HMRC Scrutinises HS2 Contractors' Use Of Agency Workers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HMRC Scrutinises HS2 Contractors' Use of Agency Workers: Concerns over Tax Avoidance

The UK's tax authority, HMRC (Her Majesty's Revenue and Customs), is intensifying its scrutiny of contractors working on the High-Speed 2 (HS2) rail project, focusing specifically on the widespread use of agency workers. This investigation raises serious questions about potential tax avoidance and the fair treatment of workers involved in the massive infrastructure undertaking.

The investigation follows growing concerns that some contractors are employing agency workers to circumvent employment laws and potentially avoid paying the correct amount of tax and National Insurance contributions. This practice, often referred to as "IR35 avoidance," involves classifying workers as self-employed contractors even when they function as employees, thereby reducing the tax burden on both the contractor and the agency.

HMRC's Focus on IR35 Compliance:

HMRC has been actively tackling IR35 loopholes for years. The rules surrounding IR35 were updated in 2021, placing the responsibility for determining the employment status of contractors on the engager (in this case, the HS2 contractors). This shift aims to reduce the incidence of tax avoidance and ensure a level playing field for all businesses. However, the sheer scale and complexity of the HS2 project present unique challenges for enforcement.

The Scale of the Problem:

The HS2 project is one of the UK's largest infrastructure projects, involving thousands of contractors and subcontractors. The reliance on agency workers is significant, providing a fertile ground for potential misuse of the IR35 rules. This extensive use of agency workers increases the difficulty of monitoring compliance and identifying instances of tax avoidance. The investigation by HMRC suggests a significant portion of contractors may be operating outside the legal framework.

Potential Consequences for Contractors:

Contractors found to be non-compliant with IR35 regulations face substantial penalties, including back taxes, interest charges, and potentially criminal prosecution in severe cases. Furthermore, reputational damage could severely impact their ability to secure future contracts. The reputational implications for HS2 itself are also considerable; any suggestion of widespread tax avoidance on such a high-profile project would be damaging.

Protecting Agency Workers' Rights:

Beyond the tax implications, the reliance on agency workers raises concerns about workers' rights. Misclassifying workers as self-employed can deprive them of crucial employment benefits, including sick pay, holiday entitlement, and pension contributions. HMRC's investigation, therefore, has implications extending beyond mere tax collection, touching upon the ethical treatment of workers involved in the project.

What's Next?

HMRC's investigation is ongoing, and the full extent of the non-compliance remains to be seen. The outcome will likely set a precedent for other large-scale infrastructure projects in the UK and will significantly impact how contractors approach the use of agency workers in the future. This development serves as a strong reminder to all businesses of the importance of adhering to employment law and ensuring correct tax declarations. Businesses should proactively review their employment practices and seek professional advice to mitigate any risks associated with IR35.

Keywords: HMRC, HS2, agency workers, IR35, tax avoidance, contractors, employment law, tax investigation, infrastructure projects, National Insurance, self-employed, employment status.

Related Articles: (Links to relevant articles on HMRC's IR35 guidance and other large infrastructure projects)

Call to Action: Stay informed about the latest developments on this story by subscribing to our newsletter (link to newsletter signup).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HMRC Scrutinises HS2 Contractors' Use Of Agency Workers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Israel Iran Standoff A Look At Potential Catastrophic Outcomes

