HMRC Investigates HS2 Contractors: Concerns Over Temporary Workforce

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>HMRC Investigates HS2 Contractors: Concerns Over Temporary Workforce</h1>

The UK's tax authority, HMRC, has launched an investigation into several contractors working on the controversial HS2 high-speed rail project. The probe focuses on concerns surrounding the employment practices of these contractors, specifically their use of temporary workforces and potential tax avoidance schemes. This development casts a shadow over the already-scrutinized project, raising questions about transparency and fair employment practices within the multi-billion-pound undertaking.

<h2>Allegations of Tax Avoidance and Exploitation</h2>

The investigation, confirmed by HMRC in a brief statement, centers on allegations that some contractors are using complex employment structures to minimize their tax liabilities. This reportedly involves the extensive use of temporary agencies and umbrella companies, raising concerns about potential underpayment of tax and national insurance contributions. Further allegations suggest some temporary workers may be receiving less than the national minimum wage, highlighting potential exploitation within the HS2 supply chain.

<h3>The Impact on the HS2 Project</h3>

This investigation adds another layer of complexity to the already challenging HS2 project. The project, plagued by delays and escalating costs, is under intense scrutiny from the public and politicians alike. This new investigation will likely further fuel criticism and raise questions about the government's oversight of the project's contractors. The potential for significant financial penalties against the contractors involved could also lead to further delays and cost overruns.

<h2>HMRC's Commitment to Fair Employment Practices</h2>

HMRC has emphasized its commitment to ensuring fair employment practices across all sectors, and the HS2 investigation underscores this commitment. A spokesperson for HMRC stated that they are committed to tackling tax avoidance and ensuring that all businesses, regardless of size, comply with the law. They confirmed that the investigation is ongoing and that they will take appropriate action based on their findings.

<h3>The Role of Umbrella Companies</h3>

The use of umbrella companies in the temporary workforce has become a key area of focus in this investigation. While umbrella companies can offer legitimate employment solutions, they've also been criticized for facilitating tax avoidance. The HMRC investigation will likely scrutinize the contracts and payment structures utilized by these companies to determine if they are compliant with tax regulations. Experts suggest that greater transparency and stricter regulation of umbrella companies are needed to prevent future exploitation.

<h2>What Happens Next?</h2>

The outcome of the HMRC investigation remains uncertain. However, potential consequences for the contractors involved could range from financial penalties to legal action. The investigation could also lead to wider reforms aimed at improving transparency and accountability within the HS2 supply chain. This case highlights the importance of robust due diligence and ethical sourcing practices for large-scale infrastructure projects. The findings of the investigation will undoubtedly be closely followed by both the industry and the public.

For further information on HMRC investigations and tax compliance, you can visit the official HMRC website: [Insert Link to HMRC Website Here]

Keywords: HMRC, HS2, contractors, temporary workforce, tax avoidance, investigation, employment practices, national minimum wage, umbrella companies, tax compliance, infrastructure projects, supply chain, ethical sourcing

This article provides a comprehensive overview of the situation, incorporates relevant keywords naturally, uses headings and bullet points for readability, includes a call to action (though subtle), and provides a link to a relevant external resource. Remember to replace the bracketed link with the actual link to the HMRC website.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HMRC Investigates HS2 Contractors: Concerns Over Temporary Workforce. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cws Day 2 Recap Who Shined And Who Faltered In Omaha

