Holding My Amazon Stock After A Massive 560% Return

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Holding My Amazon Stock After a Massive 560% Return: A Case Study in Patience and Portfolio Management

Amazon. The name conjures images of ubiquitous online shopping, cloud computing dominance, and a seemingly unstoppable growth trajectory. For many investors, holding Amazon stock (AMZN) has been a wildly successful venture. But what happens when your investment yields a staggering 560% return? Do you sell, cash out, and enjoy the spoils? Or do you hold on, betting on continued growth in the face of market volatility and potential future challenges? This article explores this very dilemma, using a real-world example to illustrate the complexities of investment decisions after significant gains.

The Temptation to Sell: Why 560% Returns Trigger Difficult Choices

A 560% return on any investment is phenomenal. It represents a life-changing amount of wealth for many. The emotional pull to sell, pay off debts, invest in a dream property, or simply enjoy a well-deserved reward is incredibly strong. This is completely understandable. However, successful long-term investing often requires overcoming these powerful emotional impulses.

My Amazon Journey: A Decade of Growth and Uncertainty

My journey with Amazon stock began over a decade ago. Initially, I invested a relatively modest sum, driven by a belief in the company's disruptive potential in e-commerce and its burgeoning cloud computing division, Amazon Web Services (AWS). The early years saw steady, if not spectacular, growth. But the past few years have been nothing short of extraordinary, culminating in that impressive 560% return.

The Factors Influencing My Decision to Hold:

Despite the significant gains, I've chosen to hold my Amazon stock. This decision is based on several key factors:

- Long-Term Growth Potential: Amazon continues to innovate across various sectors. From its expansion into grocery delivery with Whole Foods Market and Amazon Fresh to its advancements in artificial intelligence and robotics, the company shows little sign of slowing down. This long-term vision remains a compelling reason to hold.

- Dominant Market Position: Amazon holds a dominant position in e-commerce and cloud computing, two sectors poised for continued expansion. This market leadership provides a significant competitive advantage.

- Diversification: While Amazon represents a significant portion of my portfolio, it's not my only holding. Diversification across different asset classes helps mitigate risk. [Link to an article about portfolio diversification]

- Reinvestment Strategy: Rather than immediately cashing out, I'm reinvesting a portion of my dividends to further capitalize on Amazon's growth potential. This strategy allows for compounding returns over the long term.

- Risk Tolerance: I have a high risk tolerance and a long-term investment horizon. This allows me to weather potential short-term market fluctuations without panic selling.

The Risks of Holding:

It's crucial to acknowledge the risks associated with holding any stock, even one as seemingly successful as Amazon. Market corrections, increased competition, regulatory changes, and unforeseen economic downturns could all impact Amazon's share price. Careful monitoring and a well-defined investment strategy are essential.

Conclusion: A Balancing Act of Greed and Fear

The decision of whether to hold or sell after achieving significant returns is intensely personal. It requires a careful assessment of your individual risk tolerance, financial goals, and investment timeline. My experience with Amazon highlights the importance of long-term thinking, diversification, and a disciplined approach to investing. While the temptation to cash out is undeniably strong, the potential for future growth often outweighs the immediate gratification of a large payout. It's a constant balancing act between greed and fear, a crucial element of successful long-term investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Holding My Amazon Stock After A Massive 560% Return. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Yankees Stanton Faces New Beginning Mariners Trade Rumors Heat Up

May 27, 2025

Yankees Stanton Faces New Beginning Mariners Trade Rumors Heat Up

May 27, 2025 -

Post Office Payment Dispute Bates Challenges Inadequate Compensation

May 27, 2025

Post Office Payment Dispute Bates Challenges Inadequate Compensation

May 27, 2025 -

George Floyd A Lasting Tribute From Those Who Knew Him Best

May 27, 2025

George Floyd A Lasting Tribute From Those Who Knew Him Best

May 27, 2025 -

South Western Railway Renationalisation A Labour Party Milestone

May 27, 2025

South Western Railway Renationalisation A Labour Party Milestone

May 27, 2025 -

Faux Images Circulant De Macron Agresse Par Brigitte Au Vietnam Dementi Officiel

May 27, 2025

Faux Images Circulant De Macron Agresse Par Brigitte Au Vietnam Dementi Officiel

May 27, 2025

Latest Posts

-

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025 -

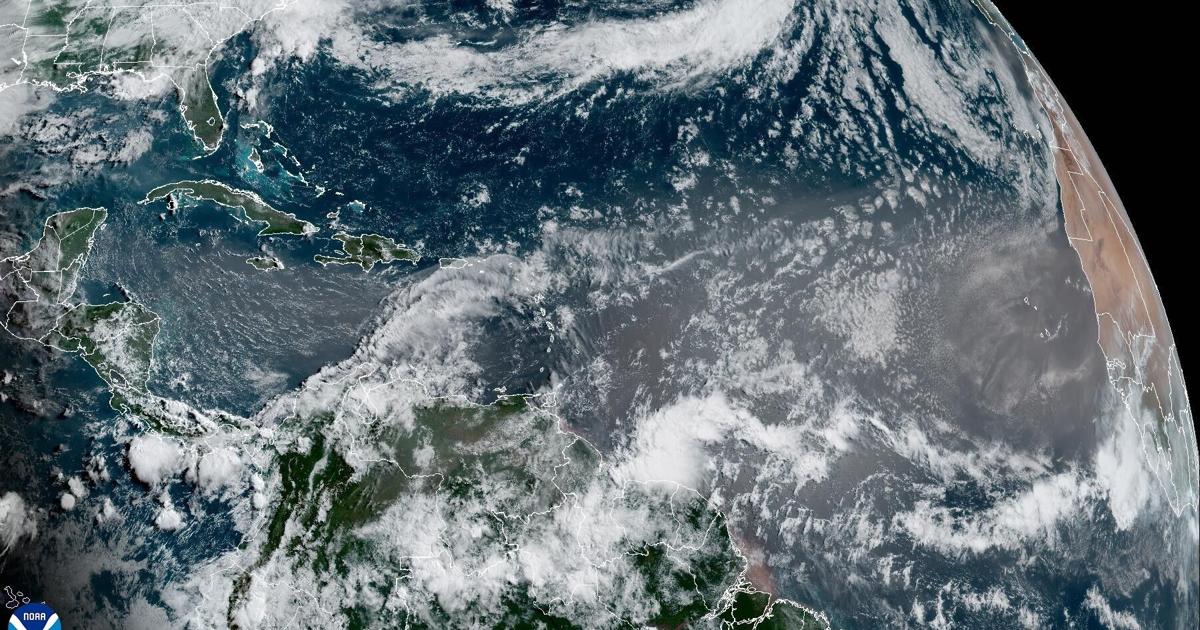

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025 -

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025 -

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025 -

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025