How State Farm's Emergency Rate Increase Impacts California Residents

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm's Emergency Rate Hike: A Shock to California Homeowners

State Farm's recent announcement of an emergency rate increase for homeowners insurance in California has sent shockwaves through the state. The move, citing escalating claims costs and a challenging insurance market, leaves many Californians facing significantly higher premiums and increased anxieties about homeownership. This article delves into the specifics of the increase, its potential impact, and what options California residents have in response.

Understanding the Rate Increase:

State Farm's emergency rate increase isn't a small adjustment. Depending on the specific policy and location, increases range from a substantial percentage to over double the current premiums for some homeowners. The insurer cites a confluence of factors driving this drastic change, including:

- Rising construction costs: The soaring price of building materials makes repairing or rebuilding homes after damage significantly more expensive.

- Increased wildfire risk: California's wildfire season has become increasingly intense and destructive, leading to a surge in claims. This is particularly impacting homeowners in high-risk areas.

- Inflation and supply chain issues: These broader economic factors contribute to higher costs for repairs and materials, impacting insurance payouts.

- Catastrophic losses: The sheer scale of losses from recent major events has strained insurance providers' resources.

The Impact on California Residents:

This sudden, substantial rate increase creates several challenges for California homeowners:

- Increased financial burden: Many homeowners will struggle to afford the higher premiums, potentially leading to policy cancellations or underinsurance.

- Difficulty finding alternative coverage: The California insurance market is already competitive, and finding affordable alternatives might prove difficult, especially for those in high-risk areas.

- Reduced home equity: Higher insurance costs can significantly reduce a homeowner's net worth and potentially impact their ability to refinance or sell their property.

- Increased vulnerability: Underinsurance leaves homeowners more financially vulnerable in the event of a disaster.

What Can California Homeowners Do?

Facing this challenging situation, California homeowners have several options to explore:

- Shop around: Compare quotes from multiple insurers to find the most competitive rates. Websites like [link to a reputable insurance comparison site] can assist in this process.

- Review your coverage: Ensure you have adequate coverage for your home and belongings. Consider raising your deductible to lower your premium, but carefully weigh the financial implications.

- Implement home safety measures: Taking steps to mitigate risks, such as installing fire-resistant roofing or clearing brush around your property, can potentially lower your premiums. Consult with your insurer about available discounts for risk mitigation.

- Explore government assistance programs: Some programs may be available to help homeowners afford insurance. Contact your local government agencies to inquire about potential assistance.

- Contact your state representatives: Voice your concerns to elected officials to advocate for insurance market reforms and consumer protection.

Looking Ahead:

State Farm's emergency rate increase highlights the ongoing challenges facing California's homeowners insurance market. The situation underscores the need for comprehensive solutions, including addressing the root causes of rising claims costs and improving the availability of affordable insurance options for all Californians. The coming months will likely see continued debate and potential policy changes as the state grapples with this critical issue. Staying informed and proactive is crucial for all California homeowners.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How State Farm's Emergency Rate Increase Impacts California Residents. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thousands Of Cracks Reported Condo Owners Sue Over Nyc Building Defects

