Homeowners And Capital Gains: The Potential Impact Of Trump's Tax Proposal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Homeowners and Capital Gains: Navigating the Potential Impact of Trump's Tax Proposals

The potential changes to capital gains taxes under various proposed tax plans, particularly those associated with the Trump administration, have left many homeowners wondering about the implications for their biggest investment: their home. Understanding how these proposals could affect your capital gains when selling your home is crucial for informed financial planning. This article will delve into the complexities, offering clarity and insights for navigating this potentially significant financial landscape.

What are Capital Gains Taxes?

Before we explore the specifics of Trump's proposed tax plans, let's define capital gains. Capital gains taxes are levied on the profit you make when you sell an asset for more than you paid for it. For homeowners, this asset is their primary residence. The tax rate depends on several factors, including your income bracket and how long you owned the property.

The Section 121 Exclusion: A Homeowner's Lifeline

The Internal Revenue Code Section 121 offers a significant exclusion from capital gains taxes for homeowners. This allows you to exclude up to $250,000 in profit ($500,000 for married couples filing jointly) from the sale of your primary residence. This exclusion applies if you've owned and lived in the home for at least two of the five years preceding the sale.

Trump's Tax Proposals and Their Potential Impact

While specific proposals have varied over time, many Trump-era tax plans focused on lowering overall tax rates. While this might seem beneficial at first glance, the actual impact on capital gains taxes for homeowners is nuanced:

- Lower Rates, Higher Overall Tax Burden?: While a lower overall tax rate could reduce the amount of capital gains tax you owe, the potential for increased taxable income from other sources could offset these savings. The impact would depend on your individual financial situation.

- Changes to the Section 121 Exclusion: Previous proposals haven't significantly altered the Section 121 exclusion itself. However, any changes to the standard deduction or other tax brackets could indirectly affect the overall tax benefit you receive from this exclusion.

Understanding the Nuances: Consult a Professional

The intricacies of capital gains taxation are complex. While lower overall tax rates might seem appealing, the actual effect on your specific situation depends on various factors like:

- Your Tax Bracket: Higher earners might see a more significant reduction in their capital gains tax liability compared to those in lower brackets.

- Holding Period: The length of time you've owned your home plays a crucial role in determining your tax liability.

- Other Income Sources: Your total income from other sources will impact your overall tax burden.

Planning for the Future: Key Considerations for Homeowners

- Long-Term Financial Planning: Incorporate potential capital gains taxes into your long-term financial plans.

- Seek Professional Advice: Consult a tax advisor or financial planner to understand how potential changes might affect your specific situation. They can help you model different scenarios and optimize your tax strategy.

- Stay Informed: Keep abreast of current and proposed tax legislation. Reliable sources like the IRS website and reputable financial news outlets can provide valuable information.

Conclusion:

Navigating the complexities of capital gains taxes, especially considering the potential impacts of past and future tax proposals, requires careful consideration. While the prospect of lower tax rates might be enticing, the actual effect on individual homeowners is highly dependent on their unique financial circumstances. Proactive planning and professional advice are key to ensuring you're making informed decisions regarding your most significant asset – your home.

Disclaimer: This article provides general information and should not be considered financial or legal advice. Consult with a qualified professional for advice tailored to your specific situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Homeowners And Capital Gains: The Potential Impact Of Trump's Tax Proposal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Jul 25, 2025

