HOOD Stock Soars: Robinhood Markets Inc. Experiences 6.46% Surge On June 3rd

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HOOD Stock Soars: Robinhood Markets Inc. Experiences 6.46% Surge on June 3rd

Robinhood Markets Inc. (HOOD) experienced a significant jump in its stock price on June 3rd, closing with a remarkable 6.46% surge. This unexpected boost caught the attention of investors and market analysts alike, prompting questions about the driving forces behind this positive momentum. What fueled this rally, and what does it mean for the future of HOOD stock? Let's delve into the details.

Understanding the June 3rd Surge

The 6.46% increase in HOOD's stock price on June 3rd wasn't attributed to any single major announcement from the company itself. Instead, several contributing factors likely converged to create this positive market reaction. These factors include:

-

Improved Market Sentiment: The broader market showed signs of recovery on June 3rd, with several tech stocks experiencing gains. This overall positive sentiment likely spilled over into the trading of HOOD stock, boosting investor confidence.

-

Short Squeeze Potential: Robinhood has historically been a target for short-selling. A short squeeze, where short-sellers are forced to buy back shares to cover their positions, can lead to rapid price increases. While there's no definitive evidence of a full-blown short squeeze, increased buying pressure could have contributed to the surge.

-

Speculative Trading: HOOD stock remains a popular choice for retail investors, leading to periods of high volatility driven by speculative trading. This can create rapid price fluctuations, both upwards and downwards.

-

Lack of Negative News: The absence of significant negative news regarding the company's financials or operations also likely contributed to the positive investor sentiment. A period of relative quiet on the regulatory or legal front can offer a boost.

Analyzing the Long-Term Outlook for HOOD Stock

While the 6.46% increase is certainly noteworthy, it's crucial to avoid reading too much into a single day's trading activity. The long-term outlook for HOOD stock remains complex and depends on several factors:

-

Competition: Robinhood faces intense competition from established players in the brokerage industry, as well as newer entrants. Its ability to differentiate itself and attract and retain users will be critical for future growth.

-

Regulatory Landscape: The regulatory environment for online brokerages continues to evolve. Changes in regulations could significantly impact Robinhood's operations and profitability.

-

Financial Performance: Consistent and improving financial performance, including user growth and revenue generation, will be essential for sustained investor confidence. Investors will closely watch key metrics like revenue, net income, and user engagement.

Investing in HOOD: Considerations for Investors

Before investing in HOOD stock, potential investors should carefully consider their risk tolerance and conduct thorough due diligence. The stock's price volatility highlights the inherent risks associated with investing in this sector. Consult with a qualified financial advisor before making any investment decisions. Understanding the company's business model, competitive landscape, and financial performance is crucial.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Keywords: HOOD stock, Robinhood Markets Inc., stock surge, stock market, investing, brokerage, online trading, financial news, stock price, June 3rd, market analysis, investor sentiment, short squeeze, speculative trading, financial performance, regulatory landscape, competition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HOOD Stock Soars: Robinhood Markets Inc. Experiences 6.46% Surge On June 3rd. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Paige De Sorbos Summer House Departure After 7 Seasons She Moves On