Jun 16, 2025

The Israel Iran Standoff A Look At Potential Catastrophic Outcomes

Jun 16, 2025 -

Gold Cup Showdown Live Updates From The Usa Vs Trinidad And Tobago Game

Jun 16, 2025

Gold Cup Showdown Live Updates From The Usa Vs Trinidad And Tobago Game

Jun 16, 2025 -

Israel Vs Iran A Look At Potential Catastrophic Outcomes

Jun 16, 2025

Israel Vs Iran A Look At Potential Catastrophic Outcomes

Jun 16, 2025 -

Beyond The Stars Examining The Cultural Phenomenon Of Guardians Of The Galaxy

Jun 16, 2025

Beyond The Stars Examining The Cultural Phenomenon Of Guardians Of The Galaxy

Jun 16, 2025 -

Nwsl Championship Soccer History And Past Winners

Jun 16, 2025

Nwsl Championship Soccer History And Past Winners

Jun 16, 2025

Latest Posts

-

Flamengos Fans Party At Rocky Statue Ahead Of Club World Cup

Jun 17, 2025

Flamengos Fans Party At Rocky Statue Ahead Of Club World Cup

Jun 17, 2025 -

Pre Club World Cup Flamengo Supporters Celebrate At Rocky Balboa Statue

Jun 17, 2025

Pre Club World Cup Flamengo Supporters Celebrate At Rocky Balboa Statue

Jun 17, 2025 -

No Kings Protest Draws Bill Mahers Ironic Commentary

Jun 17, 2025

No Kings Protest Draws Bill Mahers Ironic Commentary

Jun 17, 2025 -

Supply Chain Scrutiny Hs 2 Contractors Referred To Hmrc

Jun 17, 2025

Supply Chain Scrutiny Hs 2 Contractors Referred To Hmrc

Jun 17, 2025 -

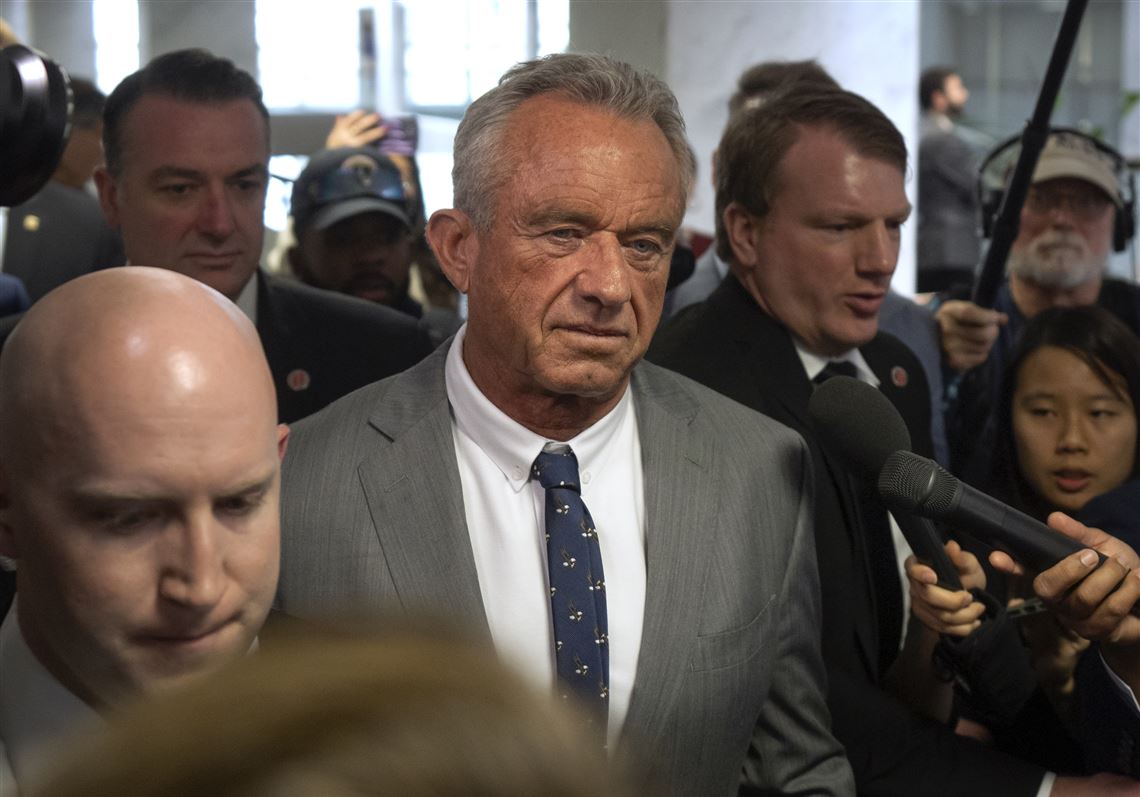

Robert F Kennedy Jr Faces Criticism From Dismissed Cdc Vaccine Committee Members

Jun 17, 2025

Robert F Kennedy Jr Faces Criticism From Dismissed Cdc Vaccine Committee Members

Jun 17, 2025