for a comprehensive understanding of the situation. [Optional: Link to a relevant tax revenue report].

-

Impact of [Specific Event – e.g., Global Economic Uncertainty/Inflation]: The ongoing [Specific Event] further exacerbated the situation, impacting both government spending and tax revenue streams. The uncertainty surrounding [Specific Event] has led to increased fiscal pressures.

Implications for the Economy

The higher-than-expected borrowing has several potential implications for the national economy:

-

Increased Interest Rates: The increased demand for borrowing could put upward pressure on interest rates, making it more expensive for businesses and consumers to borrow money. This could stifle economic growth and potentially lead to [Potential Consequences - e.g., higher inflation or a recession].

-

National Debt: The surge in borrowing will undoubtedly add to the already substantial national debt. A growing national debt can lead to long-term economic challenges, including reduced creditworthiness and increased vulnerability to economic shocks.

-

Impact on Government Programs and Services: The increased borrowing could necessitate difficult choices regarding government spending in the future. This could lead to cuts in essential public services or delays in crucial infrastructure projects.

Expert Opinions and Future Outlook

Economists have offered varied perspectives on the situation. [Quote an economist's opinion about the situation and link to their source]. Some experts suggest that [Expert Opinion 1], while others argue that [Expert Opinion 2]. The uncertainty surrounding the future trajectory of the economy adds to the complexity of the situation.

The government's response to this situation will be critical. Policymakers will likely need to consider a range of options, including [Possible Government Responses – e.g., spending cuts, tax increases, or exploring alternative financing mechanisms]. The coming months will be crucial in determining how the government addresses this fiscal challenge and its impact on the national economy. Further analysis and transparency regarding government finances are essential for building public confidence and ensuring responsible fiscal management.

Call to Action: Stay informed about the evolving economic situation by following reputable financial news sources and engaging in informed discussions about fiscal policy. Understanding the complexities of government borrowing is vital for every citizen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Higher-Than-Expected Government Borrowing In April: Analysis And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk Faces Marine Heatwave Impact Of An Exceptionally Warm Spring On Sea Temperatures

May 24, 2025

Uk Faces Marine Heatwave Impact Of An Exceptionally Warm Spring On Sea Temperatures

May 24, 2025 -

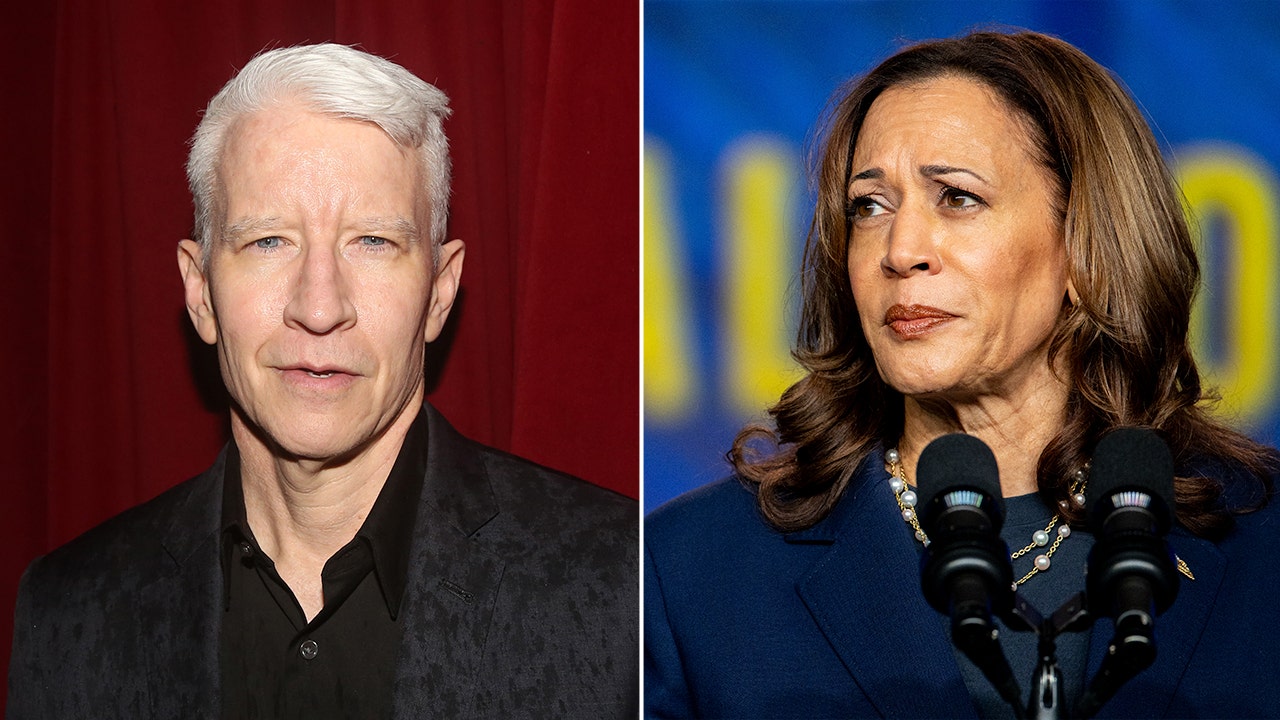

Behind The Scenes Kamala Harriss Confrontation With Anderson Cooper Following Debate

May 24, 2025

Behind The Scenes Kamala Harriss Confrontation With Anderson Cooper Following Debate

May 24, 2025 -

Severe Weather Alert Flash Flooding Threatens Western Pennsylvania

May 24, 2025

Severe Weather Alert Flash Flooding Threatens Western Pennsylvania

May 24, 2025 -

Danica Patricks Painful Revelation Emotional Abuse In Relationship With Aaron Rodgers

May 24, 2025

Danica Patricks Painful Revelation Emotional Abuse In Relationship With Aaron Rodgers

May 24, 2025 -

Trumps Misidentification Of South African Road As Burial Site

May 24, 2025

Trumps Misidentification Of South African Road As Burial Site

May 24, 2025