How The Proposed Republican Retirement Plan Affects Americans In Their 30s

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How the Proposed Republican Retirement Plan Affects Americans in Their 30s

The Republican party has recently unveiled its proposed retirement plan, sparking considerable debate about its impact on Americans across different age groups. While the specifics may evolve, understanding its potential effects on those in their 30s is crucial. This demographic, often juggling mortgages, student loans, and starting families, faces unique challenges regarding retirement savings. Let's examine how this proposed plan might affect this critical segment of the population.

Key Proposals and Their Impact on 30-Somethings

The core tenets of the Republican retirement plan often include proposals like expanding tax-advantaged retirement accounts (like 401(k)s and IRAs), potentially increasing contribution limits, and possibly modifying or eliminating certain taxes on retirement income. For those in their 30s, these changes could translate into several significant impacts:

-

Increased Savings Potential: Higher contribution limits to 401(k)s and IRAs could allow 30-somethings to save more aggressively, potentially closing the retirement savings gap many feel they're facing. This is especially beneficial for those who haven't yet maximized their current contribution limits.

-

Tax Advantages: Lower taxes on retirement income, if implemented, could mean a larger nest egg upon retirement. This is crucial for this age group, as they have a longer time horizon until retirement and the benefits of compound interest could significantly increase their savings.

-

Addressing the "Retirement Savings Gap": Many in their 30s are grappling with significant debt and competing financial priorities. The Republican plan aims to address this by making retirement savings more accessible and appealing through tax incentives. This could potentially help close the retirement savings gap many in this demographic are experiencing.

However, Challenges Remain

While the proposed plan offers potential advantages, several aspects could pose challenges for individuals in their 30s:

-

Current Debt Burden: The effectiveness of increased contribution limits depends on individuals' ability to contribute more. High student loan debt and mortgage payments might severely limit the amount 30-somethings can put towards retirement, negating some of the plan's benefits.

-

Economic Volatility: The long-term success of any retirement plan hinges on economic stability. Market fluctuations could significantly impact the growth of retirement savings, irrespective of tax incentives.

-

Lack of Employer-Sponsored Plans: Not all 30-somethings have access to employer-sponsored retirement plans, limiting their ability to take advantage of the proposed increases in contribution limits. This highlights the need for broader retirement security solutions.

Comparing to Existing Plans & Future Considerations

It’s vital to compare the Republican plan to existing retirement plans and policies to accurately assess its potential impact. For example, a thorough analysis would compare its proposed changes to the Secure Act 2.0 and other existing legislative efforts aimed at bolstering retirement savings. Furthermore, future economic conditions and unforeseen policy changes could significantly alter the effectiveness of the Republican plan's provisions.

Conclusion: A Mixed Bag for Millennials & Gen Z

The proposed Republican retirement plan presents a mixed bag for Americans in their 30s. While the potential for increased savings and tax benefits is significant, the realities of existing debt burdens and economic uncertainties cannot be ignored. Ultimately, the impact will depend on individual circumstances and the final details of the enacted legislation. It's crucial to stay informed about legislative developments and seek personalized financial advice to make informed decisions about retirement planning. Consider consulting a financial advisor to discuss your specific situation and how this proposed plan could affect your long-term financial goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How The Proposed Republican Retirement Plan Affects Americans In Their 30s. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

