How The Republican Retirement Plan Impacts Americans In Their 30s

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How the Republican Retirement Plan Impacts Americans in Their 30s: A Closer Look

For Americans in their 30s, retirement might seem like a distant concern. Mortgages, student loans, and raising families often dominate the financial landscape. However, the choices made today significantly impact future retirement security. Recent Republican retirement proposals have sparked debate, and understanding their potential impact on this crucial demographic is vital. This article delves into how these plans could affect those in their 30s, examining both the potential benefits and drawbacks.

Understanding the Current Republican Proposals:

While specific proposals vary, many Republican retirement plans focus on promoting private savings and reducing government involvement in retirement programs. Key elements often include:

- Changes to 401(k) and IRA Contribution Limits: Some plans suggest increasing contribution limits, potentially offering greater tax advantages for those diligently saving. This could be particularly beneficial for 30-somethings aiming to catch up on retirement savings.

- Tax Incentives for Retirement Savings: Increased tax deductions or credits for retirement contributions are frequently proposed. This would directly reduce the tax burden for individuals actively saving for retirement, making it more attractive to contribute more.

- Potential Changes to Social Security: While not always a central focus, some Republican plans involve adjustments to Social Security, which could indirectly affect retirement security for those in their 30s. These changes might involve altering benefit calculations or raising the retirement age.

Impact on 30-Somethings:

The implications of these proposals are multifaceted and depend on individual circumstances.

Potential Benefits:

- Increased Savings Potential: Higher contribution limits and tax incentives could significantly boost retirement savings, allowing 30-somethings to build a larger nest egg faster.

- Greater Control over Retirement Planning: A shift towards private savings emphasizes personal responsibility, giving individuals more control over their retirement investments and potentially higher returns.

- Long-Term Financial Growth: Early and consistent contributions, even with small adjustments due to tax benefits, can lead to substantial long-term growth through compounding interest.

Potential Drawbacks:

- Increased Responsibility and Risk: Relying more heavily on private savings introduces greater personal responsibility and market risk. Investment losses could significantly impact retirement security.

- Limited Access to Retirement Plans: Not all employers offer 401(k) plans, and self-employed individuals may face challenges contributing consistently.

- Uncertainty Regarding Social Security: Changes to Social Security could reduce future benefits, potentially leaving 30-somethings with a larger retirement savings gap to fill.

What 30-Somethings Should Do Now:

Regardless of the political landscape, proactive retirement planning is crucial. Here are some key steps for those in their 30s:

- Maximize Retirement Contributions: Contribute the maximum amount allowed to your 401(k) and/or IRA, taking advantage of any employer matching programs.

- Diversify Investments: Spread your investments across different asset classes to mitigate risk.

- Seek Professional Financial Advice: A financial advisor can help you create a personalized retirement plan based on your individual circumstances and goals.

- Stay Informed: Keep abreast of changes in retirement legislation and their potential impact on your savings. Websites like the and the offer valuable resources.

Conclusion:

The proposed Republican retirement plans present both opportunities and challenges for Americans in their 30s. While potential tax incentives and increased contribution limits could boost savings, the increased reliance on private savings also introduces higher risk and responsibility. Proactive planning, informed decision-making, and seeking professional advice are essential to secure a comfortable retirement regardless of future legislative changes. The time to act is now. Don't delay securing your financial future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How The Republican Retirement Plan Impacts Americans In Their 30s. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

