How The Republican Retirement Plan Impacts 30-Year-Olds' Savings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How the Republican Retirement Plan Impacts 30-Year-Olds' Savings: A Closer Look

For 30-year-olds, the future of retirement savings is a significant concern. Recent proposals from the Republican party regarding retirement plans have sparked debate, leaving many wondering how these changes will affect their financial security. This article delves into the potential impact of Republican retirement plan proposals on the savings of this crucial demographic.

Understanding the Current Retirement Landscape for 30-Year-Olds

Thirty-year-olds today face a unique set of challenges when it comes to retirement planning. Student loan debt, rising housing costs, and the increasing cost of living often leave little room for substantial retirement contributions. Many rely on employer-sponsored 401(k) plans and individual retirement accounts (IRAs) to build their nest egg. However, the adequacy of these plans for future needs is a constant worry.

Key Republican Retirement Plan Proposals and Their Potential Effects

While specific Republican proposals vary, several common themes emerge that could significantly impact 30-year-olds:

-

Changes to Tax Benefits: Some proposals suggest altering the tax advantages associated with retirement savings vehicles like 401(k)s and IRAs. Reductions in tax deductions or credits could directly impact the amount of money a 30-year-old can save, effectively decreasing their retirement fund. This could disproportionately affect those in lower and middle-income brackets, who rely heavily on these tax benefits.

-

Increased Access to Retirement Savings: Conversely, some Republican plans aim to expand access to retirement accounts through initiatives like increasing participation in employer-sponsored plans or simplifying the process of setting up individual accounts. This could be beneficial for 30-year-olds who currently lack access to such plans.

-

Focus on Private Retirement Accounts: A shift towards greater emphasis on private retirement accounts might mean less reliance on government-sponsored programs. While this could offer more control over investments, it also places a heavier responsibility on individuals to plan effectively and wisely. For a 30-year-old, this means understanding investment options and actively managing their portfolio.

-

Impact on Social Security: Proposed changes to Social Security could also indirectly affect 30-year-olds' retirement savings. Reduced benefits or changes to eligibility could necessitate larger personal savings to maintain a desired retirement lifestyle. Understanding the long-term implications of these potential changes is crucial.

Strategies for 30-Year-Olds to Navigate Uncertainty

Despite the uncertainty surrounding Republican retirement plan proposals, 30-year-olds can proactively take steps to secure their financial future:

-

Maximize Employer Matching: Take full advantage of any employer matching contributions to 401(k) plans. This is essentially free money, significantly boosting retirement savings.

-

Diversify Investments: Spread investments across different asset classes to mitigate risk. Consider consulting a financial advisor to create a personalized investment strategy.

-

Start Saving Early and Often: Even small, consistent contributions over time can make a significant difference in retirement savings thanks to the power of compound interest.

-

Stay Informed: Keep abreast of changes in retirement legislation and adjust savings strategies accordingly. Reliable financial news sources and consultations with financial professionals are invaluable.

-

Consider a Roth IRA: A Roth IRA offers tax-free withdrawals in retirement, which can be particularly advantageous in the long run.

Conclusion: Proactive Planning is Key

The impact of Republican retirement plan proposals on 30-year-olds' savings remains to be seen. However, proactive planning and a commitment to saving are crucial regardless of legislative changes. By understanding the potential implications and taking appropriate steps, 30-year-olds can increase their chances of achieving a comfortable and secure retirement. Seeking professional financial advice tailored to individual circumstances is highly recommended.

Keywords: Republican retirement plan, retirement savings, 30-year-olds, 401k, IRA, Roth IRA, retirement planning, financial planning, Social Security, investment strategy, financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How The Republican Retirement Plan Impacts 30-Year-Olds' Savings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Hailee Steinfeld Secretly Married To Josh Allen Rumor Debunked

