HMRC Targets HS2 Contractors Over Alleged Supply Chain Tax Evasion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HMRC Targets HS2 Contractors Over Alleged Supply Chain Tax Evasion

Millions of pounds in unpaid taxes are at the heart of a major investigation into the HS2 high-speed rail project. HMRC (Her Majesty's Revenue and Customs) has launched a wide-ranging probe into alleged supply chain tax evasion involving contractors working on the ambitious £100 billion infrastructure project. The investigation, which is expected to last several months, promises to shine a light on potential widespread tax avoidance within the complex network of companies involved in Britain's largest ever infrastructure project.

This unprecedented move by HMRC signals a determined effort to crack down on tax evasion within large-scale construction projects. The scale of the alleged evasion is significant, with sources suggesting that millions of pounds may be at stake. This isn't just about lost revenue; it impacts the fairness of the system and could potentially delay the already controversial project.

The Scope of the Investigation

The investigation is focusing on several key areas:

- VAT Fraud: HMRC is reportedly investigating potential Value Added Tax (VAT) fraud, a common method of tax evasion in the construction industry. This involves manipulating invoices and claiming false refunds.

- IR35 Compliance: The investigation is also scrutinizing compliance with IR35 legislation, which aims to ensure that contractors working through their own limited companies pay the correct amount of tax and National Insurance contributions. Non-compliance with IR35 is a significant concern for HMRC, particularly in large-scale projects like HS2.

- Payroll Tax Evasion: HMRC is looking into allegations of underreporting employee wages and failing to pay the correct amount of PAYE (Pay As You Earn) tax.

The complexity of the HS2 supply chain, with numerous subcontractors and tiered arrangements, creates fertile ground for such activities. This intricate network makes tracing payments and ensuring compliance extremely challenging.

HS2 and the Pressure to Deliver

The HS2 project, already facing significant scrutiny over its cost and environmental impact, now finds itself embroiled in this tax evasion scandal. The pressure to deliver the project on time and within budget may have inadvertently created an environment where some contractors felt tempted to cut corners, potentially compromising on tax compliance. This situation highlights the need for robust oversight and ethical procurement practices in large-scale infrastructure projects.

The Implications for the Construction Industry

This HMRC investigation has sent shockwaves through the construction industry. It serves as a stark reminder of the importance of tax compliance and the serious consequences of non-compliance. The industry as a whole needs to reassess its practices and ensure that robust systems are in place to prevent future incidents of tax evasion. This case sets a precedent for stricter enforcement and could lead to further investigations into other large-scale infrastructure projects.

What Happens Next?

HMRC will continue its investigation, examining financial records and interviewing individuals involved. Depending on the findings, penalties could range from financial fines to criminal prosecution. The outcome of this investigation will have significant implications not only for the contractors involved but also for the future of large-scale public projects in the UK. The government will likely need to review its procurement processes to mitigate the risk of future tax evasion within such projects.

For further information on tax compliance in the construction industry, you can consult the HMRC website: [Insert link to relevant HMRC page here]

Stay tuned for further updates on this developing story.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HMRC Targets HS2 Contractors Over Alleged Supply Chain Tax Evasion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Air India Plane Crash Grim Toll Reaches 270 Search For Survivors Continues