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Jul 25, 2025 -

Washington 2025 Tennis Extended Highlights Key Wins And Advances

Jul 25, 2025

Washington 2025 Tennis Extended Highlights Key Wins And Advances

Jul 25, 2025 -

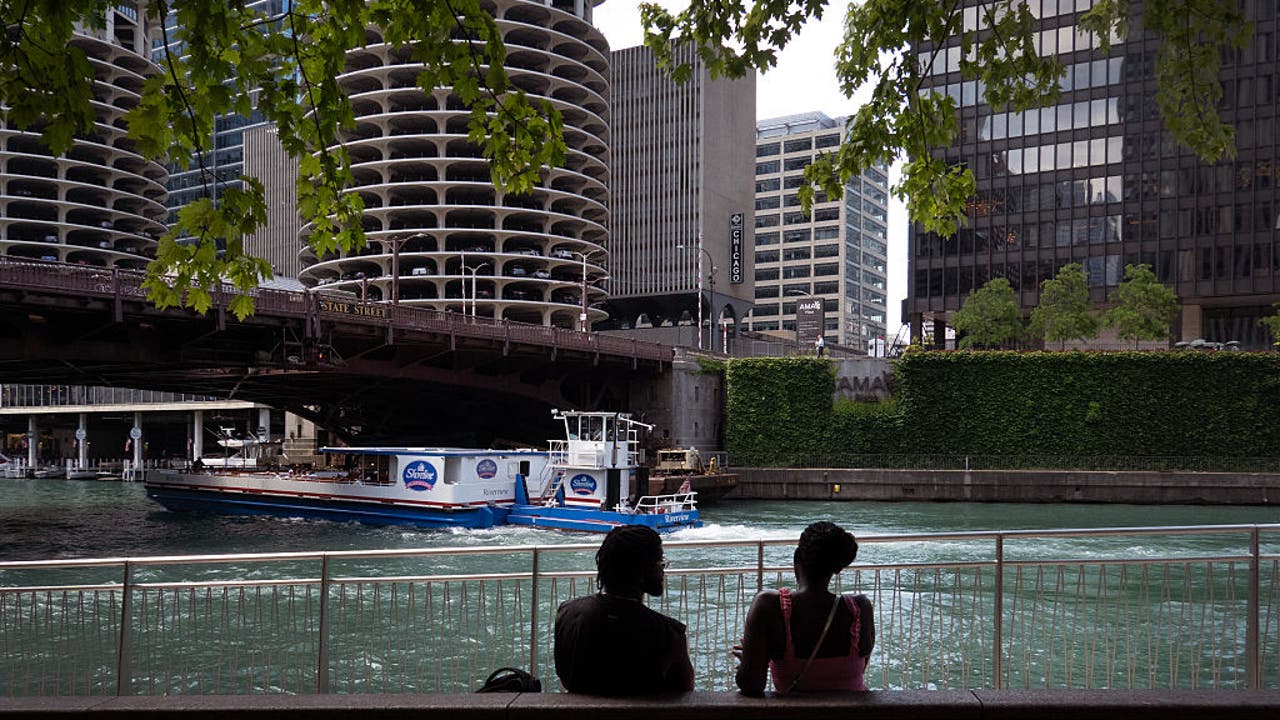

Dangerous Heat And Storms Expected In Chicago Heat Index Near 110

Jul 25, 2025

Dangerous Heat And Storms Expected In Chicago Heat Index Near 110

Jul 25, 2025 -

Wu And Norrie Score Upsets Shelton Advances At Washington 2025

Jul 25, 2025

Wu And Norrie Score Upsets Shelton Advances At Washington 2025

Jul 25, 2025 -

Denials From Essex Police Pro Migrant Protests And Asylum Hotel Transportation

Jul 25, 2025

Denials From Essex Police Pro Migrant Protests And Asylum Hotel Transportation

Jul 25, 2025

Latest Posts

-

