Holding Onto Amazon Stock After A Massive 560% Return

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Holding Onto Amazon Stock After a Massive 560% Return: A Smart Move or Time to Cash Out?

Amazon. The name conjures images of ubiquitous online shopping, innovative technology, and, for many investors, substantial wealth. For those who bought Amazon stock years ago, the returns have been nothing short of phenomenal. A 560% increase is a dream for most investors, but the question now becomes: should you hold onto your Amazon stock, or is it time to cash out? This article explores the complexities of this decision, examining the factors that should influence your choice.

The Tempting Allure of a 560% Return:

A 560% return is undoubtedly impressive. It represents a significant increase in your investment portfolio, potentially changing your financial future dramatically. The natural inclination is to secure those profits and celebrate a massive win. However, before making any rash decisions, consider the potential for future growth.

Arguments for Holding:

- Continued Growth Potential: Despite its size, Amazon continues to expand into new markets and develop innovative products and services. From cloud computing (AWS) to grocery delivery (Whole Foods), Amazon shows no signs of slowing down. This ongoing innovation fuels optimism for continued stock growth. [Link to Amazon's investor relations page]

- Long-Term Investment Strategy: If your investment strategy focuses on long-term growth, then selling after such a significant return might contradict your overall financial plan. Holding onto the stock allows you to benefit from potential future gains.

- Market Volatility: The stock market is inherently volatile. Cashing out now might mean missing out on further growth, particularly if the market recovers from any short-term dips.

Arguments Against Holding:

- Risk of Market Corrections: No investment is guaranteed. Even seemingly invincible companies like Amazon can experience periods of decline. Holding onto your stock carries the risk of losing some or all of your gains.

- Diversification: Having a large portion of your portfolio concentrated in a single stock, even a successful one like Amazon, can be risky. Diversification across various asset classes is crucial for mitigating risk.

- Alternative Investment Opportunities: The substantial profit from your Amazon stock could provide capital for other potentially lucrative investment opportunities.

Analyzing Your Personal Circumstances:

The decision to hold or sell should be based on your individual circumstances and financial goals. Consider these factors:

- Your Risk Tolerance: Are you comfortable with the potential for short-term losses in exchange for the possibility of long-term gains?

- Your Financial Goals: How does holding or selling Amazon stock align with your short-term and long-term financial goals (e.g., retirement planning, purchasing a home)?

- Your Investment Time Horizon: Do you have a short-term or long-term investment horizon?

Seeking Professional Advice:

Before making any major investment decisions, it's always wise to consult with a qualified financial advisor. They can help you assess your risk tolerance, financial goals, and investment strategy, providing personalized advice tailored to your situation.

Conclusion:

Holding onto Amazon stock after a 560% return is a complex decision with no easy answer. Weighing the potential for continued growth against the risks of market volatility and diversification needs is paramount. Thoroughly analyze your personal financial situation and consider seeking professional advice before making any decisions. Remember, informed choices are key to long-term investment success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Holding Onto Amazon Stock After A Massive 560% Return. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Baroness Mones Journey A Case Study In Entrepreneurial Success And Failure

May 27, 2025

Baroness Mones Journey A Case Study In Entrepreneurial Success And Failure

May 27, 2025 -

Tenis Swiatek W Roland Garros Relacja Na Zywo Z Meczow

May 27, 2025

Tenis Swiatek W Roland Garros Relacja Na Zywo Z Meczow

May 27, 2025 -

Moment De Complicite L Elysee Repond Aux Rumeurs De Violence Entre Macron Et Sa Femme

May 27, 2025

Moment De Complicite L Elysee Repond Aux Rumeurs De Violence Entre Macron Et Sa Femme

