Home Seller Surplus Reaches 12-Year Peak: Analysis And Market Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Home Seller Surplus Reaches 12-Year Peak: Analysis and Market Implications

The US housing market is experiencing a significant shift, with a recent report revealing a 12-year high in the surplus of homes available for sale. This surge in inventory has major implications for both sellers and buyers, potentially signaling a cooling-off period after years of intense competition. Understanding this trend is crucial for anyone navigating the current real estate landscape.

A Twelve-Year High: Understanding the Numbers

Data from [insert reputable source, e.g., National Association of Realtors] indicates a substantial increase in the number of homes available for sale, exceeding the previous peak seen in [insert year]. This surplus represents a dramatic change from the seller's market that dominated the past few years, characterized by low inventory and bidding wars. This increase is particularly noteworthy in [mention specific regions or states experiencing the most significant changes].

Factors Contributing to the Seller Surplus:

Several key factors contribute to this unprecedented rise in home listings:

-

Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes have significantly increased mortgage rates, making home purchases less affordable for many potential buyers. This reduced demand directly impacts the number of homes sold and consequently increases the supply.

-

Economic Uncertainty: Concerns about inflation, recession, and job security are causing many potential buyers to hesitate or postpone their purchasing decisions. This hesitancy further contributes to the growing surplus.

-

Increased New Construction: While not the sole factor, a modest increase in new home construction contributes to the overall inventory, adding to the available supply.

-

Shifting Market Sentiment: The perception of a cooling market is itself a factor. As sellers observe the market slowdown, some may become more willing to list their properties, adding to the surplus.

Implications for Home Sellers:

The shift to a seller surplus means a less favorable market for those looking to sell their homes. Expect:

- Increased Competition: Sellers will face greater competition from other listings, necessitating more competitive pricing strategies.

- Longer Selling Times: Homes may stay on the market for a longer period before finding a buyer.

- Negotiating Power Shift: Buyers now hold more negotiating power, potentially leading to lower sale prices.

Implications for Home Buyers:

For prospective homebuyers, this surplus represents a significant opportunity:

- Increased Choice: A wider selection of homes is available, allowing buyers more time to find the perfect property.

- Reduced Competition: The intense bidding wars of recent years are significantly less common.

- Greater Negotiating Power: Buyers have more leverage to negotiate lower prices and favorable terms.

Looking Ahead: Predictions and Future Trends

Experts predict that the seller surplus will likely persist for at least the next [insert timeframe, e.g., six months to a year]. However, the exact trajectory remains uncertain, dependent on factors such as future interest rate adjustments and overall economic conditions. It is vital to monitor market trends closely. [Link to a relevant market analysis report].

Conclusion:

The 12-year peak in the home seller surplus signals a significant turning point in the US housing market. While challenging for sellers, it offers substantial advantages for buyers. Navigating this shift requires careful planning, market awareness, and potentially seeking professional advice from real estate agents and financial advisors. Staying informed about market fluctuations will be key for making sound real estate decisions in the coming months.

Keywords: Home Seller Surplus, Housing Market, Real Estate Market, Interest Rates, Mortgage Rates, Home Prices, Housing Inventory, Buyer's Market, Seller's Market, Real Estate Trends, Economic Uncertainty, [Add location-specific keywords if applicable, e.g., California Housing Market, Texas Real Estate]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Home Seller Surplus Reaches 12-Year Peak: Analysis And Market Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

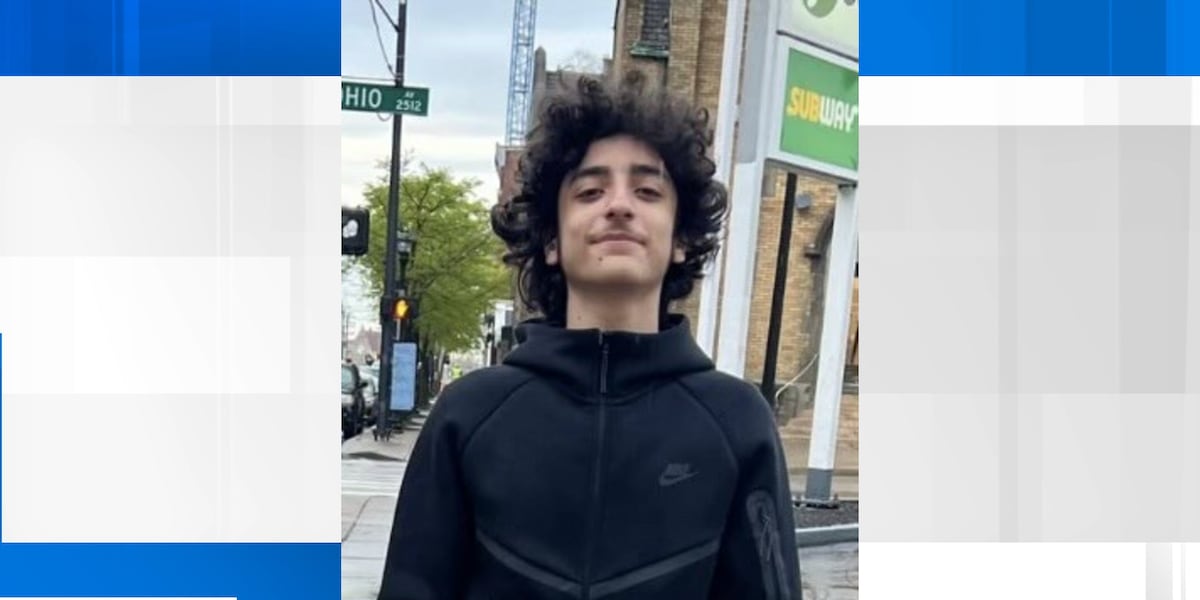

Lexington Police Continue Search For Missing And Endangered Teen

May 31, 2025

Lexington Police Continue Search For Missing And Endangered Teen

May 31, 2025 -

Adult Hecklers Target Transgender Athlete At Track Meets A Story Of Prejudice And Resilience

May 31, 2025

Adult Hecklers Target Transgender Athlete At Track Meets A Story Of Prejudice And Resilience

May 31, 2025 -

Reviving Extinct Blooms A Fragrance Companys Innovative Approach To Scent Reproduction

May 31, 2025

Reviving Extinct Blooms A Fragrance Companys Innovative Approach To Scent Reproduction

May 31, 2025 -

Day 7 Match Highlights Popcorn Time Movie Review

May 31, 2025

Day 7 Match Highlights Popcorn Time Movie Review

May 31, 2025 -

Ukraine Races To Build Drone Defense System Ahead Of Expected Russian Assault

May 31, 2025

Ukraine Races To Build Drone Defense System Ahead Of Expected Russian Assault

May 31, 2025

Latest Posts

-

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025 -

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025 -

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025 -

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025 -

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025