Camden Yards Hosts Savannah Bananas Where And How To Watch

Jul 27, 2025

Camden Yards Hosts Savannah Bananas Where And How To Watch

Jul 27, 2025 -

Chaos At Rock Legends 82nd Birthday Police Presence Reported

Jul 27, 2025

Chaos At Rock Legends 82nd Birthday Police Presence Reported

Jul 27, 2025 -

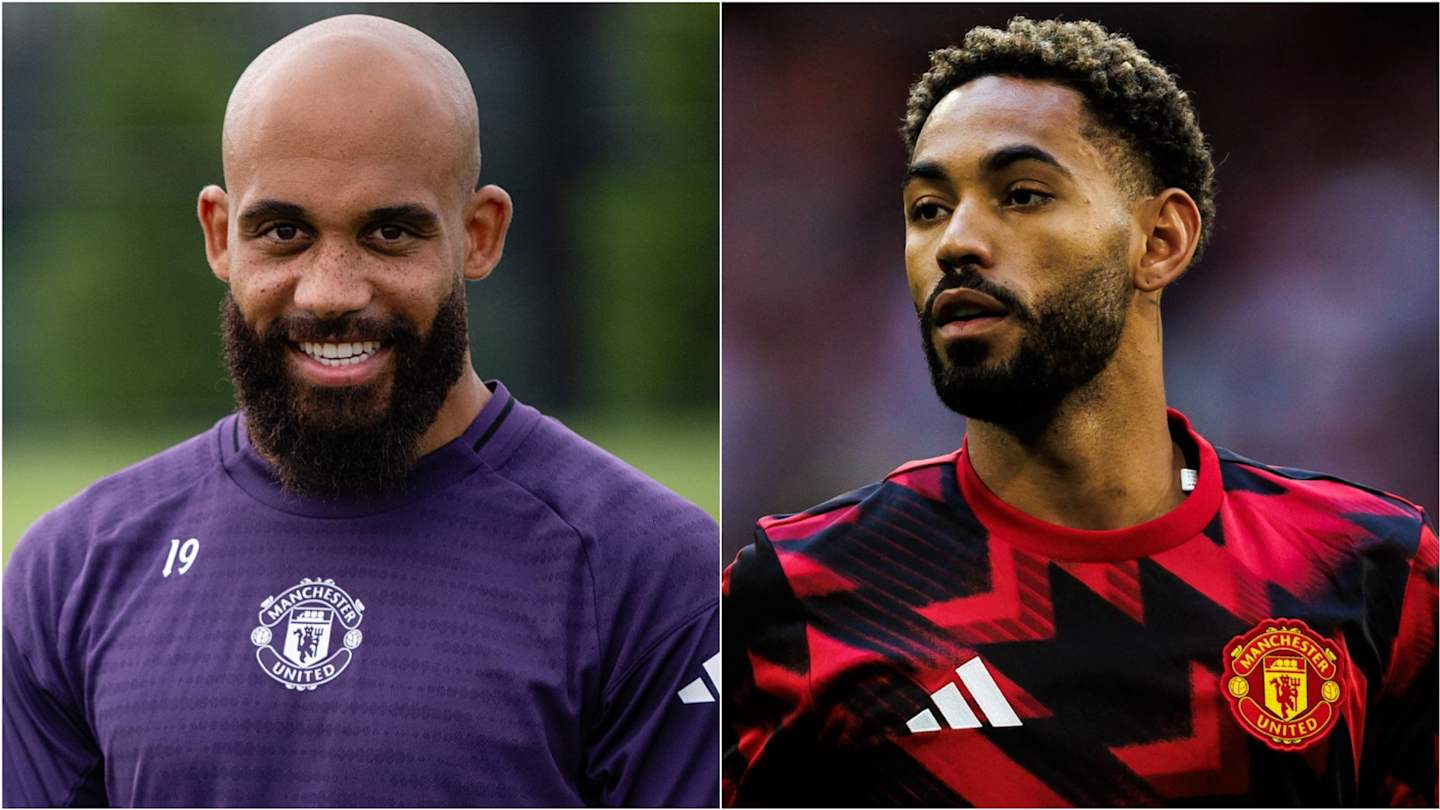

Mbeumo And Cunhas First Game Together Predicted Man Utd Lineup Vs West Ham

Jul 27, 2025

Mbeumo And Cunhas First Game Together Predicted Man Utd Lineup Vs West Ham

Jul 27, 2025 -

Los Angeles Sparks Vs New York Liberty Live Stream And Tv Guide

Jul 27, 2025

Los Angeles Sparks Vs New York Liberty Live Stream And Tv Guide

Jul 27, 2025 -

Update Kenny Mc Intosh Carted Off During Georgia Bulldogs Practice

Jul 27, 2025

Update Kenny Mc Intosh Carted Off During Georgia Bulldogs Practice

Jul 27, 2025