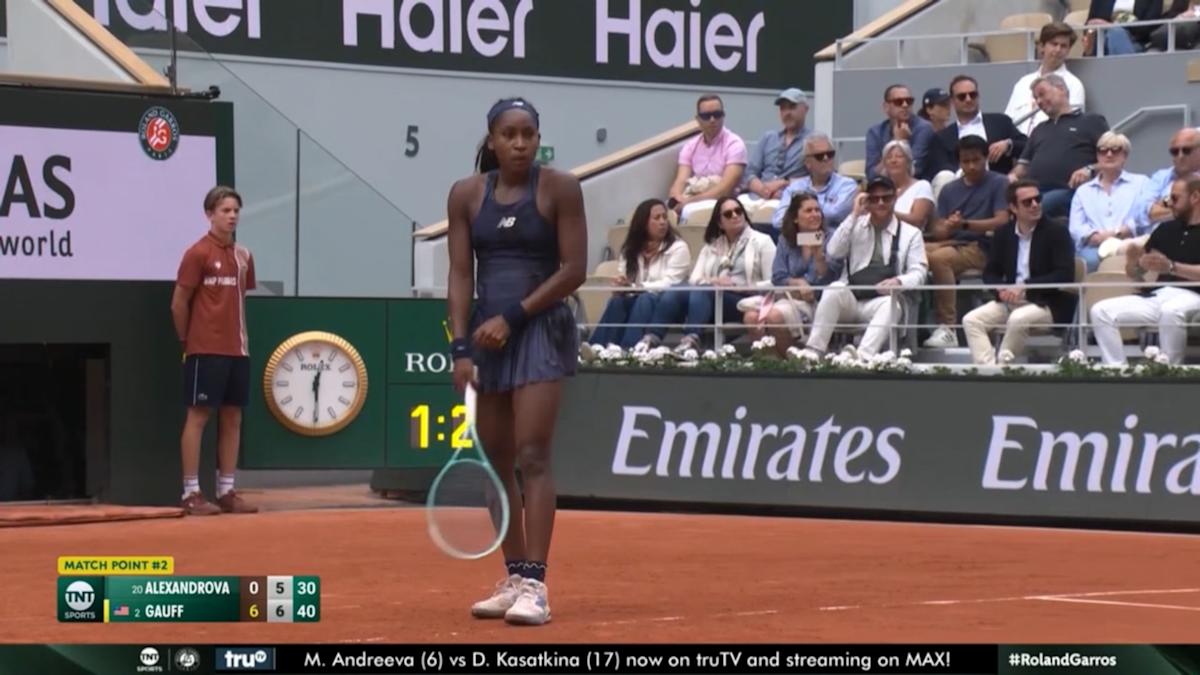

Bubliks Shock Win Djokovics Steady Advance At The French Open

Jun 04, 2025

Bubliks Shock Win Djokovics Steady Advance At The French Open

Jun 04, 2025 -

Lorenzo Musettis Top 10 Breakthrough Us Open Highlights

Jun 04, 2025

Lorenzo Musettis Top 10 Breakthrough Us Open Highlights

Jun 04, 2025 -

A Smithsonian Showcase The Legacy Of A Penn State And Nfl Football Icon

Jun 04, 2025

A Smithsonian Showcase The Legacy Of A Penn State And Nfl Football Icon

Jun 04, 2025 -

Navigating College Costs In Ohio Innovative 529 Plan Approaches

Jun 04, 2025

Navigating College Costs In Ohio Innovative 529 Plan Approaches

Jun 04, 2025 -

Strong Us Showing Eight Americans Move On At French Open

Jun 04, 2025

Strong Us Showing Eight Americans Move On At French Open

Jun 04, 2025

Latest Posts

-

Urgent Search Police Investigate Death Of Three Sisters Father Missing

Jun 06, 2025

Urgent Search Police Investigate Death Of Three Sisters Father Missing

Jun 06, 2025 -

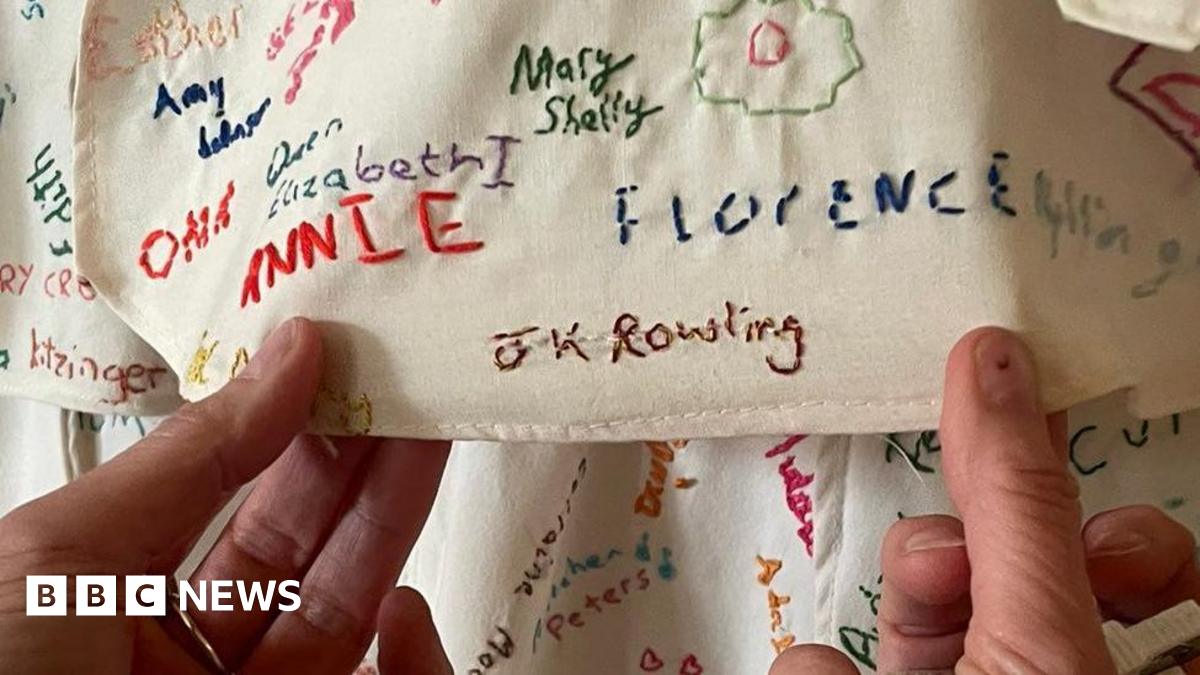

Damaged J K Rowling Artwork Covered Up At Derbyshire National Trust Site

Jun 06, 2025

Damaged J K Rowling Artwork Covered Up At Derbyshire National Trust Site

Jun 06, 2025 -

Should You Buy Robinhood Stock Analyzing The Current Market Trends

Jun 06, 2025

Should You Buy Robinhood Stock Analyzing The Current Market Trends

Jun 06, 2025 -

The My Pillow Story Cnns Harry Enten Analyzes Mike Lindells Public Image

Jun 06, 2025

The My Pillow Story Cnns Harry Enten Analyzes Mike Lindells Public Image

Jun 06, 2025 -

Police Probe Deaths Following Heart Operations At Nhs Hospital

Jun 06, 2025

Police Probe Deaths Following Heart Operations At Nhs Hospital

Jun 06, 2025