Holding Onto Amazon Stock: A 560% Return And My Rationale

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Holding onto Amazon Stock: A 560% Return and My Rationale

Introduction: Investing in the stock market is a gamble, but sometimes, holding onto a winning stock can yield extraordinary results. My experience with Amazon (AMZN) is a prime example. Over the years, I've witnessed a staggering 560% return on my initial investment. This article details my journey, the rationale behind my decision to hold, and offers insights for navigating the volatile world of long-term stock investing.

The Initial Investment: A Leap of Faith in E-commerce

My investment in Amazon began in [Year]. At the time, the internet was still burgeoning, and the concept of online retail was relatively new. Many questioned Amazon's long-term viability, but I saw the potential. Jeff Bezos' vision of a customer-centric online marketplace resonated with me, and I believed in his disruptive business model. My initial investment was relatively modest, but it represented a significant portion of my investment portfolio at the time. The key was believing in the underlying strength of the company and its long-term prospects, even amidst market fluctuations.

Navigating the Ups and Downs: Patience and Long-Term Vision

The journey wasn't always smooth sailing. Like any stock, Amazon experienced periods of volatility. There were dips and market corrections that tested my resolve. There were times I questioned my decision, especially during periods of significant market downturn. However, I consistently revisited my initial rationale: Amazon's innovative spirit, its expansion into new markets (like AWS - Amazon Web Services), and its relentless focus on customer satisfaction. These were the fundamental pillars that underpinned my confidence. Regularly reviewing financial reports and industry analyses reinforced my belief in Amazon's long-term growth potential. This is crucial for any long-term investment strategy. Remember, successful investing often requires patience and a long-term perspective.

The 560% Return: A Testament to Long-Term Holding

Fast forward to today, and my initial investment has yielded a remarkable 560% return. This incredible growth highlights the power of identifying a strong company with a solid business model and holding onto it for the long haul. This isn't just about luck; it's a testament to thorough research, careful consideration, and the discipline to resist impulsive trading decisions based on short-term market fluctuations. Understanding the company's financial health, competitive landscape, and future growth potential is key. For resources on conducting thorough company research, explore sites like the and reputable financial news outlets.

My Rationale for Holding: More Than Just a Stock

My decision to hold onto Amazon stock wasn't simply driven by financial gains. It was a belief in the transformative power of technology and Amazon's role in shaping the future of commerce. Amazon's expansion into cloud computing (AWS), digital media, and other sectors further solidified my conviction. Understanding the broader industry trends and the company's strategic adaptations is vital for making informed investment decisions.

Lessons Learned: Key Takeaways for Investors

- Thorough Due Diligence: Conduct extensive research before investing in any stock.

- Long-Term Perspective: Investing is a marathon, not a sprint. Patience is key.

- Diversification: Never put all your eggs in one basket. Diversify your portfolio.

- Emotional Discipline: Avoid impulsive decisions based on fear or greed.

- Continuous Learning: Stay updated on market trends and company performance.

Conclusion: A Case Study in Long-Term Investing

My experience with Amazon serves as a compelling case study for the potential rewards of long-term investing. However, it's crucial to remember that past performance is not indicative of future results. Investing in the stock market always involves risk. This article is not financial advice; always conduct your own research and consult with a qualified financial advisor before making any investment decisions. But the core principles – thorough research, patience, and a long-term perspective – remain crucial for success in the world of stock market investing. What are your thoughts on long-term investing strategies? Share your experiences in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Holding Onto Amazon Stock: A 560% Return And My Rationale. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beef Costs Drive Year High Food Inflation Whats Behind The Surge

May 28, 2025

Beef Costs Drive Year High Food Inflation Whats Behind The Surge

May 28, 2025 -

King Charles Iiis Impactful Canada Trip Overshadowed By Trumps 51st State Claim

May 28, 2025

King Charles Iiis Impactful Canada Trip Overshadowed By Trumps 51st State Claim

May 28, 2025 -

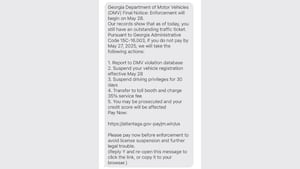

Received A Suspicious Text From The Ga Department Of Driver Services

May 28, 2025

Received A Suspicious Text From The Ga Department Of Driver Services

May 28, 2025 -

Two Sigmas Significant Bank Of America Investment What Does It Mean For Investors

May 28, 2025

Two Sigmas Significant Bank Of America Investment What Does It Mean For Investors

May 28, 2025 -

Nyse Bac Update Birmingham Capital Managements Recent Transaction And Market Implications

May 28, 2025

Nyse Bac Update Birmingham Capital Managements Recent Transaction And Market Implications

May 28, 2025

Latest Posts

-

Real Estate Report Sellers Outnumber Buyers By Largest Margin In A Decade

May 31, 2025

Real Estate Report Sellers Outnumber Buyers By Largest Margin In A Decade

May 31, 2025 -

Is Kemi Badenochs Leadership Failing Insiders Detail Critical Flaws

May 31, 2025

Is Kemi Badenochs Leadership Failing Insiders Detail Critical Flaws

May 31, 2025 -

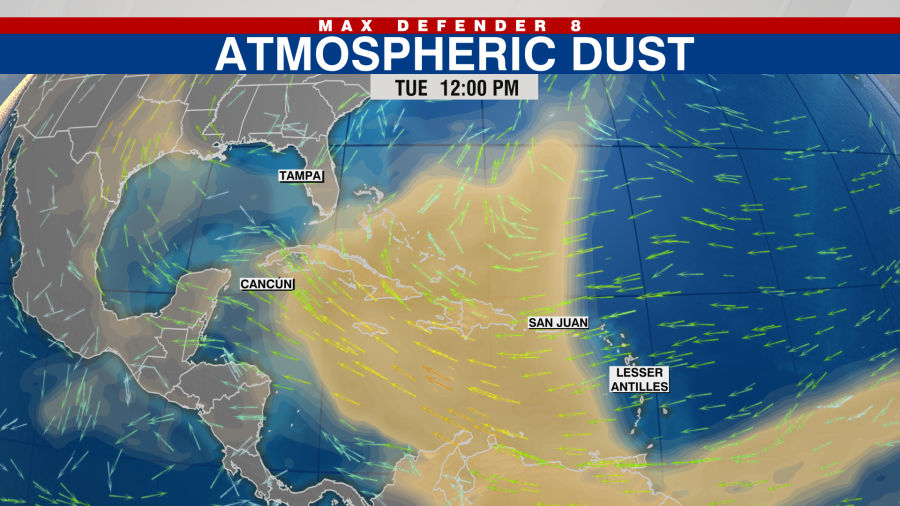

Saharan Dust Cloud Approaching Florida Potential Health Effects

May 31, 2025

Saharan Dust Cloud Approaching Florida Potential Health Effects

May 31, 2025 -

Urgent Search Missing Teen Substantial Reward For Information

May 31, 2025

Urgent Search Missing Teen Substantial Reward For Information

May 31, 2025 -

Un Hearing Palestinian Representative Weeps Describing Gaza Childrens Suffering

May 31, 2025

Un Hearing Palestinian Representative Weeps Describing Gaza Childrens Suffering

May 31, 2025