Higher Than Forecast: Government Borrowing For April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Higher Than Forecast: Government Borrowing Soars in April

Government borrowing in April surged to a higher-than-anticipated £22.7 billion, significantly exceeding forecasts and raising concerns about the UK's public finances. This figure, released by the Office for National Statistics (ONS) on [Date of Release], represents a substantial increase compared to the same period last year and casts a shadow over the government's fiscal plans. Economists had predicted borrowing closer to £18 billion, highlighting the unexpectedly large shortfall.

This unexpected jump in borrowing comes amidst a backdrop of persistent high inflation and a slowing economy. The combination of increased government spending and lower-than-expected tax revenues has contributed significantly to this fiscal deficit. Let's delve deeper into the key factors driving this alarming increase.

Factors Contributing to Increased Government Borrowing

Several factors contributed to the higher-than-expected April borrowing figure:

-

Inflationary Pressures: Persistent high inflation has eroded the real value of tax revenues, while simultaneously increasing government spending on areas like social welfare programs designed to mitigate the cost of living crisis. This squeeze on both sides of the government's budget is a significant contributor to the widening deficit.

-

Reduced Tax Revenues: While the government has implemented various tax measures, tax revenues haven't kept pace with the rising costs of public services. This is partly due to the impact of inflation on disposable income, leading to reduced consumer spending and consequently, lower tax receipts.

-

Increased Government Spending: The government has increased spending in several key areas, including healthcare and social security, to address the ongoing cost of living crisis. While necessary to support vulnerable populations, this added expenditure has put further pressure on public finances. The energy support schemes, though vital, also represent a substantial outlay.

-

Economic Slowdown: The UK economy is currently experiencing a slowdown, further impacting tax revenues and potentially increasing the demand for government support. This sluggish growth contributes to the challenging fiscal environment.

Implications for the UK Economy

The significantly higher-than-expected borrowing figure has significant implications for the UK economy:

-

Increased National Debt: This adds to the UK's already substantial national debt, potentially impacting the country's credit rating and increasing borrowing costs in the future.

-

Fiscal Policy Challenges: The government faces a significant challenge in balancing its budget and managing the national debt. Future fiscal policy decisions will need to carefully consider both economic growth and the need for fiscal responsibility.

-

Interest Rate Implications: The increased borrowing could put upward pressure on interest rates, further impacting consumer spending and potentially exacerbating the economic slowdown. The Bank of England will be closely monitoring this development.

Looking Ahead: What to Expect

The government will likely face increased scrutiny regarding its fiscal strategy following this announcement. Experts anticipate further analysis and potential revisions to the government's economic forecasts. The upcoming budget will be crucial in outlining the government's plans to address the widening fiscal deficit and navigate the ongoing economic challenges. We will continue to monitor the situation and provide updates as more information becomes available. For further economic news and analysis, visit [link to relevant financial news website].

Call to Action: Stay informed about crucial economic developments by subscribing to our newsletter [link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Higher Than Forecast: Government Borrowing For April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Improve Your I Phones Performance 6 Steps After I Os 18 5 Installation

May 24, 2025

Improve Your I Phones Performance 6 Steps After I Os 18 5 Installation

May 24, 2025 -

Government Considers Early Release For Violent Criminals What You Need To Know

May 24, 2025

Government Considers Early Release For Violent Criminals What You Need To Know

May 24, 2025 -

A Communitys Trauma One Hundred Yards From A School Shooting

May 24, 2025

A Communitys Trauma One Hundred Yards From A School Shooting

May 24, 2025 -

Analyse Du Match La Defaite D Adrian Mannarino En Grand Chelem

May 24, 2025

Analyse Du Match La Defaite D Adrian Mannarino En Grand Chelem

May 24, 2025 -

North Korea Kim Jong Un Addresses Mishap At Warship Commissioning

May 24, 2025

North Korea Kim Jong Un Addresses Mishap At Warship Commissioning

May 24, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

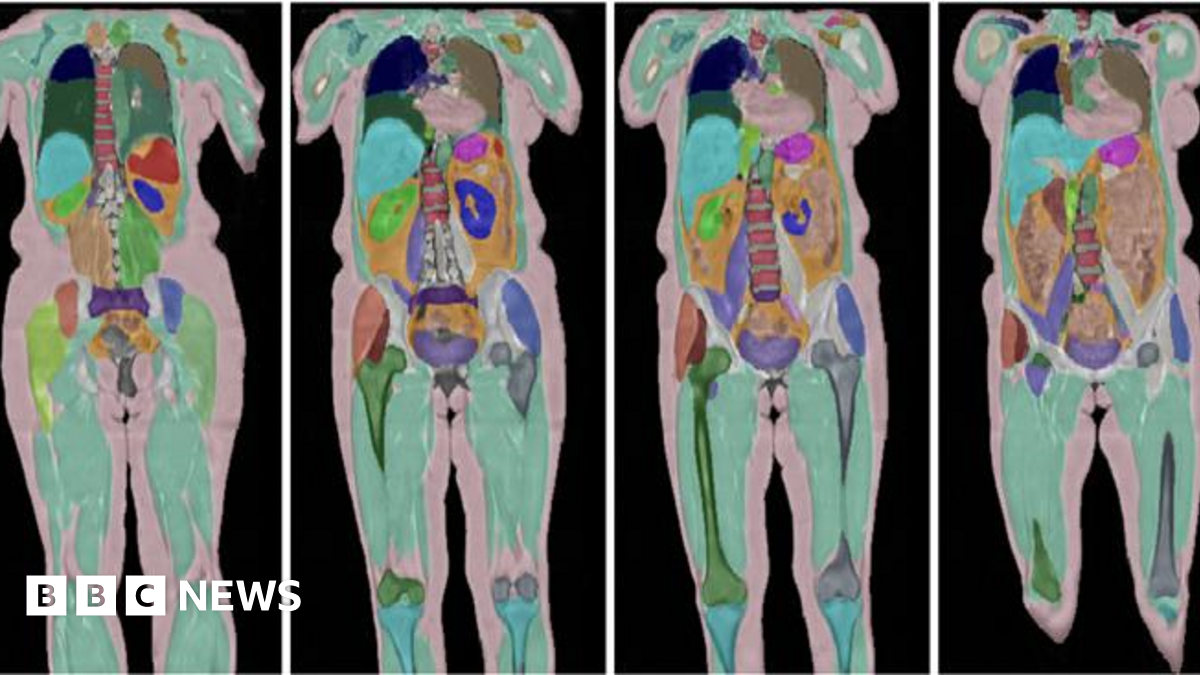

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025