HMRC Investigation: Allegations Of Tax Evasion By HS2 Contractors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HMRC Investigation: Allegations of Tax Evasion by HS2 Contractors Rock High-Speed Rail Project

Shockwaves are rippling through the UK's ambitious High-Speed 2 (HS2) rail project following allegations of widespread tax evasion by several major contractors. The investigation, launched by Her Majesty's Revenue and Customs (HMRC), is focusing on potential irregularities in tax returns submitted over the past five years, potentially costing the UK taxpayer millions of pounds. This development casts a significant shadow over the already controversial project, raising serious questions about accountability and transparency.

Millions at Stake: The Scale of the HMRC Investigation

The HMRC investigation, currently underway, is reportedly examining the financial records of at least five prominent construction firms involved in various stages of the HS2 project. Sources close to the investigation suggest that the potential tax evasion could run into tens of millions of pounds. The scale of the alleged fraud is significant, potentially impacting the project's already stretched budget and delaying its completion further. This is particularly concerning given the project's substantial cost to the British taxpayer, already exceeding initial estimates by a considerable margin. [Link to a relevant government report on HS2 costs]

Key Areas Under Scrutiny

HMRC investigators are focusing on several key areas, including:

- Incorrectly claimed VAT refunds: Allegations center on inflated claims for Value Added Tax (VAT) refunds, potentially misrepresenting the true costs of materials and labor.

- Offshore tax havens: The investigation is also exploring the possibility of contractors using offshore tax havens to avoid paying their fair share of corporation tax.

- Subcontractors' payments: Scrutiny is also being applied to payments made to subcontractors, examining potential attempts to conceal income and reduce tax liabilities.

These alleged practices, if proven, represent a serious breach of trust and could lead to substantial fines and criminal prosecution. The implications extend beyond financial penalties, potentially damaging the reputation of both the contractors involved and the HS2 project itself.

Impact on HS2 Delivery and Public Trust

The timing of this investigation is particularly damaging, occurring as the HS2 project faces ongoing challenges related to budget overruns and delays. The allegations of tax evasion further erode public trust in the project’s management and its commitment to responsible spending of public funds. The government will need to demonstrate a firm commitment to transparency and accountability to regain public confidence.

This scandal also raises questions about the effectiveness of current procurement processes for major infrastructure projects. [Link to an article on HS2 procurement processes] Could stricter regulations and more robust auditing be implemented to prevent similar situations in the future?

What Happens Next?

The HMRC investigation is ongoing, and it remains unclear exactly how long it will take to reach a conclusion. However, the severity of the allegations suggests significant penalties are likely if evidence of tax evasion is substantiated. The outcome will have far-reaching consequences, not only for the implicated contractors but also for the future of the HS2 project and public perception of government infrastructure spending. We will continue to monitor this developing story and provide updates as they emerge.

Call to Action: Stay informed on the latest developments by subscribing to our newsletter for regular updates on the HS2 project and other major infrastructure news. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HMRC Investigation: Allegations Of Tax Evasion By HS2 Contractors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Naacp Snubs Trump President Uninvited From National Convention In Charlotte