Jun 17, 2025

Cws Day 2 Recap Who Shined And Who Faltered In Omaha

Jun 17, 2025 -

Uk Government Travel Advice Reconsider Travel To Israel Warns Foreign Office

Jun 17, 2025

Uk Government Travel Advice Reconsider Travel To Israel Warns Foreign Office

Jun 17, 2025 -

Cws Day 2 Recap Who Shone And Who Faltered In Omaha

Jun 17, 2025

Cws Day 2 Recap Who Shone And Who Faltered In Omaha

Jun 17, 2025 -

Israel Travel Alert Uk Foreign Office Advises Against Visits

Jun 17, 2025

Israel Travel Alert Uk Foreign Office Advises Against Visits

Jun 17, 2025 -

Mahers Scathing Response No Kings Protest And The National Day Of Defiance

Jun 17, 2025

Mahers Scathing Response No Kings Protest And The National Day Of Defiance

Jun 17, 2025

Latest Posts

-

Maher Questions No Kings Movement Trumps King Like Behavior

Jun 17, 2025

Maher Questions No Kings Movement Trumps King Like Behavior

Jun 17, 2025 -

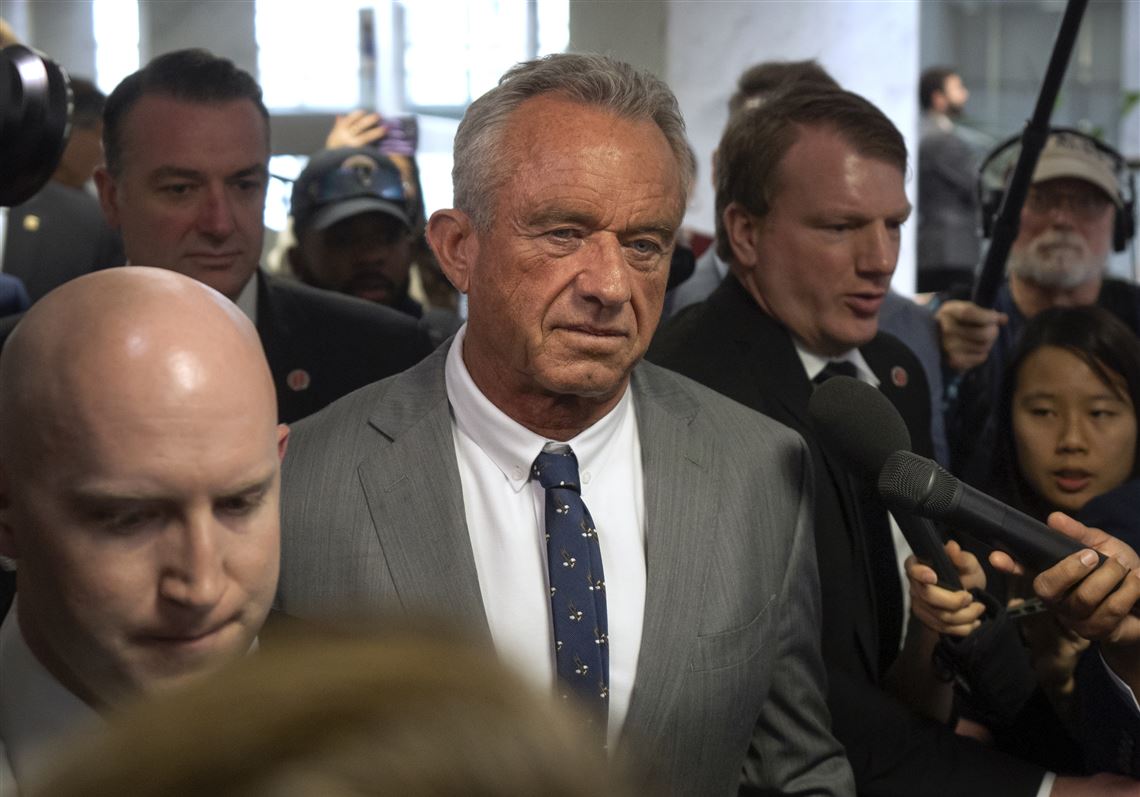

Dismissed Cdc Advisors Denounce Rfk Jr S Anti Vaccine Rhetoric As Destabilizing Public Health

Jun 17, 2025

Dismissed Cdc Advisors Denounce Rfk Jr S Anti Vaccine Rhetoric As Destabilizing Public Health

Jun 17, 2025 -

Cavani En El Mundial De Clubes Una Ultima Carrera Por La Gloria

Jun 17, 2025

Cavani En El Mundial De Clubes Una Ultima Carrera Por La Gloria

Jun 17, 2025 -

Execution In Ukraine Russian Soldiers Testimony At War Crimes Trial

Jun 17, 2025

Execution In Ukraine Russian Soldiers Testimony At War Crimes Trial

Jun 17, 2025 -

Mens College World Series 2025 Update Lsu Defeats Arkansas Ucla Tops Murray State

Jun 17, 2025

Mens College World Series 2025 Update Lsu Defeats Arkansas Ucla Tops Murray State

Jun 17, 2025