April Jobs Report Hiring Increase Points To Resilient Us Economy

Jun 05, 2025

April Jobs Report Hiring Increase Points To Resilient Us Economy

Jun 05, 2025 -

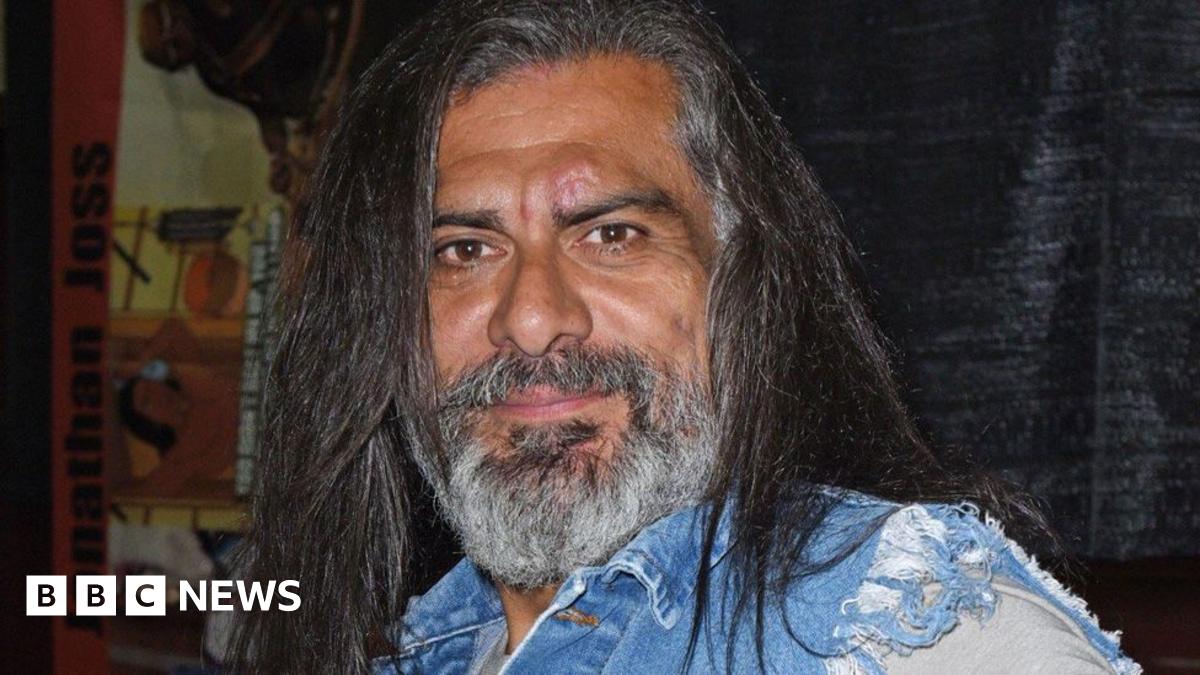

Tragic News Jonathan Joss King Of The Hills John Redcorn Dies In Shooting

Jun 05, 2025

Tragic News Jonathan Joss King Of The Hills John Redcorn Dies In Shooting

Jun 05, 2025 -

Paige De Sorbos Summer House Journey Ends Confirmation And Fan Reaction

Jun 05, 2025

Paige De Sorbos Summer House Journey Ends Confirmation And Fan Reaction

Jun 05, 2025 -

Bbc Stands Firm Countering White House Claims On Gaza Reporting

Jun 05, 2025

Bbc Stands Firm Countering White House Claims On Gaza Reporting

Jun 05, 2025 -

Halle Berrys Anti Aging Skincare The Neck Cream Taking Center Stage

Jun 05, 2025

Halle Berrys Anti Aging Skincare The Neck Cream Taking Center Stage

Jun 05, 2025

Latest Posts

-

Bidens 1992 Warning On Dc Crime Dont Stop At A Stoplight

Aug 17, 2025

Bidens 1992 Warning On Dc Crime Dont Stop At A Stoplight

Aug 17, 2025 -

Battlefield 6 Multiplayer Beta A Comprehensive Review Work In Progress

Aug 17, 2025

Battlefield 6 Multiplayer Beta A Comprehensive Review Work In Progress

Aug 17, 2025 -

Democrats Divided Response To Crime Comparing Bidens 1992 Warning To Trumps Policies

Aug 17, 2025

Democrats Divided Response To Crime Comparing Bidens 1992 Warning To Trumps Policies

Aug 17, 2025 -

Near Disaster Averted The Untold Story Of A New York City Skyscraper

Aug 17, 2025

Near Disaster Averted The Untold Story Of A New York City Skyscraper

Aug 17, 2025 -

S T A L K E R 2 Heart Of Chornobyl 2025 Ps 5 Release And Key Gameplay Improvements

Aug 17, 2025

S T A L K E R 2 Heart Of Chornobyl 2025 Ps 5 Release And Key Gameplay Improvements

Aug 17, 2025