Jun 06, 2025

Paige De Sorbos Summer House Departure After 7 Seasons She Moves On

Jun 06, 2025 -

From Success To Struggle Harry Enten On Mike Lindell And My Pillows Decline

Jun 06, 2025

From Success To Struggle Harry Enten On Mike Lindell And My Pillows Decline

Jun 06, 2025 -

Robinhood Stocks Continued Appeal A Deep Dive For Investors

Jun 06, 2025

Robinhood Stocks Continued Appeal A Deep Dive For Investors

Jun 06, 2025 -

Applied Digital 48 Stock Jump On 7 Billion Core Weave Ai Lease

Jun 06, 2025

Applied Digital 48 Stock Jump On 7 Billion Core Weave Ai Lease

Jun 06, 2025 -

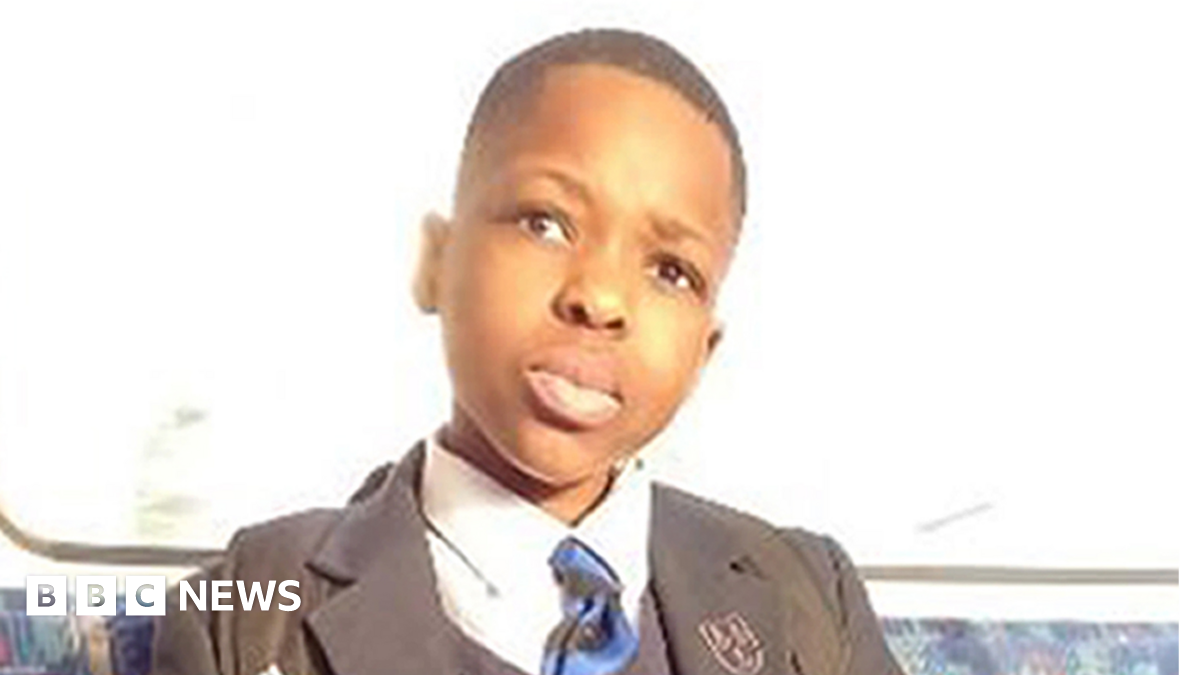

Daniel Anjorin Murder Case Prosecution Presents Evidence Of Marcus Monzos Intent

Jun 06, 2025

Daniel Anjorin Murder Case Prosecution Presents Evidence Of Marcus Monzos Intent

Jun 06, 2025

Latest Posts

-

Ibm From Legacy Tech To Modern Innovator

Jun 06, 2025

Ibm From Legacy Tech To Modern Innovator

Jun 06, 2025 -

Rebranding Big Blue Is Ibm Relevant In Todays Tech Landscape

Jun 06, 2025

Rebranding Big Blue Is Ibm Relevant In Todays Tech Landscape

Jun 06, 2025 -

Bidens Former Press Secretary Karine Jean Pierre Announces Independent Status

Jun 06, 2025

Bidens Former Press Secretary Karine Jean Pierre Announces Independent Status

Jun 06, 2025 -

Sussex Pregnancy Announcement Meghans Dancing Celebration

Jun 06, 2025

Sussex Pregnancy Announcement Meghans Dancing Celebration

Jun 06, 2025 -

Taylor Lewans Wild Pitch Cardinals Game Opening Fails Spectacularly

Jun 06, 2025

Taylor Lewans Wild Pitch Cardinals Game Opening Fails Spectacularly

Jun 06, 2025