May 18, 2025

Thousands Of Cracks Reported Condo Owners Sue Over Nyc Building Defects

May 18, 2025 -

Nyc Condo Residents Take Legal Action Against Building With Thousands Of Cracks

May 18, 2025

Nyc Condo Residents Take Legal Action Against Building With Thousands Of Cracks

May 18, 2025 -

Shocking Uk Savings Statistics One In Ten Have No Emergency Fund

May 18, 2025

Shocking Uk Savings Statistics One In Ten Have No Emergency Fund

May 18, 2025 -

Wsj Report Air Traffic Controller Exposes Newark Airports Critical Problems

May 18, 2025

Wsj Report Air Traffic Controller Exposes Newark Airports Critical Problems

May 18, 2025 -

Aoc Calls Out Trumps Border Czar The Full Story And Response

May 18, 2025

Aoc Calls Out Trumps Border Czar The Full Story And Response

May 18, 2025

Latest Posts

-

Australian Man Sentenced To 13 Years In Russian Prison For Fighting In Ukraine

May 18, 2025

Australian Man Sentenced To 13 Years In Russian Prison For Fighting In Ukraine

May 18, 2025 -

12 In A Row Twins Winning Streak Powered By Joe Ryans Pitching

May 18, 2025

12 In A Row Twins Winning Streak Powered By Joe Ryans Pitching

May 18, 2025 -

Nine Killed In Russian Missile Strike On Civilian Bus In Eastern Ukraine

May 18, 2025

Nine Killed In Russian Missile Strike On Civilian Bus In Eastern Ukraine

May 18, 2025 -

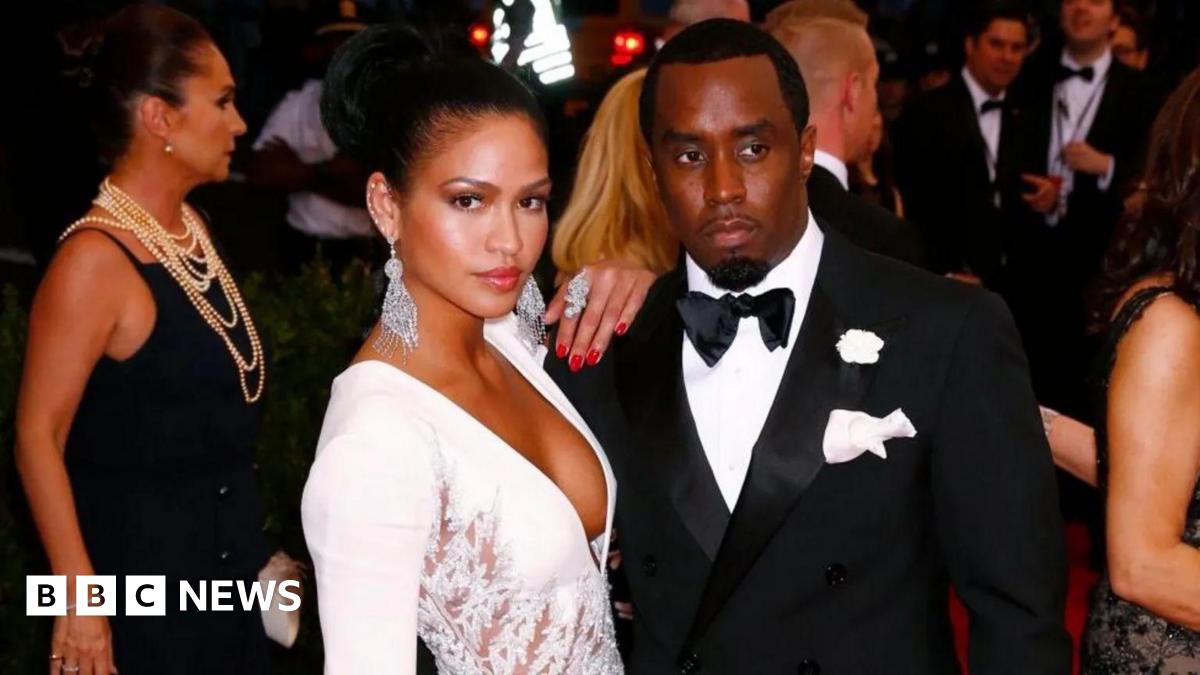

Will Cassies Testimony Sink Or Save Sean Diddy Combs

May 18, 2025

Will Cassies Testimony Sink Or Save Sean Diddy Combs

May 18, 2025 -

Aubrey O Day Skips Sean Combs Trial No Subpoena No Testimony

May 18, 2025

Aubrey O Day Skips Sean Combs Trial No Subpoena No Testimony

May 18, 2025