How To Interpret VRNA Data In My Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding the Mystery: How to Interpret VRNA Data in Your Stock Portfolio

Are you an investor trying to navigate the complexities of the stock market? Understanding various financial metrics is crucial for making informed decisions, and one often-overlooked data point is Volume Relative to Net Asset Value (VRNA). This article will demystify VRNA, explaining what it means, how to interpret it, and why it's a valuable tool in your investment arsenal.

What is VRNA (Volume Relative to Net Asset Value)?

VRNA is a less common but potentially powerful indicator that compares the trading volume of a stock to its net asset value (NAV). It provides insights into the relative strength of buying and selling pressure, offering a unique perspective beyond traditional volume analysis. Essentially, it helps answer: Is the current trading volume significant compared to the underlying value of the company? A high VRNA might suggest strong interest, while a low VRNA could indicate subdued activity. However, interpreting VRNA effectively requires understanding its context.

Understanding the Components:

- Trading Volume: This represents the total number of shares traded during a specific period (e.g., daily, weekly). High volume usually signals increased investor activity and interest.

- Net Asset Value (NAV): This is the net value of a company's assets minus its liabilities, often used in the context of mutual funds and ETFs, but applicable to individual stocks as well, particularly for companies with significant tangible assets. Calculating the NAV for a publicly traded stock requires accessing financial statements and potentially employing valuation models.

How to Calculate VRNA:

While there's no universally accepted formula, a simple calculation can be helpful:

VRNA = Trading Volume / NAV

The resulting number represents the ratio of volume to NAV. A higher number suggests relatively higher volume compared to the company's underlying asset value. However, remember that this is a relative measure and needs to be interpreted within the context of the specific stock and market conditions.

Interpreting VRNA Data:

- High VRNA: A high VRNA might indicate significant buying or selling pressure, possibly driven by news events, earnings announcements, or market sentiment. It warrants further investigation into the underlying causes. This is not necessarily a bullish or bearish signal on its own.

- Low VRNA: A low VRNA may suggest low investor interest or a lack of significant price movement. It could also mean the market is accurately pricing the asset's value. Again, further analysis is needed to confirm any implications.

Using VRNA in Your Investment Strategy:

VRNA should not be used in isolation. It's most effective when combined with other technical and fundamental analysis tools. Consider using it alongside:

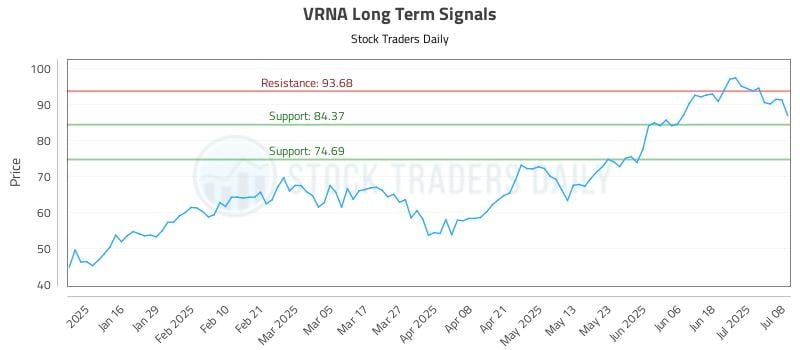

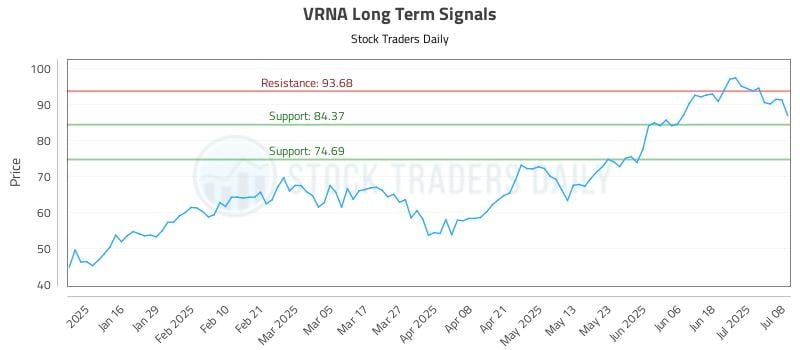

- Price Charts: Observe how VRNA correlates with price movements. Are high VRNA periods associated with significant price changes?

- Moving Averages: Compare VRNA to moving averages of volume and price to identify potential trends.

- Other Financial Metrics: Integrate VRNA with other crucial indicators like Price-to-Earnings ratio (P/E), Return on Equity (ROE), and debt-to-equity ratio for a more comprehensive picture.

Limitations of VRNA:

It's crucial to acknowledge the limitations:

- No Standardized Calculation: The lack of a universally accepted formula can lead to inconsistencies in interpretation.

- Context is Key: VRNA must be analyzed within the context of the specific company, industry, and overall market conditions.

- Not a Standalone Indicator: VRNA should never be the sole basis for investment decisions.

Conclusion:

VRNA offers a unique perspective on market activity, adding another layer to your investment analysis. By understanding how to calculate and interpret VRNA in conjunction with other indicators, you can improve your investment decision-making process and potentially identify opportunities in the market. Remember to always conduct thorough research and consider seeking professional financial advice before making any investment decisions. Learn more about fundamental analysis .

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How To Interpret VRNA Data In My Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thailands Top 50 Richest In 2025 A 170 Billion Fortune

Jul 10, 2025

Thailands Top 50 Richest In 2025 A 170 Billion Fortune

Jul 10, 2025 -

Delta Flight Diverted Emergency Landing Due To Onboard Battery Fire

Jul 10, 2025

Delta Flight Diverted Emergency Landing Due To Onboard Battery Fire

Jul 10, 2025 -

Shteyngarts Narrative Prowess Crafting A Believable Child Protagonist

Jul 10, 2025

Shteyngarts Narrative Prowess Crafting A Believable Child Protagonist

Jul 10, 2025 -

Yorkshire Faces Water Restrictions Hosepipe Ban Confirmed

Jul 10, 2025

Yorkshire Faces Water Restrictions Hosepipe Ban Confirmed

Jul 10, 2025 -

Ice Raids Target Mac Arthur Park Immigration Enforcement Intensifies In Los Angeles

Jul 10, 2025

Ice Raids Target Mac Arthur Park Immigration Enforcement Intensifies In Los Angeles

Jul 10, 2025