Jun 17, 2025

Air India Plane Crash Grim Toll Reaches 270 Search For Survivors Continues

Jun 17, 2025 -

Prince Williams Family New Photos Released By The Royals

Jun 17, 2025

Prince Williams Family New Photos Released By The Royals

Jun 17, 2025 -

Tucker Carlsons Drop Israel Comment Scott Jennings Sharp Response

Jun 17, 2025

Tucker Carlsons Drop Israel Comment Scott Jennings Sharp Response

Jun 17, 2025 -

Traitors Series Returns Alongside Yungbluds New Album This Week

Jun 17, 2025

Traitors Series Returns Alongside Yungbluds New Album This Week

Jun 17, 2025 -

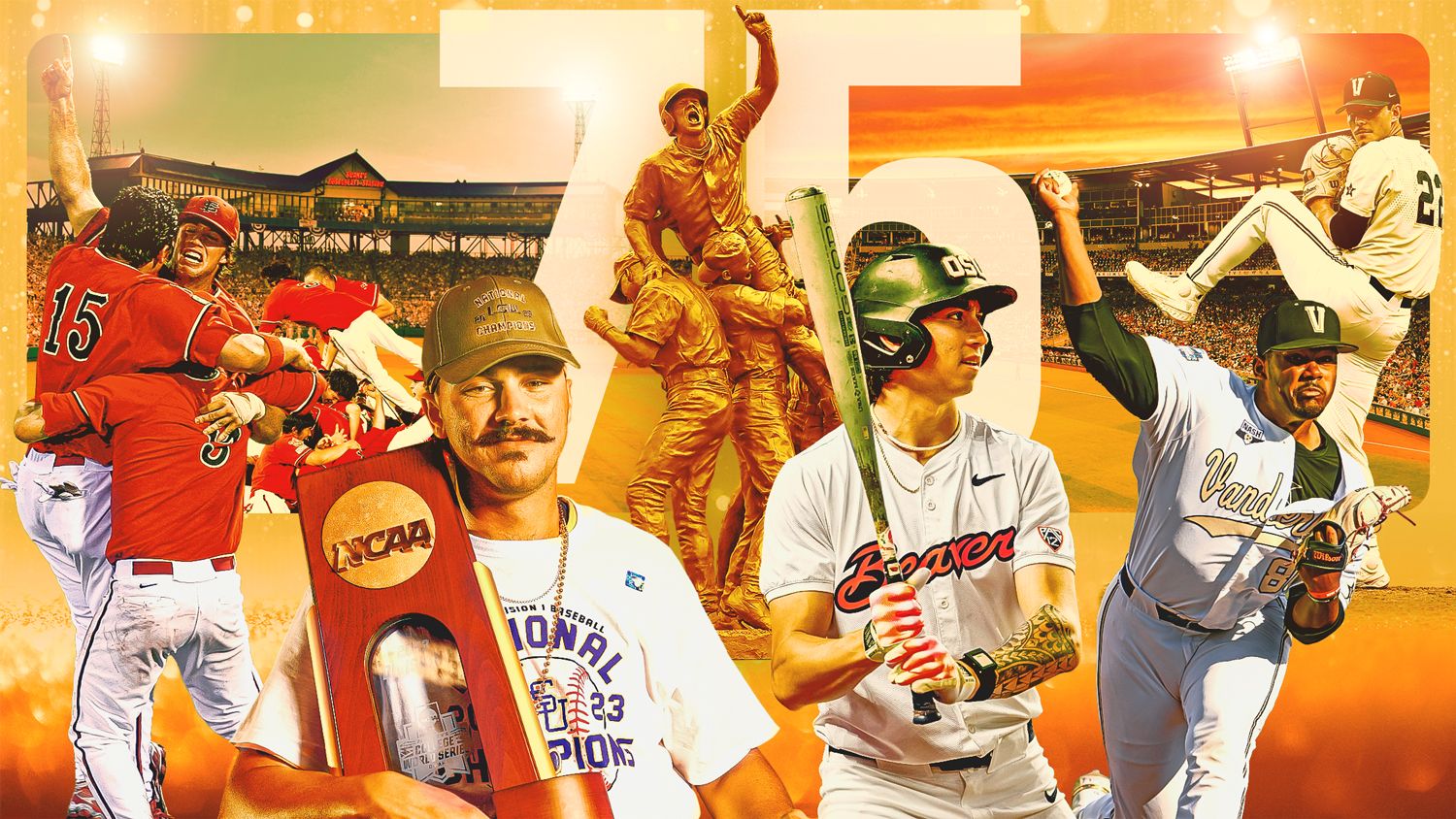

The Mcws And Omaha A Story Of Shared Triumph

Jun 17, 2025

The Mcws And Omaha A Story Of Shared Triumph

Jun 17, 2025

Latest Posts

-

Air India Plane Crash Update Death Toll Reaches 270

Jun 17, 2025

Air India Plane Crash Update Death Toll Reaches 270

Jun 17, 2025 -

Life In The Crosshairs The Impact Of Israeli Attacks On Iranian Citizens

Jun 17, 2025

Life In The Crosshairs The Impact Of Israeli Attacks On Iranian Citizens

Jun 17, 2025 -

Omaha Cws A Recap Of Day 2s Best And Worst Performances

Jun 17, 2025

Omaha Cws A Recap Of Day 2s Best And Worst Performances

Jun 17, 2025 -

Bill Maher On Trump And The No Kings Movement A Critical Analysis

Jun 17, 2025

Bill Maher On Trump And The No Kings Movement A Critical Analysis

Jun 17, 2025 -

Increased Appendix Cancer Risk In Millennials A Significant Finding Compared To Gen X

Jun 17, 2025

Increased Appendix Cancer Risk In Millennials A Significant Finding Compared To Gen X

Jun 17, 2025