How State Farm's Emergency Rate Increase Impacts California Policyholders

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm's Emergency Rate Hike: What it Means for California Policyholders

State Farm's recent emergency rate increase for California homeowners has sent shockwaves through the state, leaving many policyholders scrambling to understand the impact on their premiums. This significant hike, approved by the California Department of Insurance (CDI), raises crucial questions about affordability and the future of homeowners insurance in the Golden State. This article breaks down the key details and explores the implications for California residents.

The Scope of the Increase:

State Farm, one of California's largest homeowners insurers, cited escalating wildfire risks and rising reinsurance costs as the primary reasons for the emergency rate increase. The exact percentage varies depending on location and specific policy details, but reports suggest increases ranging from 10% to over 60% for some policyholders. This drastic increase is impacting thousands of Californians and has ignited a heated debate about insurance affordability and the state's wildfire mitigation strategies.

Why the Emergency Rate Increase?

The CDI's approval highlights the severity of the situation. State Farm, facing immense financial pressure due to escalating claims related to wildfires, argued that the rate increase was necessary to maintain its solvency and continue offering coverage in California. The insurer emphasized the increasing frequency and intensity of wildfires, leading to exponentially higher payouts. This is further exacerbated by the rising costs of reinsurance, which protects insurance companies from catastrophic losses.

What Can Policyholders Do?

Facing such significant increases, many Californians are looking for options:

- Shop Around: Comparing quotes from different insurers is crucial. While rates are rising across the board, some companies may offer more competitive options. Utilize online comparison tools and contact multiple insurers directly.

- Review Your Coverage: Assess your current coverage levels. Reducing unnecessary coverage or raising your deductible can potentially lower your premiums. However, carefully weigh the potential savings against the increased out-of-pocket costs in case of a claim.

- Improve Your Home's Fire Safety: Implementing wildfire mitigation measures can significantly reduce your risk profile and potentially qualify you for discounts. This might include clearing brush around your home, installing fire-resistant roofing, and creating defensible space. Check with your insurer for specific requirements and potential discounts.

- Contact Your Insurance Agent: Discuss your options with your agent. They can provide personalized advice and help you navigate the complexities of your policy. Understanding your policy's specifics is key to finding the best solution for your individual needs.

- Advocate for Change: Engage with your local representatives and advocate for policies that address wildfire risk and improve insurance affordability. Support initiatives promoting wildfire prevention and mitigation efforts.

The Broader Implications:

State Farm's emergency rate increase is not an isolated incident. Many other insurers in California are facing similar challenges. This highlights a broader crisis in the state's homeowners insurance market, raising serious concerns about accessibility and affordability for many Californians. The situation underscores the urgent need for comprehensive strategies addressing wildfire risk mitigation and insurance market stability.

Looking Ahead:

The future of homeowners insurance in California remains uncertain. The State Farm increase sets a precedent, likely prompting other insurers to seek similar adjustments. This situation demands a multi-faceted approach, involving collaboration between insurers, policymakers, and homeowners to address the underlying issues contributing to this escalating crisis. Staying informed and proactively managing your insurance coverage is more critical than ever.

Keywords: State Farm, California, Homeowners Insurance, Rate Increase, Wildfires, Insurance Premiums, CDI, Reinsurance, Wildfire Mitigation, Insurance Affordability, Home Insurance Costs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How State Farm's Emergency Rate Increase Impacts California Policyholders. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Passengers Flight Nightmare British Airways Fails To Recognize Booking