Jun 04, 2025

Is Hailee Steinfeld Secretly Married To Josh Allen Rumor Debunked

Jun 04, 2025 -

Nyt Spelling Bee Puzzle Hints And Solutions For Tuesday June 3rd

Jun 04, 2025

Nyt Spelling Bee Puzzle Hints And Solutions For Tuesday June 3rd

Jun 04, 2025 -

Sean Diddy Combs Faces Court Recent News And Analysis Of The Trial

Jun 04, 2025

Sean Diddy Combs Faces Court Recent News And Analysis Of The Trial

Jun 04, 2025 -

Us Job Market Defies Expectations Aprils Hiring Data Analyzed

Jun 04, 2025

Us Job Market Defies Expectations Aprils Hiring Data Analyzed

Jun 04, 2025 -

Jack Draper Vs Top Seeds Bridging The Gap Before The 2025 French Open

Jun 04, 2025

Jack Draper Vs Top Seeds Bridging The Gap Before The 2025 French Open

Jun 04, 2025

Latest Posts

-

No More Summer House For Paige De Sorbo Confirmation And Fan Reactions

Jun 06, 2025

No More Summer House For Paige De Sorbo Confirmation And Fan Reactions

Jun 06, 2025 -

Sean Diddy Combs Trial Forensic Video Expert Takes Stand

Jun 06, 2025

Sean Diddy Combs Trial Forensic Video Expert Takes Stand

Jun 06, 2025 -

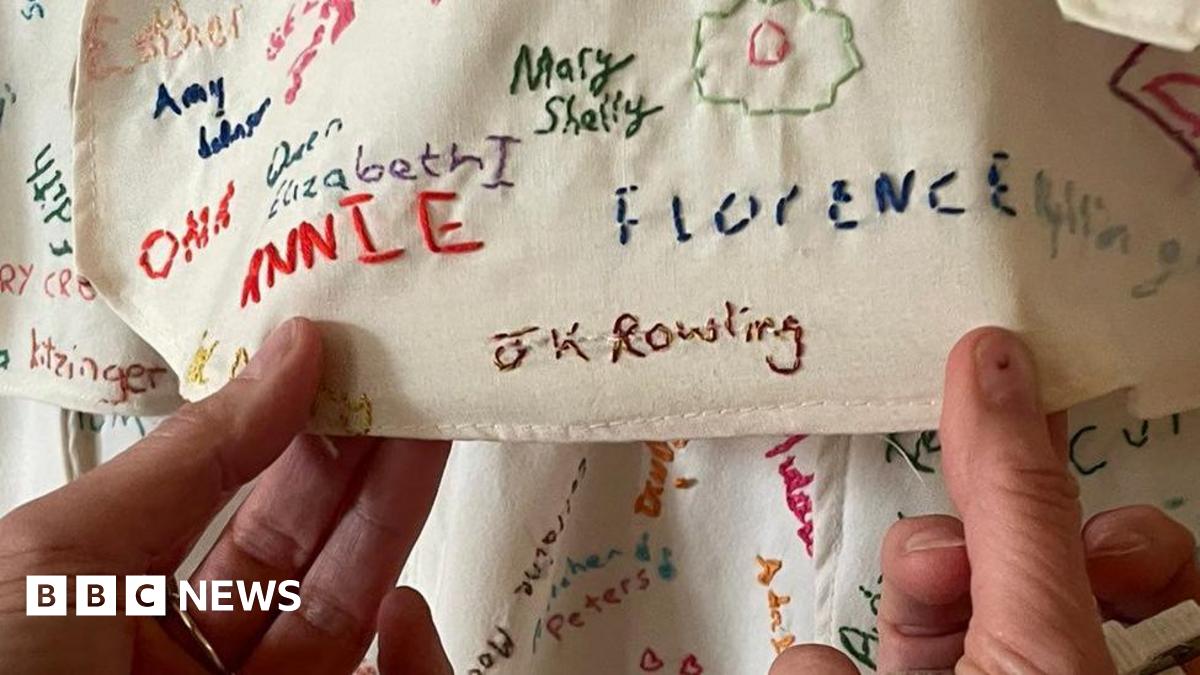

Damaged J K Rowling Artwork At Derbyshire National Trust Site A Cover Up

Jun 06, 2025

Damaged J K Rowling Artwork At Derbyshire National Trust Site A Cover Up

Jun 06, 2025 -

Major Bomb Disposal Operation In Cologne Thousands Evacuated

Jun 06, 2025

Major Bomb Disposal Operation In Cologne Thousands Evacuated

Jun 06, 2025 -

Hegseths Action Navy Vessels Name Removed Replacing Gay Rights Icon

Jun 06, 2025

Hegseths Action Navy Vessels Name Removed Replacing Gay Rights Icon

Jun 06, 2025