House GOP Releases Specifics On Trump-Backed Tax Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

House GOP Unveils Details of Trump-Backed Tax Reform Plan: A Boon for Businesses or a Windfall for the Wealthy?

The House GOP has released specifics on its long-awaited tax reform plan, a cornerstone of the Trump-era agenda that promises significant changes to the US tax code. The proposal, heavily influenced by former President Trump's economic policies, aims to simplify the tax system while boosting economic growth. However, critics argue it disproportionately benefits corporations and high-income earners. This article delves into the key details of the plan and analyzes its potential impact on different segments of the American population.

Key Provisions of the Proposed Tax Reform:

The released document outlines several key provisions, many mirroring the 2017 Tax Cuts and Jobs Act but with proposed adjustments and refinements. Specifics include:

-

Corporate Tax Rate: The plan proposes a significant reduction in the corporate tax rate, potentially bringing it down to a level competitive with other developed nations. While the exact figure remains under debate, it's expected to be lower than the current rate, aimed at stimulating business investment and job creation. This is a core element echoing Trump's focus on incentivizing American businesses.

-

Individual Tax Rates: The proposed changes to individual tax rates are less drastic than those for corporations. While specific bracket changes haven't been fully disclosed, the plan aims for a simplification of the tax brackets, potentially merging some existing tiers. This simplification is presented as a means of reducing the complexity of the tax code for individual filers.

-

Tax Credits and Deductions: The proposal is likely to include revisions to various tax credits and deductions. Details on which credits will be modified or eliminated remain scarce at this stage, leading to uncertainty and sparking debate among taxpayers and tax professionals. The potential elimination or reduction of certain deductions could disproportionately impact specific demographic groups.

-

Pass-Through Businesses: The plan likely addresses the taxation of pass-through businesses, such as partnerships and S corporations, a crucial aspect for many small and medium-sized enterprises (SMEs). The specifics regarding adjustments to their tax treatment are crucial for assessing the plan's impact on small business owners.

Potential Impacts and Criticisms:

The proposed tax reform has already sparked heated debate. Supporters argue it will stimulate economic growth by encouraging investment and job creation. They point to the potential for increased business activity as a result of lower corporate tax rates. Furthermore, the simplification of the tax code is touted as a major benefit for both businesses and individuals.

However, critics raise concerns about its distributional effects. Concerns center around the potential for the plan to primarily benefit wealthy individuals and large corporations at the expense of middle- and lower-income households. The lack of transparency regarding specific changes to tax credits and deductions fuels these concerns. The potential widening of the wealth gap is a major point of contention.

What Happens Next?

The release of these specifics marks a significant step in the legislative process. The proposal will now face intense scrutiny from various stakeholders, including economists, tax experts, and the general public. The plan will likely undergo revisions and amendments before being considered for a vote in the House. The ultimate fate of the proposal remains uncertain, hinging on the ongoing political climate and the ability of the House GOP to garner sufficient support.

Further Reading:

For more in-depth analysis on tax reform and its potential implications, we recommend exploring resources from the and the .

Call to Action: Stay informed on the latest developments in this crucial legislative process by following reputable news sources and engaging in informed discussions about the proposed tax reform and its potential effects on you and your community.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on House GOP Releases Specifics On Trump-Backed Tax Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk Civil Service Job Exodus Thousands To Leave London

May 15, 2025

Uk Civil Service Job Exodus Thousands To Leave London

May 15, 2025 -

The Business Ventures Of P K Subban From Hockey To Entrepreneur

May 15, 2025

The Business Ventures Of P K Subban From Hockey To Entrepreneur

May 15, 2025 -

Finding Hope After Decades Behind Bars A Story Of Resilience And The Rise Of Innovative Weight Loss Treatments

May 15, 2025

Finding Hope After Decades Behind Bars A Story Of Resilience And The Rise Of Innovative Weight Loss Treatments