May 18, 2025

Passengers Flight Nightmare British Airways Fails To Recognize Booking

May 18, 2025 -

Sfpd Officer Arrested Dui Crash Results In Multiple Injuries And Charges

May 18, 2025

Sfpd Officer Arrested Dui Crash Results In Multiple Injuries And Charges

May 18, 2025 -

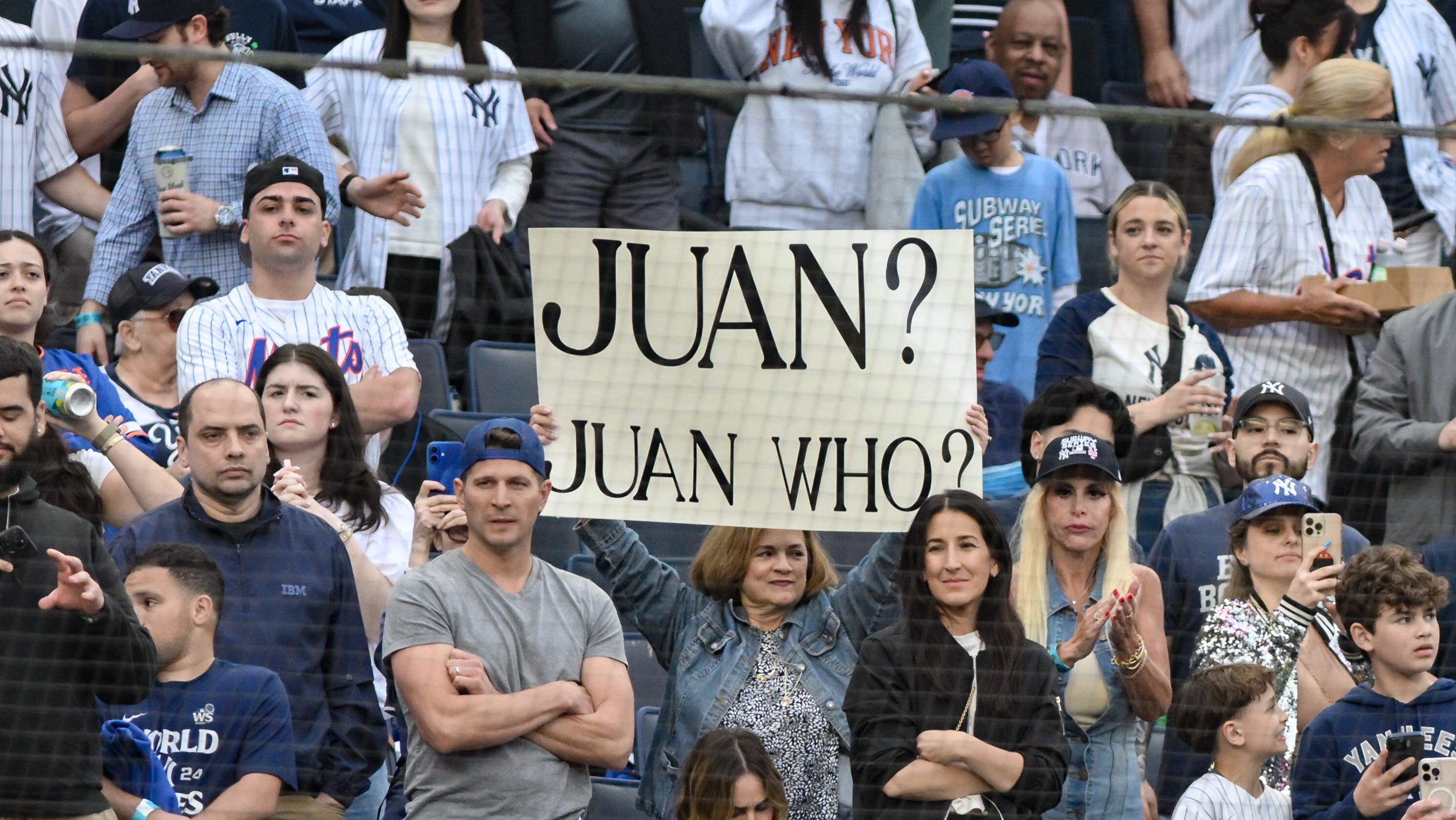

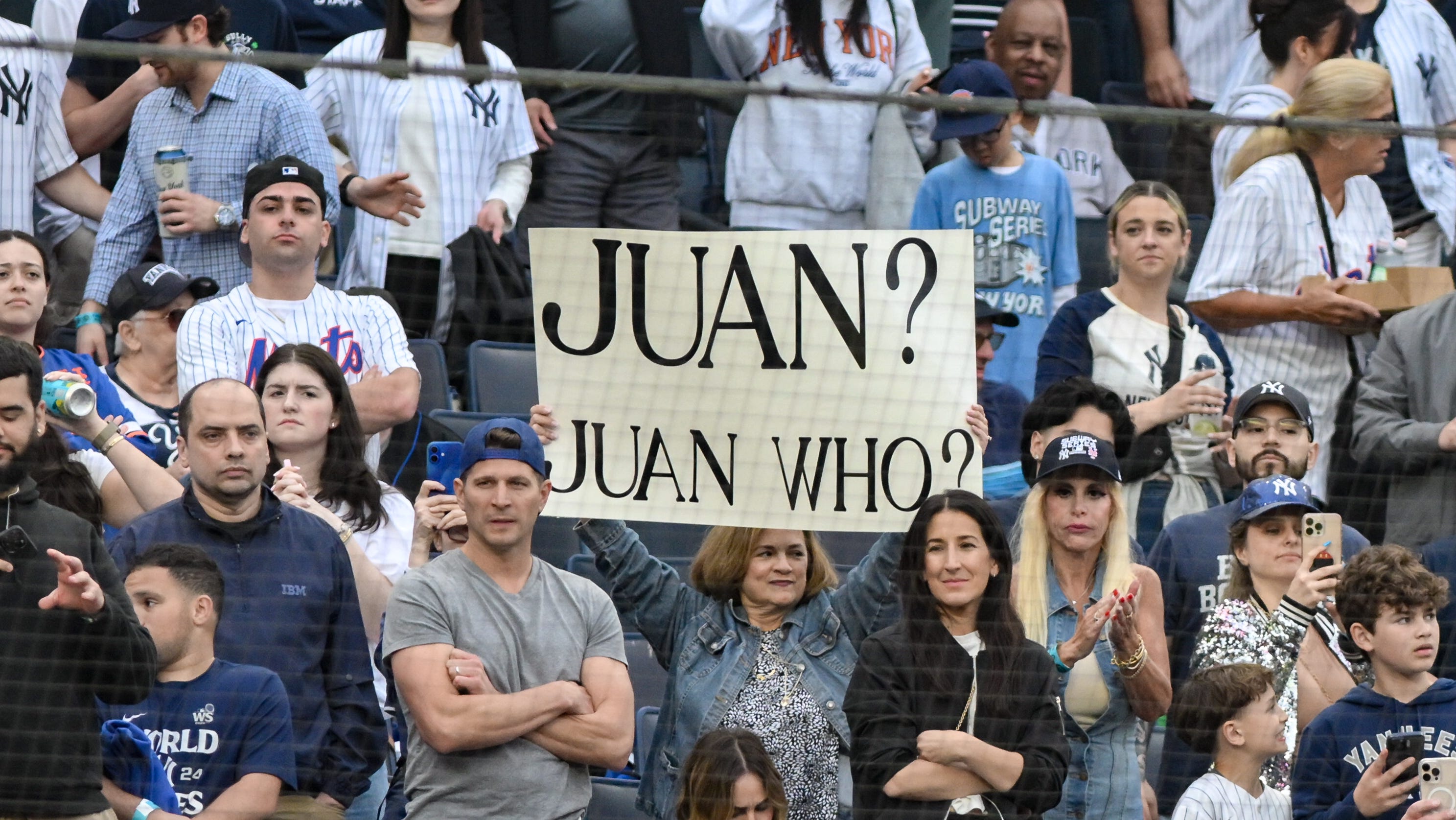

2025 Subway Series A Photographic Review Of Yankees Vs Mets

May 18, 2025

2025 Subway Series A Photographic Review Of Yankees Vs Mets

May 18, 2025 -

Mlb Seasons Second Quarter 7 Startling Statistics Revealed

May 18, 2025

Mlb Seasons Second Quarter 7 Startling Statistics Revealed

May 18, 2025 -

Tense Situation Alex Fines Public Accusation Against Diddy Sparks Controversy

May 18, 2025

Tense Situation Alex Fines Public Accusation Against Diddy Sparks Controversy

May 18, 2025

Latest Posts

-

Mets Vs Yankees Unforgettable Villains Of The Subway Series

May 18, 2025

Mets Vs Yankees Unforgettable Villains Of The Subway Series

May 18, 2025 -

Best Shots Yankees And Mets Battle In The 2025 Subway Series

May 18, 2025

Best Shots Yankees And Mets Battle In The 2025 Subway Series

May 18, 2025 -

Diddy Faces Accusations From Cassie Venturas Husband Alex Fine

May 18, 2025

Diddy Faces Accusations From Cassie Venturas Husband Alex Fine

May 18, 2025 -

Tom Cruise And Ana De Armas New Movie Collaboration Sparks Relationship Speculation

May 18, 2025

Tom Cruise And Ana De Armas New Movie Collaboration Sparks Relationship Speculation

May 18, 2025 -

From Ballpark Evictions To Goliath Battles Ranking The Top 10 Hottest Moments In Ny Baseball History

May 18, 2025

From Ballpark Evictions To Goliath Battles Ranking The Top 10 Hottest Moments In Ny Baseball History

May 18, 2025