May 27, 2025 -

Discover 5 Key I Os 18 5 Improvements And 3 More

May 27, 2025

Discover 5 Key I Os 18 5 Improvements And 3 More

May 27, 2025 -

Ncaa Championship Monday Big Red Vs Terrapins

May 27, 2025

Ncaa Championship Monday Big Red Vs Terrapins

May 27, 2025

Latest Posts

-

A1 Northumberland Road Project Failure Results In Blighted Homes

May 29, 2025

A1 Northumberland Road Project Failure Results In Blighted Homes

May 29, 2025 -

England Vs West Indies First Odi International Live Score And Highlights

May 29, 2025

England Vs West Indies First Odi International Live Score And Highlights

May 29, 2025 -

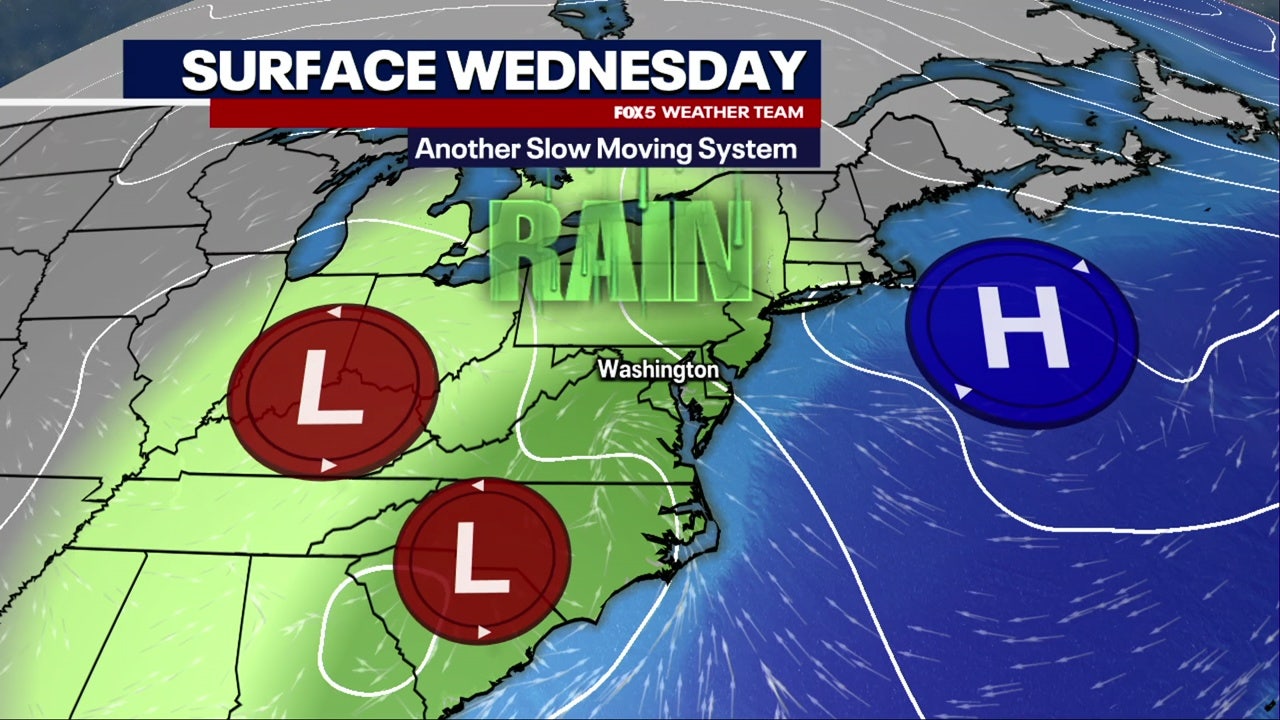

Severe Weather Warning Heavy Rain And Thunderstorms To Impact Washington D C Wednesday

May 29, 2025

Severe Weather Warning Heavy Rain And Thunderstorms To Impact Washington D C Wednesday

May 29, 2025 -

Uks Largest Ever Environmental Fine Thames Water To Pay 122 7m

May 29, 2025

Uks Largest Ever Environmental Fine Thames Water To Pay 122 7m

May 29, 2025 -

D C Residents Brace For Wet Wednesday And Rainy Forecast

May 29, 2025

D C Residents Brace For Wet Wednesday And Rainy Forecast

May 29, 2025