May 15, 2025 -

Athletics Rout Dodgers 11 1 Complete Game Recap From May 13 2025

May 15, 2025

Athletics Rout Dodgers 11 1 Complete Game Recap From May 13 2025

May 15, 2025 -

Proposed Week Long Everest Ascent With Anesthetic Gas Sparks Outrage

May 15, 2025

Proposed Week Long Everest Ascent With Anesthetic Gas Sparks Outrage

May 15, 2025

Latest Posts

-

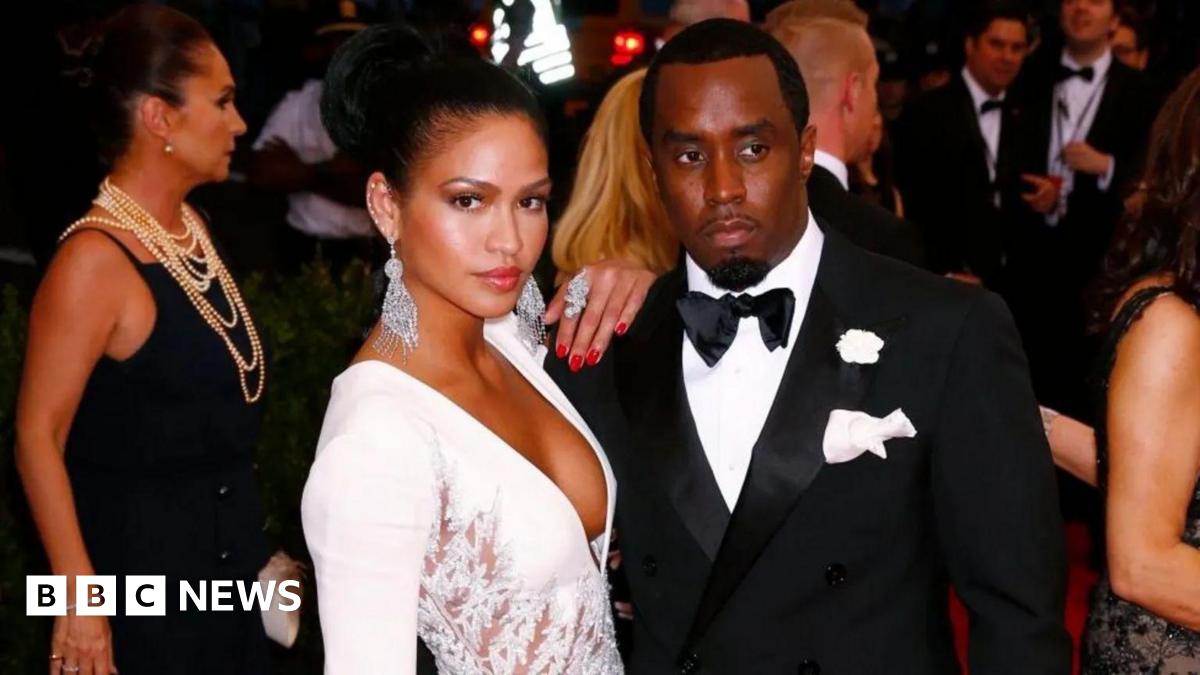

Sean Diddy Combs Trial The Importance Of Ex Girlfriend Cassies Evidence

May 18, 2025

Sean Diddy Combs Trial The Importance Of Ex Girlfriend Cassies Evidence

May 18, 2025 -

Stres Seviyesi Yuekseliyor Istanbul Bueyueksehir Belediyesi Nden Kritik Degerlendirme

May 18, 2025

Stres Seviyesi Yuekseliyor Istanbul Bueyueksehir Belediyesi Nden Kritik Degerlendirme

May 18, 2025 -

Aydos Dagi Nda Rekor Yagis Istanbul Da Yasami Etkileyen Saganak

May 18, 2025

Aydos Dagi Nda Rekor Yagis Istanbul Da Yasami Etkileyen Saganak

May 18, 2025 -

Names Released Firefighters Perish In Large Business Park Fire

May 18, 2025

Names Released Firefighters Perish In Large Business Park Fire

May 18, 2025 -

13th Straight Win For Twins Three Consecutive Shutouts Power Dominance

May 18, 2025

13th Straight Win For Twins Three Consecutive Shutouts Power Dominance

May 18, 2025