HOOD Stock Surge: Robinhood Shares Up 6.46% — What Investors Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HOOD Stock Surge: Robinhood Shares Up 6.46% — What Investors Need to Know

Robinhood Markets, Inc. (HOOD) experienced a significant surge on [Date of surge], with its stock price jumping 6.46%. This unexpected boost has left many investors wondering about the underlying reasons and what the future holds for the popular trading app. This article delves into the potential catalysts behind this impressive gain and offers insights for investors considering HOOD stock.

What Drove the HOOD Stock Surge?

While pinpointing the exact cause of any single-day stock movement is challenging, several factors likely contributed to the 6.46% increase in HOOD shares. These include:

-

Improved Financial Performance (if applicable): Recent earnings reports or positive financial news, such as exceeding revenue expectations or announcing cost-cutting measures, could have significantly influenced investor sentiment. (Note: Replace this bullet point with specific details if available. If no specific news is available, remove this bullet point and adjust the following accordingly.)

-

Market Sentiment and Broader Market Trends: The overall performance of the technology sector and the broader market can have a ripple effect on individual stocks. A positive market trend could have boosted investor confidence in growth stocks like HOOD.

-

Increased Trading Volume: A sudden increase in trading volume for HOOD shares could signal renewed investor interest and fuel price increases. This could be driven by positive news, speculation, or a short squeeze.

-

Analyst Upgrades (if applicable): Positive ratings changes from financial analysts often impact investor perception and may have contributed to the price jump. (Note: Replace this bullet point with specific details if available. If no specific news is available, remove this bullet point.)

Analyzing the Long-Term Outlook for HOOD Stock

While a single-day surge is encouraging, investors should consider the long-term prospects of HOOD before making any investment decisions. Key factors to analyze include:

-

Competition: Robinhood faces fierce competition from established players like Fidelity and Charles Schwab, as well as newer entrants in the fintech space. Understanding the competitive landscape is crucial.

-

Regulatory Landscape: The regulatory environment for brokerage firms is constantly evolving. Changes in regulations could significantly impact Robinhood's operations and profitability.

-

Innovation and Growth Strategies: Robinhood's ability to innovate and expand its product offerings will be vital for its long-term success. Investors should assess the company's strategic direction.

-

Financial Stability: Analyzing Robinhood's financial health, including its revenue growth, profitability, and debt levels, is essential for understanding its long-term viability.

Should You Invest in HOOD Stock?

The decision to invest in HOOD stock depends entirely on your individual risk tolerance, investment goals, and a thorough understanding of the company's financials and the broader market conditions. It's crucial to conduct thorough research and potentially consult with a financial advisor before making any investment decisions. Remember, past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Keywords: HOOD stock, Robinhood stock, stock market, investment, trading app, fintech, stock price, stock surge, market analysis, investment strategy, financial news, stock market trends, Robinhood Markets, HOOD shares.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HOOD Stock Surge: Robinhood Shares Up 6.46% — What Investors Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Blake Livelys Lawsuit Against Justin Baldoni Dismissed

Jun 05, 2025

Blake Livelys Lawsuit Against Justin Baldoni Dismissed

Jun 05, 2025 -

Self Directed Gold Iras A Retirement Planning Guide

Jun 05, 2025

Self Directed Gold Iras A Retirement Planning Guide

Jun 05, 2025 -

Political Earthquake In Netherlands Coalition Collapse Following Far Right Departure

Jun 05, 2025

Political Earthquake In Netherlands Coalition Collapse Following Far Right Departure

Jun 05, 2025 -

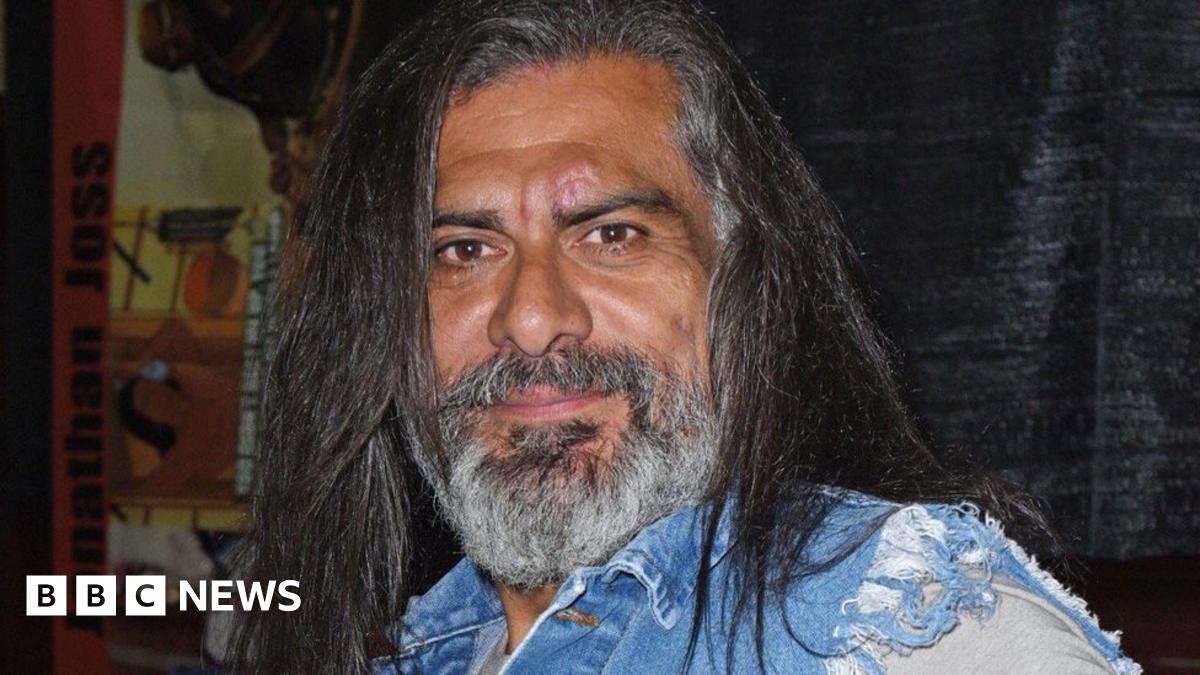

Confirmed Jonathan Joss John Redcorn In King Of The Hill Dies In Shooting

Jun 05, 2025

Confirmed Jonathan Joss John Redcorn In King Of The Hill Dies In Shooting

Jun 05, 2025 -

Thames Water Faces Delays After Preferred Bidders Withdrawal

Jun 05, 2025

Thames Water Faces Delays After Preferred Bidders Withdrawal

Jun 05, 2025

Latest Posts

-

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025