Jun 17, 2025

Naacp Snubs Trump President Uninvited From National Convention In Charlotte

Jun 17, 2025 -

Club World Cup Flamengo Supporters Party At Rocky Statue

Jun 17, 2025

Club World Cup Flamengo Supporters Party At Rocky Statue

Jun 17, 2025 -

Former Dungeons And Dragons Leadership Bolsters Critical Roles Production

Jun 17, 2025

Former Dungeons And Dragons Leadership Bolsters Critical Roles Production

Jun 17, 2025 -

Israeli Strikes On Iran A Nation On Edge Sharing Their Stories Of Fear

Jun 17, 2025

Israeli Strikes On Iran A Nation On Edge Sharing Their Stories Of Fear

Jun 17, 2025 -

Frances Greenland Support A Direct Response To Trumps Claims

Jun 17, 2025

Frances Greenland Support A Direct Response To Trumps Claims

Jun 17, 2025

Latest Posts

-

Students Deaths At Scenic National Park Spark Safety Concerns

Jun 18, 2025

Students Deaths At Scenic National Park Spark Safety Concerns

Jun 18, 2025 -

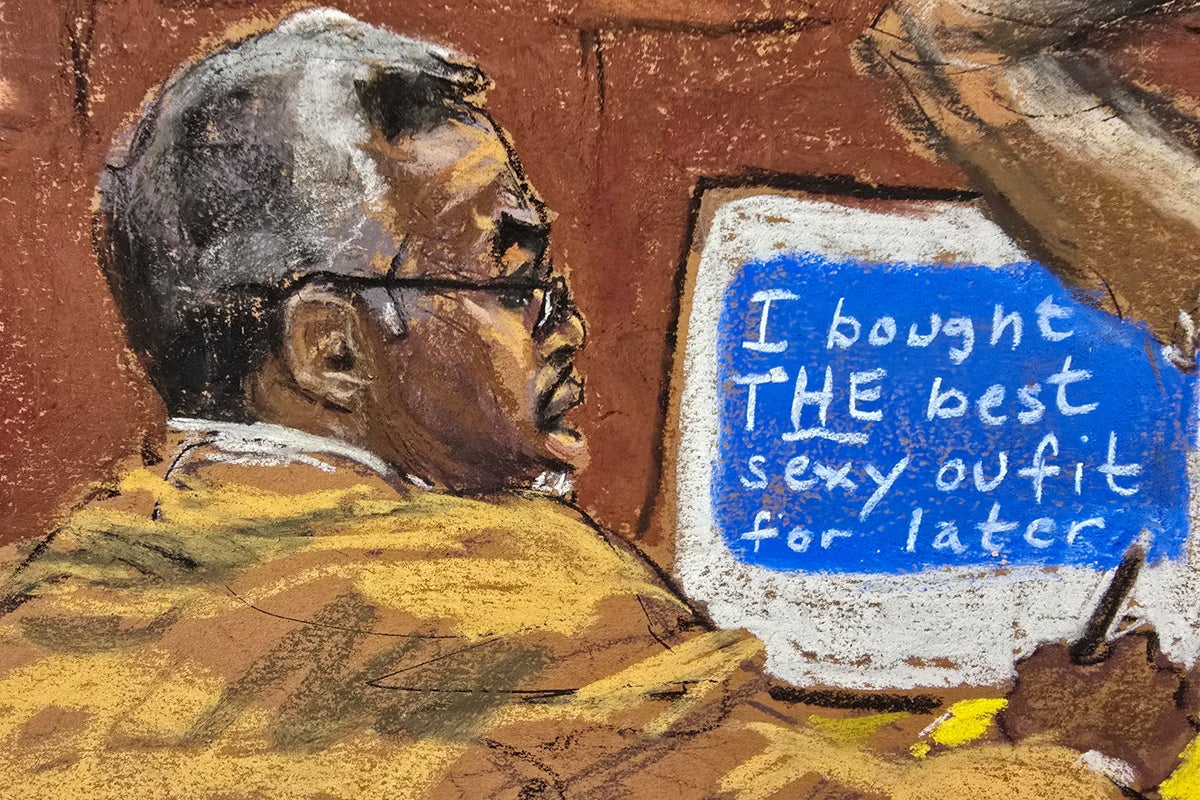

Diddy Trial Jurors View Explicit Footage Of Freak Offs

Jun 18, 2025

Diddy Trial Jurors View Explicit Footage Of Freak Offs

Jun 18, 2025 -

Actor Kelsey Grammer Expecting Fourth Child With Wife Kayte

Jun 18, 2025

Actor Kelsey Grammer Expecting Fourth Child With Wife Kayte

Jun 18, 2025 -

June 17th Mlb Blue Jays Vs Diamondbacks Picks And Best Bets Analysis

Jun 18, 2025

June 17th Mlb Blue Jays Vs Diamondbacks Picks And Best Bets Analysis

Jun 18, 2025 -

Blue Jays Vs Diamondbacks Expert Picks And Predictions For June 17th

Jun 18, 2025

Blue Jays Vs Diamondbacks Expert Picks And Predictions For June 17th

Jun 18, 2025